BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

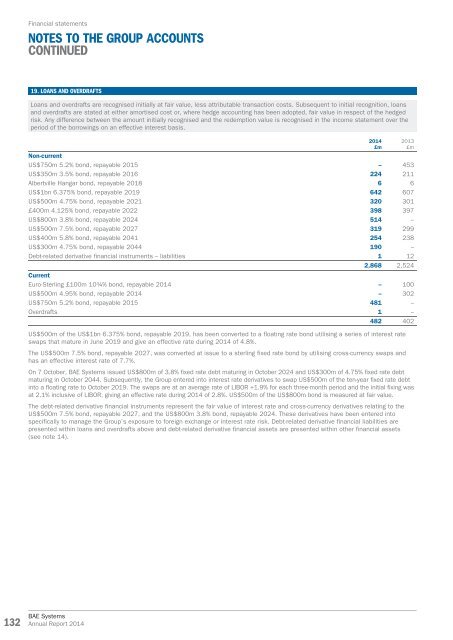

19. LOANS AND OVERDRAFTS<br />

Loans and overdrafts are recognised initially at fair value, less attributable transaction costs. Subsequent to initial recognition, loans<br />

and overdrafts are stated at either amortised cost or, where hedge accounting has been adopted, fair value in respect of the hedged<br />

risk. Any difference between the amount initially recognised and the redemption value is recognised in the income statement over the<br />

period of the borrowings on an effective interest basis.<br />

Non-current<br />

US$750m 5.2% bond, repayable 2015 – 453<br />

US$350m 3.5% bond, repayable 2016 224 211<br />

Albertville Hangar bond, repayable 2018 6 6<br />

US$1bn 6.375% bond, repayable 2019 642 607<br />

US$500m 4.75% bond, repayable 2021 320 301<br />

£400m 4.125% bond, repayable 2022 398 397<br />

US$800m 3.8% bond, repayable 2024 514 –<br />

US$500m 7.5% bond, repayable 2027 319 299<br />

US$400m 5.8% bond, repayable 2041 254 238<br />

US$300m 4.75% bond, repayable 2044 190 –<br />

Debt-related derivative financial instruments – liabilities 1 12<br />

2,868 2,524<br />

Current<br />

Euro-Sterling £100m 10¾% bond, repayable <strong>2014</strong> – 100<br />

US$500m 4.95% bond, repayable <strong>2014</strong> – 302<br />

US$750m 5.2% bond, repayable 2015 481 –<br />

Overdrafts 1 –<br />

482 402<br />

US$500m of the US$1bn 6.375% bond, repayable 2019, has been converted to a floating rate bond utilising a series of interest rate<br />

swaps that mature in June 2019 and give an effective rate during <strong>2014</strong> of 4.8%.<br />

The US$500m 7.5% bond, repayable 2027, was converted at issue to a sterling fixed rate bond by utilising cross-currency swaps and<br />

has an effective interest rate of 7.7%.<br />

On 7 October, <strong>BAE</strong> Systems issued US$800m of 3.8% fixed rate debt maturing in October 2024 and US$300m of 4.75% fixed rate debt<br />

maturing in October 2044. Subsequently, the Group entered into interest rate derivatives to swap US$500m of the ten-year fixed rate debt<br />

into a floating rate to October 2019. The swaps are at an average rate of LIBOR +1.9% for each three-month period and the initial fixing was<br />

at 2.1% inclusive of LIBOR, giving an effective rate during <strong>2014</strong> of 2.8%. US$500m of the US$800m bond is measured at fair value.<br />

The debt-related derivative financial instruments represent the fair value of interest rate and cross-currency derivatives relating to the<br />

US$500m 7.5% bond, repayable 2027, and the US$800m 3.8% bond, repayable 2024. These derivatives have been entered into<br />

specifically to manage the Group’s exposure to foreign exchange or interest rate risk. Debt-related derivative financial liabilities are<br />

presented within loans and overdrafts above and debt-related derivative financial assets are presented within other financial assets<br />

(see note 14).<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

132<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>