BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

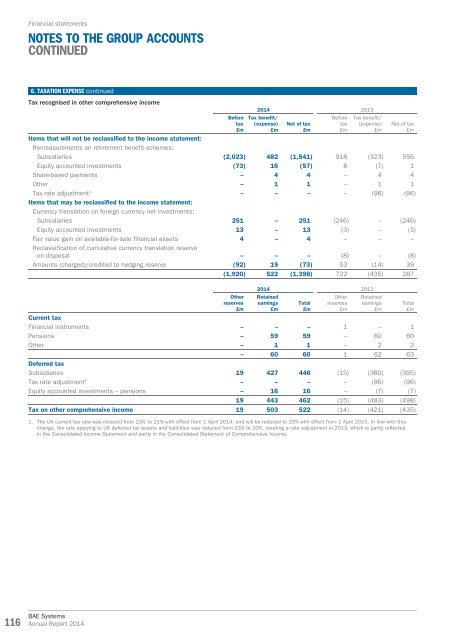

6. TAXATION EXPENSE continued<br />

Tax recognised in other comprehensive income<br />

Before<br />

tax<br />

£m<br />

<strong>2014</strong> 2013<br />

Tax benefit/<br />

(expense)<br />

£m<br />

Net of tax<br />

£m<br />

Before<br />

tax<br />

£m<br />

Tax benefit/<br />

(expense)<br />

£m<br />

Net of tax<br />

£m<br />

Items that will not be reclassified to the income statement:<br />

Remeasurements on retirement benefit schemes:<br />

Subsidiaries (2,023) 482 (1,541) 918 (323) 595<br />

Equity accounted investments (73) 16 (57) 8 (7) 1<br />

Share-based payments – 4 4 – 4 4<br />

Other – 1 1 – 1 1<br />

Tax rate adjustment 1 – – – – (96) (96)<br />

Items that may be reclassified to the income statement:<br />

Currency translation on foreign currency net investments:<br />

Subsidiaries 251 – 251 (246) – (246)<br />

Equity accounted investments 13 – 13 (3) – (3)<br />

Fair value gain on available-for-sale financial assets 4 – 4 – – –<br />

Reclassification of cumulative currency translation reserve<br />

on disposal – – – (8) – (8)<br />

Amounts (charged)/credited to hedging reserve (92) 19 (73) 53 (14) 39<br />

(1,920) 522 (1,398) 722 (435) 287<br />

Other<br />

reserves<br />

£m<br />

<strong>2014</strong> 2013<br />

Retained<br />

earnings<br />

£m<br />

Total<br />

£m<br />

Other<br />

reserves<br />

£m<br />

Retained<br />

earnings<br />

£m<br />

Current tax<br />

Financial instruments – – – 1 – 1<br />

Pensions – 59 59 – 60 60<br />

Other – 1 1 – 2 2<br />

– 60 60 1 62 63<br />

Deferred tax<br />

Subsidiaries 19 427 446 (15) (380) (395)<br />

Tax rate adjustment 1 – – – – (96) (96)<br />

Equity accounted investments – pensions – 16 16 – (7) (7)<br />

19 443 462 (15) (483) (498)<br />

Tax on other comprehensive income 19 503 522 (14) (421) (435)<br />

1. The UK current tax rate was reduced from 23% to 21% with effect from 1 April <strong>2014</strong>, and will be reduced to 20% with effect from 1 April 2015. In line with this<br />

change, the rate applying to UK deferred tax assets and liabilities was reduced from 23% to 20%, creating a rate adjustment in 2013, which is partly reflected<br />

in the Consolidated Income Statement and partly in the Consolidated Statement of Comprehensive Income.<br />

Total<br />

£m<br />

116<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>