BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

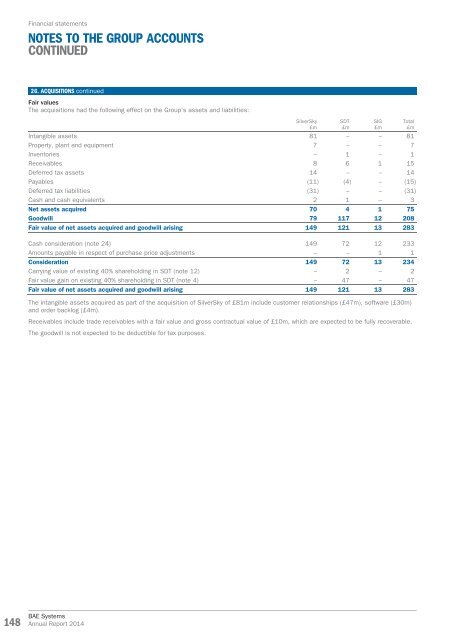

26. ACQUISITIONS continued<br />

Fair values<br />

The acquisitions had the following effect on the Group’s assets and liabilities:<br />

SilverSky<br />

£m<br />

Intangible assets 81 – – 81<br />

Property, plant and equipment 7 – – 7<br />

Inventories – 1 – 1<br />

Receivables 8 6 1 15<br />

Deferred tax assets 14 – – 14<br />

Payables (11) (4) – (15)<br />

Deferred tax liabilities (31) – – (31)<br />

Cash and cash equivalents 2 1 – 3<br />

Net assets acquired 70 4 1 75<br />

Goodwill 79 117 12 208<br />

Fair value of net assets acquired and goodwill arising 149 121 13 283<br />

SDT<br />

£m<br />

SIG<br />

£m<br />

Total<br />

£m<br />

Cash consideration (note 24) 149 72 12 233<br />

Amounts payable in respect of purchase price adjustments – – 1 1<br />

Consideration 149 72 13 234<br />

Carrying value of existing 40% shareholding in SDT (note 12) – 2 – 2<br />

Fair value gain on existing 40% shareholding in SDT (note 4) – 47 – 47<br />

Fair value of net assets acquired and goodwill arising 149 121 13 283<br />

The intangible assets acquired as part of the acquisition of SilverSky of £81m include customer relationships (£47m), software (£30m)<br />

and order backlog (£4m).<br />

Receivables include trade receivables with a fair value and gross contractual value of £10m, which are expected to be fully recoverable.<br />

The goodwill is not expected to be deductible for tax purposes.<br />

148<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>