BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

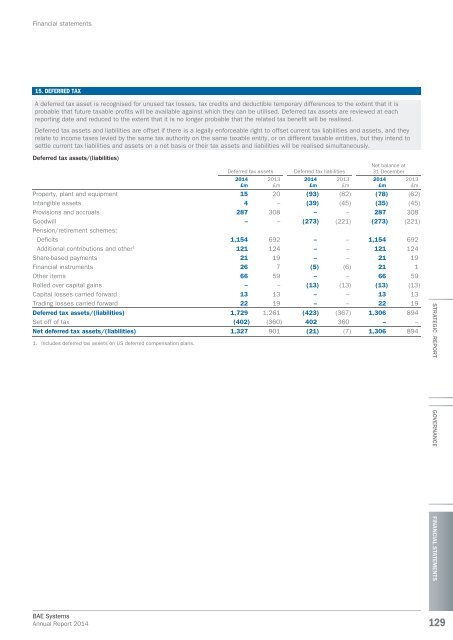

15. DEFERRED TAX<br />

A deferred tax asset is recognised for unused tax losses, tax credits and deductible temporary differences to the extent that it is<br />

probable that future taxable profits will be available against which they can be utilised. Deferred tax assets are reviewed at each<br />

<strong>report</strong>ing date and reduced to the extent that it is no longer probable that the related tax benefit will be realised.<br />

Deferred tax assets and liabilities are offset if there is a legally enforceable right to offset current tax liabilities and assets, and they<br />

relate to income taxes levied by the same tax authority on the same taxable entity, or on different taxable entities, but they intend to<br />

settle current tax liabilities and assets on a net basis or their tax assets and liabilities will be realised simultaneously.<br />

Deferred tax assets/(liabilities)<br />

Deferred tax assets<br />

Deferred tax liabilities<br />

Net balance at<br />

31 December<br />

Property, plant and equipment 15 20 (93) (82) (78) (62)<br />

Intangible assets 4 – (39) (45) (35) (45)<br />

Provisions and accruals 287 308 – – 287 308<br />

Goodwill – – (273) (221) (273) (221)<br />

Pension/retirement schemes:<br />

Deficits 1,154 692 – – 1,154 692<br />

Additional contributions and other 1 121 124 – – 121 124<br />

Share-based payments 21 19 – – 21 19<br />

Financial instruments 26 7 (5) (6) 21 1<br />

Other items 66 59 – – 66 59<br />

Rolled over capital gains – – (13) (13) (13) (13)<br />

Capital losses carried forward 13 13 – – 13 13<br />

Trading losses carried forward 22 19 – – 22 19<br />

Deferred tax assets/(liabilities) 1,729 1,261 (423) (367) 1,306 894<br />

Set off of tax (402) (360) 402 360 – –<br />

Net deferred tax assets/(liabilities) 1,327 901 (21) (7) 1,306 894<br />

1. Includes deferred tax assets on US deferred compensation plans.<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

129