BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Governance<br />

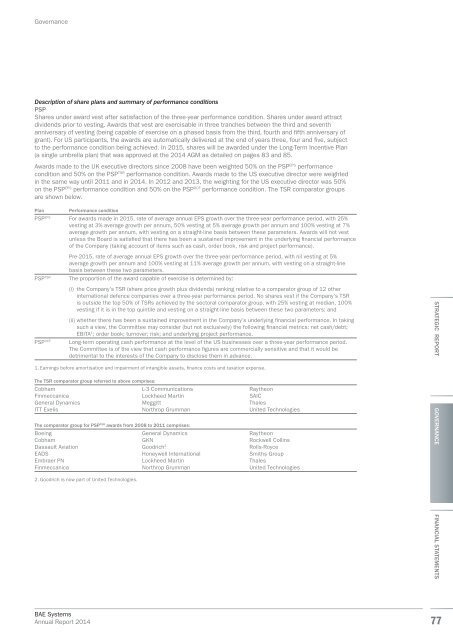

Description of share plans and summary of performance conditions<br />

PSP<br />

Shares under award vest after satisfaction of the three-year performance condition. Shares under award attract<br />

dividends prior to vesting. Awards that vest are exercisable in three tranches between the third and seventh<br />

anniversary of vesting (being capable of exercise on a phased basis from the third, fourth and fifth anniversary of<br />

grant). For US participants, the awards are automatically delivered at the end of years three, four and five, subject<br />

to the performance condition being achieved. In 2015, shares will be awarded under the Long-Term Incentive Plan<br />

(a single umbrella plan) that was approved at the <strong>2014</strong> AGM as detailed on pages 83 and 85.<br />

Awards made to the UK executive directors since 2008 have been weighted 50% on the PSP EPS performance<br />

condition and 50% on the PSP TSR performance condition. Awards made to the US executive director were weighted<br />

in the same way until 2011 and in <strong>2014</strong>. In 2012 and 2013, the weighting for the US executive director was 50%<br />

on the PSP EPS performance condition and 50% on the PSP OCF performance condition. The TSR comparator groups<br />

are shown below.<br />

Plan<br />

Performance condition<br />

PSP EPS For awards made in 2015, rate of average <strong>annual</strong> EPS growth over the three-year performance period, with 25%<br />

vesting at 3% average growth per annum, 50% vesting at 5% average growth per annum and 100% vesting at 7%<br />

average growth per annum, with vesting on a straight-line basis between these parameters. Awards will not vest<br />

unless the Board is satisfied that there has been a sustained improvement in the underlying financial performance<br />

of the Company (taking account of items such as cash, order book, risk and project performance).<br />

PSP TSR<br />

Pre-2015, rate of average <strong>annual</strong> EPS growth over the three-year performance period, with nil vesting at 5%<br />

average growth per annum and 100% vesting at 11% average growth per annum, with vesting on a straight-line<br />

basis between these two parameters.<br />

The proportion of the award capable of exercise is determined by:<br />

PSP OCF<br />

(i) the Company’s TSR (share price growth plus dividends) ranking relative to a comparator group of 12 other<br />

international defence companies over a three-year performance period. No shares vest if the Company’s TSR<br />

is outside the top 50% of TSRs achieved by the sectoral comparator group, with 25% vesting at median, 100%<br />

vesting if it is in the top quintile and vesting on a straight-line basis between these two parameters; and<br />

(ii) whether there has been a sustained improvement in the Company’s underlying financial performance. In taking<br />

such a view, the Committee may consider (but not exclusively) the following financial metrics: net cash/debt;<br />

EBITA 1 ; order book; turnover; risk; and underlying project performance.<br />

Long-term operating cash performance at the level of the US businesses over a three-year performance period.<br />

The Committee is of the view that cash performance figures are commercially sensitive and that it would be<br />

detrimental to the interests of the Company to disclose them in advance.<br />

1. Earnings before amortisation and impairment of intangible assets, finance costs and taxation expense.<br />

The TSR comparator group referred to above comprises:<br />

Cobham<br />

Finmeccanica<br />

General Dynamics<br />

ITT Exelis<br />

L-3 Communications<br />

Lockheed Martin<br />

Meggitt<br />

Northrop Grumman<br />

The comparator group for PSP TSR awards from 2008 to 2011 comprises:<br />

Boeing<br />

Cobham<br />

Dassault Aviation<br />

EADS<br />

Embraer PN<br />

Finmeccanica<br />

2. Goodrich is now part of United Technologies.<br />

General Dynamics<br />

GKN<br />

Goodrich 2<br />

Honeywell International<br />

Lockheed Martin<br />

Northrop Grumman<br />

Raytheon<br />

SAIC<br />

Thales<br />

United Technologies<br />

Raytheon<br />

Rockwell Collins<br />

Rolls-Royce<br />

Smiths Group<br />

Thales<br />

United Technologies<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

77