BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

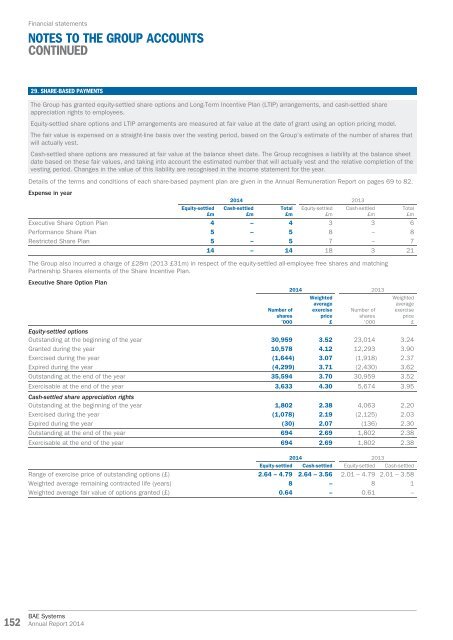

29. SHARE-BASED PAYMENTS<br />

The Group has granted equity-settled share options and Long-Term Incentive Plan (LTIP) arrangements, and cash-settled share<br />

appreciation rights to employees.<br />

Equity-settled share options and LTIP arrangements are measured at fair value at the date of grant using an option pricing model.<br />

The fair value is expensed on a straight-line basis over the vesting period, based on the Group’s estimate of the number of shares that<br />

will actually vest.<br />

Cash-settled share options are measured at fair value at the balance sheet date. The Group recognises a liability at the balance sheet<br />

date based on these fair values, and taking into account the estimated number that will actually vest and the relative completion of the<br />

vesting period. Changes in the value of this liability are recognised in the income statement for the year.<br />

Details of the terms and conditions of each share-based payment plan are given in the Annual Remuneration Report on pages 69 to 82.<br />

Expense in year<br />

<strong>2014</strong> 2013<br />

Equity-settled<br />

£m<br />

Cash-settled<br />

£m<br />

Total<br />

£m<br />

Equity-settled<br />

£m<br />

Cash-settled<br />

£m<br />

Executive Share Option Plan 4 – 4 3 3 6<br />

Performance Share Plan 5 – 5 8 – 8<br />

Restricted Share Plan 5 – 5 7 – 7<br />

14 – 14 18 3 21<br />

The Group also incurred a charge of £28m (2013 £31m) in respect of the equity-settled all-employee free shares and matching<br />

Partnership Shares elements of the Share Incentive Plan.<br />

Executive Share Option Plan<br />

<strong>2014</strong> 2013<br />

Number of<br />

shares<br />

’000<br />

Weighted<br />

average<br />

exercise<br />

price<br />

£<br />

Number of<br />

shares<br />

’000<br />

Total<br />

£m<br />

Weighted<br />

average<br />

exercise<br />

price<br />

£<br />

Equity-settled options<br />

Outstanding at the beginning of the year 30,959 3.52 23,014 3.24<br />

Granted during the year 10,578 4.12 12,293 3.90<br />

Exercised during the year (1,644) 3.07 (1,918) 2.37<br />

Expired during the year (4,299) 3.71 (2,430) 3.62<br />

Outstanding at the end of the year 35,594 3.70 30,959 3.52<br />

Exercisable at the end of the year 3,633 4.30 5,674 3.95<br />

Cash-settled share appreciation rights<br />

Outstanding at the beginning of the year 1,802 2.38 4,063 2.20<br />

Exercised during the year (1,078) 2.19 (2,125) 2.03<br />

Expired during the year (30) 2.07 (136) 2.30<br />

Outstanding at the end of the year 694 2.69 1,802 2.38<br />

Exercisable at the end of the year 694 2.69 1,802 2.38<br />

<strong>2014</strong> 2013<br />

Equity-settled Cash-settled Equity-settled Cash-settled<br />

Range of exercise price of outstanding options (£) 2.64 – 4.79 2.64 – 3.56 2.01 – 4.79 2.01 – 3.58<br />

Weighted average remaining contracted life (years) 8 – 8 1<br />

Weighted average fair value of options granted (£) 0.64 – 0.61 –<br />

152<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>