BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

9. INTANGIBLE ASSETS continued<br />

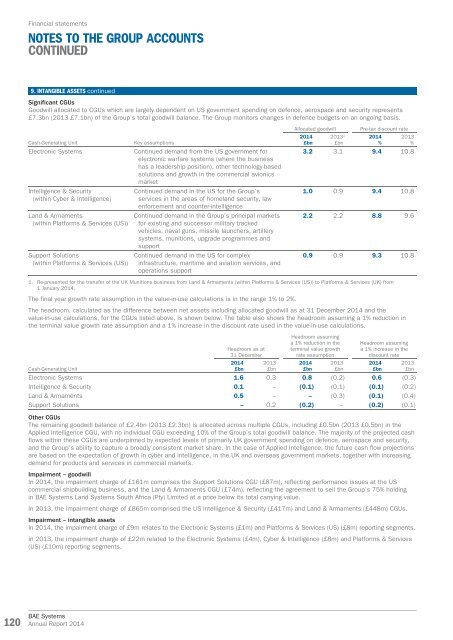

Significant CGUs<br />

Goodwill allocated to CGUs which are largely dependent on US government spending on defence, aerospace and security represents<br />

£7.3bn (2013 £7.1bn) of the Group’s total goodwill balance. The Group monitors changes in defence budgets on an ongoing basis.<br />

Cash-Generating Unit<br />

Electronic Systems<br />

Intelligence & Security<br />

(within Cyber & Intelligence)<br />

Land & Armaments<br />

(within Platforms & Services (US))<br />

Support Solutions<br />

(within Platforms & Services (US))<br />

Key assumptions<br />

Continued demand from the US government for<br />

electronic warfare systems (where the business<br />

has a leadership position), other technology-based<br />

solutions and growth in the commercial avionics<br />

market<br />

Continued demand in the US for the Group’s<br />

services in the areas of homeland security, law<br />

enforcement and counter-intelligence<br />

Continued demand in the Group’s principal markets<br />

for existing and successor military tracked<br />

vehicles, naval guns, missile launchers, artillery<br />

systems, munitions, upgrade programmes and<br />

support<br />

Continued demand in the US for complex<br />

infrastructure, maritime and aviation services, and<br />

operations support<br />

Allocated goodwill<br />

<strong>2014</strong><br />

£bn<br />

2013 1<br />

£bn<br />

Pre-tax discount rate<br />

<strong>2014</strong><br />

%<br />

2013<br />

%<br />

3.2 3.1 9.4 10.8<br />

1.0 0.9 9.4 10.8<br />

2.2 2.2 8.8 9.6<br />

0.9 0.9 9.3 10.8<br />

1. Re-presented for the transfer of the UK Munitions business from Land & Armaments (within Platforms & Services (US)) to Platforms & Services (UK) from<br />

1 January <strong>2014</strong>.<br />

The final year growth rate assumption in the value-in-use calculations is in the range 1% to 2%.<br />

The headroom, calculated as the difference between net assets including allocated goodwill as at 31 December <strong>2014</strong> and the<br />

value-in-use calculations, for the CGUs listed above, is shown below. The table also shows the headroom assuming a 1% reduction in<br />

the terminal value growth rate assumption and a 1% increase in the discount rate used in the value-in-use calculations.<br />

Cash-Generating Unit<br />

Headroom as at<br />

31 December<br />

<strong>2014</strong><br />

£bn<br />

2013<br />

£bn<br />

Headroom assuming<br />

a 1% reduction in the<br />

terminal value growth<br />

rate assumption<br />

<strong>2014</strong><br />

£bn<br />

2013<br />

£bn<br />

Headroom assuming<br />

a 1% increase in the<br />

discount rate<br />

Electronic Systems 1.6 0.3 0.8 (0.2) 0.6 (0.3)<br />

Intelligence & Security 0.1 – (0.1) (0.1) (0.1) (0.2)<br />

Land & Armaments 0.5 – – (0.3) (0.1) (0.4)<br />

Support Solutions – 0.2 (0.2) – (0.2) (0.1)<br />

Other CGUs<br />

The remaining goodwill balance of £2.4bn (2013 £2.3bn) is allocated across multiple CGUs, including £0.5bn (2013 £0.5bn) in the<br />

Applied Intelligence CGU, with no individual CGU exceeding 10% of the Group’s total goodwill balance. The majority of the projected cash<br />

flows within these CGUs are underpinned by expected levels of primarily UK government spending on defence, aerospace and security,<br />

and the Group’s ability to capture a broadly consistent market share. In the case of Applied Intelligence, the future cash flow projections<br />

are based on the expectation of growth in cyber and intelligence, in the UK and overseas government markets, together with increasing<br />

demand for products and services in commercial markets.<br />

Impairment – goodwill<br />

In <strong>2014</strong>, the impairment charge of £161m comprises the Support Solutions CGU (£87m), reflecting performance issues at the US<br />

commercial shipbuilding business, and the Land & Armaments CGU (£74m), reflecting the agreement to sell the Group’s 75% holding<br />

in <strong>BAE</strong> Systems Land Systems South Africa (Pty) Limited at a price below its total carrying value.<br />

In 2013, the impairment charge of £865m comprised the US Intelligence & Security (£417m) and Land & Armaments (£448m) CGUs.<br />

Impairment – intangible assets<br />

In <strong>2014</strong>, the impairment charge of £9m relates to the Electronic Systems (£1m) and Platforms & Services (US) (£8m) <strong>report</strong>ing segments.<br />

In 2013, the impairment charge of £22m related to the Electronic Systems (£4m), Cyber & Intelligence (£8m) and Platforms & Services<br />

(US) (£10m) <strong>report</strong>ing segments.<br />

<strong>2014</strong><br />

£bn<br />

2013<br />

£bn<br />

120<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>