BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Strategic Report<br />

respectively. These repayments had been largely<br />

pre-financed by the £0.4bn raised in the UK bond market<br />

in 2012.<br />

principal joint ventures, Eurofighter, MBDA and Air<br />

Astana, and, this year, provides additional information<br />

in respect of the Group’s interests in those companies.<br />

In October, the Group issued $800m (£495m) 3.8%<br />

and $300m (£184m) 4.75% bonds maturing in 2024<br />

and 2044, respectively, intended for general corporate<br />

purposes, including the repayment of debt securities<br />

at maturity in 2015 and 2016.<br />

Cash and cash equivalents of £2,314m (2013 £2,222m)<br />

are held primarily for the repayment of £0.7bn of debt<br />

securities maturing in 2015 and 2016, the share<br />

repurchase programme, pension deficit funding,<br />

payment of the <strong>2014</strong> final dividend and management<br />

of working capital.<br />

Balance sheet<br />

The £248m increase in intangible assets to £10.0bn<br />

(2013 £9.7bn) arises from business acquisitions made<br />

in the year (£289m) and exchange translation (£258m),<br />

partly offset by the impairment of goodwill relating to the<br />

US commercial shipbuilding and South African businesses<br />

(£161m), and the year’s amortisation charge (£179m).<br />

Property, plant and equipment, and investment property<br />

reduced to £1.7bn (2013 £2.1bn) reflecting the disposal<br />

of a residential and office facility in Saudi Arabia.<br />

Equity accounted investments and other investments<br />

reduced to £236m (2013 £286m) mainly reflecting the<br />

dividends of £63m received in the year. Note 12 to the<br />

Group accounts on page 125 identifies the Group’s<br />

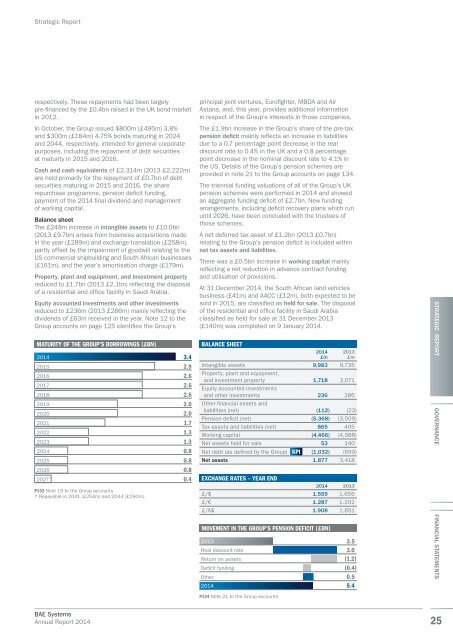

MATURITY OF THE GROUP’S BORROWINGS (£BN)<br />

The £1.9bn increase in the Group’s share of the pre-tax<br />

pension deficit mainly reflects an increase in liabilities<br />

due to a 0.7 percentage point decrease in the real<br />

discount rate to 0.4% in the UK and a 0.8 percentage<br />

point decrease in the nominal discount rate to 4.1% in<br />

the US. Details of the Group’s pension schemes are<br />

provided in note 21 to the Group accounts on page 134.<br />

The triennial funding valuations of all of the Group’s UK<br />

pension schemes were performed in <strong>2014</strong> and showed<br />

an aggregate funding deficit of £2.7bn. New funding<br />

arrangements, including deficit recovery plans which run<br />

until 2026, have been concluded with the trustees of<br />

those schemes.<br />

A net deferred tax asset of £1.2bn (2013 £0.7bn)<br />

relating to the Group’s pension deficit is included within<br />

net tax assets and liabilities.<br />

There was a £0.5bn increase in working capital mainly<br />

reflecting a net reduction in advance contract funding<br />

and utilisation of provisions.<br />

At 31 December <strong>2014</strong>, the South African land vehicles<br />

business (£41m) and AACC (£12m), both expected to be<br />

sold in 2015, are classified as held for sale. The disposal<br />

of the residential and office facility in Saudi Arabia<br />

classified as held for sale at 31 December 2013<br />

(£140m) was completed on 9 January <strong>2014</strong>.<br />

BALANCE SHEET<br />

<strong>2014</strong><br />

3.4<br />

2015<br />

2.9 Intangible assets 9,983 9,735<br />

Property, plant and equipment,<br />

2016<br />

2.6<br />

and investment property<br />

2017<br />

2.6<br />

Equity accounted investments<br />

1,718 2,071<br />

2018<br />

2.6 and other investments 236 286<br />

2019<br />

2.0 Other financial assets and<br />

liabilities (net) (112) (23)<br />

2020<br />

2.0<br />

Pension deficit (net) (5,368) (3,509)<br />

2021<br />

1.7<br />

Tax assets and liabilities (net) 865 405<br />

2022<br />

1.3 Working capital (4,466) (4,988)<br />

2023<br />

1.3 Net assets held for sale 53 140<br />

2024<br />

0.8 Net debt (as defined by the Group) KPI (1,032) (699)<br />

2025<br />

0.8 Net assets 1,877 3,418<br />

2026<br />

0.8<br />

2027 * 0.4 EXCHANGE RATES – YEAR END<br />

<strong>2014</strong> 2013<br />

P132 Note 19 to the Group accounts<br />

* Repayable in 2041 (£254m) and 2044 (£190m).<br />

£/$ 1.559 1.656<br />

£/€ 1.287 1.202<br />

£/A$ 1.908 1.851<br />

MOVEMENT IN THE GROUP’S PENSION DEFICIT (£BN)<br />

2013<br />

Real discount rate<br />

Return on assets<br />

Deficit funding<br />

Other<br />

<strong>2014</strong><br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

3.5<br />

3.0<br />

(1.2)<br />

(0.4)<br />

0.5<br />

5.4<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

P134 Note 21 to the Group accounts<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

25