BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

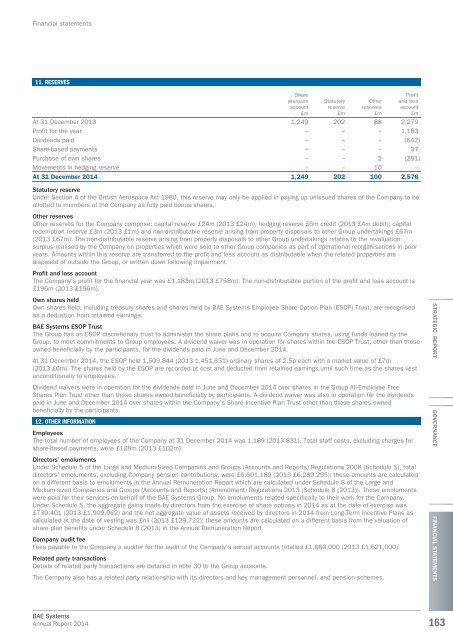

11. RESERVES<br />

Share<br />

premium<br />

account<br />

£m<br />

Statutory<br />

reserve<br />

£m<br />

Other<br />

reserves<br />

£m<br />

Profit<br />

and loss<br />

account<br />

£m<br />

At 31 December 2013 1,249 202 88 2,279<br />

Profit for the year – – – 1,183<br />

Dividends paid – – – (642)<br />

Share-based payments – – – 37<br />

Purchase of own shares – – 2 (281)<br />

Movements in hedging reserve – – 10 –<br />

At 31 December <strong>2014</strong> 1,249 202 100 2,576<br />

Statutory reserve<br />

Under Section 4 of the British Aerospace Act 1980, this reserve may only be applied in paying up unissued shares of the Company to be<br />

allotted to members of the Company as fully paid bonus shares.<br />

Other reserves<br />

Other reserves for the Company comprise: capital reserve £24m (2013 £24m); hedging reserve £6m credit (2013 £4m debit); capital<br />

redemption reserve £3m (2013 £1m) and non-distributable reserve arising from property disposals to other Group undertakings £67m<br />

(2013 £67m). The non-distributable reserve arising from property disposals to other Group undertakings relates to the revaluation<br />

surplus realised by the Company on properties which were sold to other Group companies as part of operational reorganisations in prior<br />

years. Amounts within this reserve are transferred to the profit and loss account as distributable when the related properties are<br />

disposed of outside the Group, or written down following impairment.<br />

Profit and loss account<br />

The Company’s profit for the financial year was £1,183m (2013 £758m). The non-distributable portion of the profit and loss account is<br />

£196m (2013 £196m).<br />

Own shares held<br />

Own shares held, including treasury shares and shares held by <strong>BAE</strong> Systems Employee Share Option Plan (ESOP) Trust, are recognised<br />

as a deduction from retained earnings.<br />

<strong>BAE</strong> Systems ESOP Trust<br />

The Group has an ESOP discretionary trust to administer the share plans and to acquire Company shares, using funds loaned by the<br />

Group, to meet commitments to Group employees. A dividend waiver was in operation for shares within the ESOP Trust, other than those<br />

owned beneficially by the participants, for the dividends paid in June and December <strong>2014</strong>.<br />

At 31 December <strong>2014</strong>, the ESOP held 1,509,844 (2013 1,451,631) ordinary shares of 2.5p each with a market value of £7m<br />

(2013 £6m). The shares held by the ESOP are recorded at cost and deducted from retained earnings until such time as the shares vest<br />

unconditionally to employees.<br />

Dividend waivers were in operation for the dividends paid in June and December <strong>2014</strong> over shares in the Group All-Employee Free<br />

Shares Plan Trust other than those shares owned beneficially by participants. A dividend waiver was also in operation for the dividends<br />

paid in June and December <strong>2014</strong> over shares within the Company’s Share Incentive Plan Trust other than those shares owned<br />

beneficially by the participants.<br />

12. OTHER INFORMATION<br />

Employees<br />

The total number of employees of the Company at 31 December <strong>2014</strong> was 1,189 (2013 831). Total staff costs, excluding charges for<br />

share-based payments, were £128m (2013 £102m).<br />

Directors’ emoluments<br />

Under Schedule 5 of the Large and Medium-Sized Companies and Groups (Accounts and Reports) Regulations 2008 (Schedule 5), total<br />

directors’ emoluments, excluding Company pension contributions, were £6,601,189 (2013 £6,289,295); these amounts are calculated<br />

on a different basis to emoluments in the Annual Remuneration Report which are calculated under Schedule 8 of the Large and<br />

Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013 (Schedule 8 (2013)). These emoluments<br />

were paid for their services on behalf of the <strong>BAE</strong> Systems Group. No emoluments related specifically to their work for the Company.<br />

Under Schedule 5, the aggregate gains made by directors from the exercise of share options in <strong>2014</strong> as at the date of exercise was<br />

£739,401 (2013 £1,909,962) and the net aggregate value of assets received by directors in <strong>2014</strong> from Long-Term Incentive Plans as<br />

calculated at the date of vesting was £nil (2013 £129,722); these amounts are calculated on a different basis from the valuation of<br />

share plan benefits under Schedule 8 (2013) in the Annual Remuneration Report.<br />

Company audit fee<br />

Fees payable to the Company’s auditor for the audit of the Company’s <strong>annual</strong> accounts totalled £1,669,000 (2013 £1,621,000).<br />

Related party transactions<br />

Details of related party transactions are detailed in note 30 to the Group accounts.<br />

The Company also has a related party relationship with its directors and key management personnel, and pension schemes.<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

163