BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance<br />

ANNUAL<br />

REMUNERATION<br />

REPORT<br />

CONTINUED<br />

ExSOP 2012<br />

Options are normally exercisable between the third and tenth anniversary of their grant, subject to the performance<br />

condition set out below being achieved. In 2015, shares will be awarded under the single umbrella plan (the Long-Term<br />

Incentive Plan) that was approved at the <strong>2014</strong> AGM as detailed on pages 83 and 85. Awards made from 2015 will<br />

be subject to a further two-year clawback period after the three-year vesting period.<br />

Plan<br />

ExSOP 2012<br />

Performance condition<br />

The proportion of the award capable of exercise is determined by the Company’s TSR (share price growth plus<br />

dividends) ranking relative to a comparator group of 12 other international defence companies over a three-year<br />

performance period. No shares vest if the Company’s TSR is outside the top 50% of TSRs achieved by the sectoral<br />

comparator group, with 25% vesting at median, 100% vesting if it is in the top quintile and vesting on a straight-line<br />

basis between these two parameters.<br />

RSP<br />

The RSP is not subject to a performance condition as it is designed to address retention issues principally in the US.<br />

The shares are subject only to the condition that the participant remains employed by the Group at the end of the<br />

vesting date (three years after the award date). Shares under award attract dividends prior to vesting. In 2015, shares<br />

will be awarded under the single umbrella plan that was approved at the <strong>2014</strong> AGM as detailed on pages 83 and 85.<br />

Awards made from 2015 will be subject to a further two-year clawback period after the initial three-year vesting period.<br />

SMP<br />

The SMP was a standalone investment plan linked to the award under the Annual Incentive Plan. It operated for the<br />

final time in 2013 in relation to the <strong>annual</strong> incentive relating to 2012 performance. Executive directors were required<br />

to invest at least one-third (and maximum 50%) of their <strong>annual</strong> incentive into the SMP and were granted a conditional<br />

award of matching shares against the gross value of the <strong>annual</strong> incentive invested. The matching shares attract<br />

dividends during the three-year deferral period, released on vesting of any matching shares.<br />

Plan<br />

SMP<br />

Performance condition<br />

In respect of a three-year performance period, nil match for average EPS growth of 5% per annum increasing<br />

uniformly to a maximum 2:1 match at 11% growth per annum.<br />

Statement of directors’ shareholdings and share interests<br />

Minimum Shareholding Requirement (MSR)<br />

Executive directors are compulsorily required to establish and maintain a minimum personal shareholding equal to<br />

a set percentage of base salary. An Initial Value must be achieved as quickly as possible using shares vesting or<br />

options exercised through the executive share option schemes and Long-Term Incentive schemes by retaining 50%<br />

of the net value (i.e. the value after deduction of exercise costs and tax) of shares acquired under these schemes.<br />

Once the Initial Value is achieved, a Subsequent Value must be achieved in the same way, except that a minimum<br />

of 25% of the net value must be retained on each exercise or acquisition. Shares owned beneficially by the director<br />

and his/her spouse count towards the MSR. The MSR does not apply after the individual has ceased to be a<br />

director. Any case of non-compliance would be dealt with by the Committee.<br />

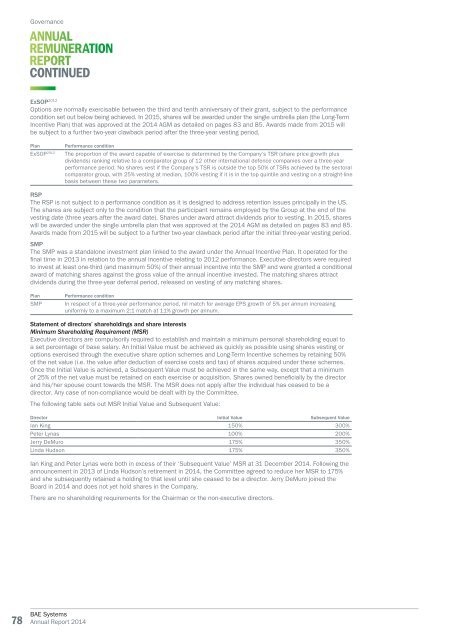

The following table sets out MSR Initial Value and Subsequent Value:<br />

Director Initial Value Subsequent Value<br />

Ian King 150% 300%<br />

Peter Lynas 100% 200%<br />

Jerry DeMuro 175% 350%<br />

Linda Hudson 175% 350%<br />

Ian King and Peter Lynas were both in excess of their ‘Subsequent Value’ MSR at 31 December <strong>2014</strong>. Following the<br />

announcement in 2013 of Linda Hudson’s retirement in <strong>2014</strong>, the Committee agreed to reduce her MSR to 175%<br />

and she subsequently retained a holding to that level until she ceased to be a director. Jerry DeMuro joined the<br />

Board in <strong>2014</strong> and does not yet hold shares in the Company.<br />

There are no shareholding requirements for the Chairman or the non-executive directors.<br />

78<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>