BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

NOTES TO THE GROUP ACCOUNTS<br />

CONTINUED<br />

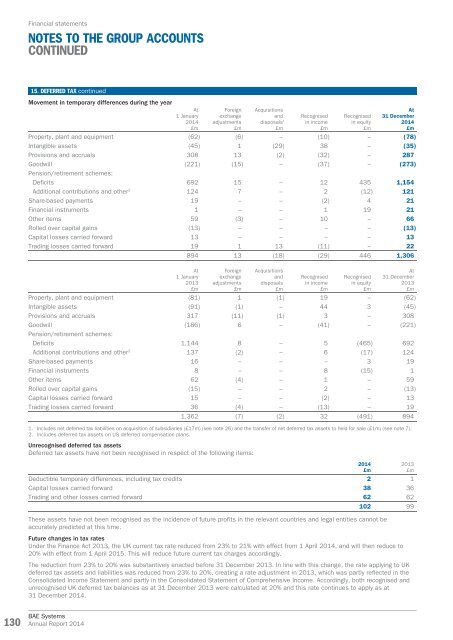

15. DEFERRED TAX continued<br />

Movement in temporary differences during the year<br />

At<br />

1 January<br />

<strong>2014</strong><br />

£m<br />

Foreign<br />

exchange<br />

adjustments<br />

£m<br />

Acquisitions<br />

and<br />

disposals 1<br />

£m<br />

Recognised<br />

in income<br />

£m<br />

Recognised<br />

in equity<br />

£m<br />

At<br />

31 December<br />

<strong>2014</strong><br />

£m<br />

Property, plant and equipment (62) (6) – (10) – (78)<br />

Intangible assets (45) 1 (29) 38 – (35)<br />

Provisions and accruals 308 13 (2) (32) – 287<br />

Goodwill (221) (15) – (37) – (273)<br />

Pension/retirement schemes:<br />

Deficits 692 15 – 12 435 1,154<br />

Additional contributions and other 2 124 7 – 2 (12) 121<br />

Share-based payments 19 – – (2) 4 21<br />

Financial instruments 1 – – 1 19 21<br />

Other items 59 (3) – 10 – 66<br />

Rolled over capital gains (13) – – – – (13)<br />

Capital losses carried forward 13 – – – – 13<br />

Trading losses carried forward 19 1 13 (11) – 22<br />

894 13 (18) (29) 446 1,306<br />

At<br />

1 January<br />

2013<br />

£m<br />

Foreign<br />

exchange<br />

adjustments<br />

£m<br />

Acquisitions<br />

and<br />

disposals<br />

£m<br />

Recognised<br />

in income<br />

£m<br />

Recognised<br />

in equity<br />

£m<br />

At<br />

31 December<br />

2013<br />

£m<br />

Property, plant and equipment (81) 1 (1) 19 – (62)<br />

Intangible assets (91) (1) – 44 3 (45)<br />

Provisions and accruals 317 (11) (1) 3 – 308<br />

Goodwill (186) 6 – (41) – (221)<br />

Pension/retirement schemes:<br />

Deficits 1,144 8 – 5 (465) 692<br />

Additional contributions and other 2 137 (2) – 6 (17) 124<br />

Share-based payments 16 – – – 3 19<br />

Financial instruments 8 – – 8 (15) 1<br />

Other items 62 (4) – 1 – 59<br />

Rolled over capital gains (15) – – 2 – (13)<br />

Capital losses carried forward 15 – – (2) – 13<br />

Trading losses carried forward 36 (4) – (13) – 19<br />

1,362 (7) (2) 32 (491) 894<br />

1. Includes net deferred tax liabilities on acquisition of subsidiaries (£17m) (see note 26) and the transfer of net deferred tax assets to held for sale (£1m) (see note 7).<br />

2. Includes deferred tax assets on US deferred compensation plans.<br />

Unrecognised deferred tax assets<br />

Deferred tax assets have not been recognised in respect of the following items:<br />

Deductible temporary differences, including tax credits 2 1<br />

Capital losses carried forward 38 36<br />

Trading and other losses carried forward 62 62<br />

102 99<br />

These assets have not been recognised as the incidence of future profits in the relevant countries and legal entities cannot be<br />

accurately predicted at this time.<br />

Future changes in tax rates<br />

Under the Finance Act 2013, the UK current tax rate reduced from 23% to 21% with effect from 1 April <strong>2014</strong>, and will then reduce to<br />

20% with effect from 1 April 2015. This will reduce future current tax charges accordingly.<br />

The reduction from 23% to 20% was substantively enacted before 31 December 2013. In line with this change, the rate applying to UK<br />

deferred tax assets and liabilities was reduced from 23% to 20%, creating a rate adjustment in 2013, which was partly reflected in the<br />

Consolidated Income Statement and partly in the Consolidated Statement of Comprehensive Income. Accordingly, both recognised and<br />

unrecognised UK deferred tax balances as at 31 December 2013 were calculated at 20% and this rate continues to apply as at<br />

31 December <strong>2014</strong>.<br />

<strong>2014</strong><br />

£m<br />

2013<br />

£m<br />

130<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>