BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

28. FINANCIAL RISK MANAGEMENT continued<br />

Borrowing facilities<br />

The Group’s objective is to maintain adequate undrawn committed borrowing facilities.<br />

At 31 December <strong>2014</strong>, the Group had a committed Revolving Credit Facility (RCF) of £2bn (2013 £2bn). The RCF is contracted<br />

until 2018 at £2bn and from 2018 to 2019 at £1.8bn. The RCF was undrawn throughout the year.<br />

Cash management<br />

Cash flow forecasting is performed by the businesses on a monthly basis. The Group monitors a rolling forecast of its liquidity<br />

requirements to ensure that there is sufficient cash to meet operational needs and maintain adequate headroom.<br />

Surplus cash held by the businesses over and above balances required for working capital management is loaned to the Group’s<br />

centralised treasury department. Surplus cash is invested in interest bearing current accounts, term deposits, money market deposits<br />

and marketable securities, choosing instruments with appropriate maturities or sufficient liquidity to provide sufficient headroom as<br />

determined by cash forecasts.<br />

The Group’s objective is to monitor and control counterparty credit risk and credit limit utilisation. The Group adopts a conservative<br />

approach to the investment of its surplus cash. It is deposited with financial institutions with the strongest credit ratings for short<br />

periods. The cash and cash equivalents balance at 31 December <strong>2014</strong> of £2,308m (2013 £2,222m) was invested with 30 (2013 27)<br />

financial institutions. A credit limit is allocated to each institution taking account of its market capitalisation, credit rating and credit<br />

default swap price. The Group has no exposure to Greek, Irish, Italian, Portuguese or Spanish banks. Additionally, the Group monitors<br />

its exposure to banks which have exposure to these countries.<br />

The cash and cash equivalents of the Group are invested in non-speculative financial instruments which are usually highly liquid, such<br />

as short-term deposits. The Group, therefore, believes it has reduced its exposure to counterparty credit risk through this process.<br />

Currency risk<br />

The Group’s objective is to reduce its exposure to transactional volatility in earnings and cash flows from movements in foreign currency<br />

exchange rates, mainly the US dollar, Euro and Saudi Riyal.<br />

The Group is exposed to movements in foreign currency exchange rates in respect of foreign currency denominated transactions. All<br />

material firm transactional exposures are hedged and the Group aims, where possible, to apply hedge accounting to these transactions.<br />

The Group is exposed to movements in foreign currency exchange rates in respect of the translation of net assets and income statements of<br />

foreign subsidiaries and equity accounted investments. The Group does not hedge the translation effect of exchange rate movements on the<br />

income statements or balance sheets of foreign subsidiaries and equity accounted investments it regards as long-term investments.<br />

Credit risk<br />

The Group has material receivables due from the UK, US and Saudi Arabian governments where credit risk is not considered an issue.<br />

For the remaining trade receivables, a provision for bad debts has been calculated taking into account individual assessments based on<br />

past credit history and prior knowledge of debtor insolvency or other credit risk, and no one counterparty constitutes more than 7% of the<br />

balance (2013 5%).<br />

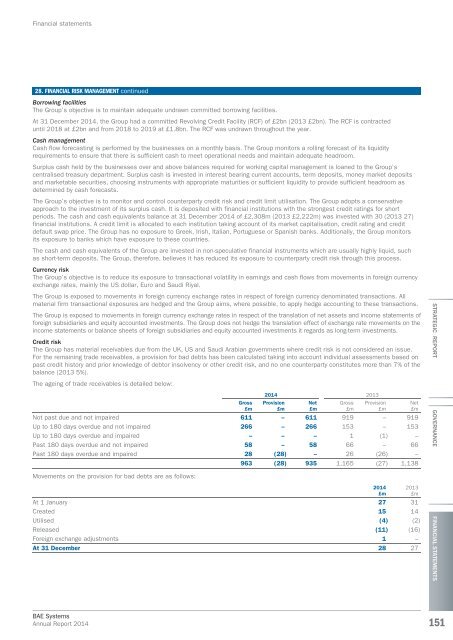

The ageing of trade receivables is detailed below:<br />

Gross<br />

£m<br />

<strong>2014</strong> 2013<br />

Provision<br />

£m<br />

Net<br />

£m<br />

Gross<br />

£m<br />

Provision<br />

£m<br />

Not past due and not impaired 611 – 611 919 – 919<br />

Up to 180 days overdue and not impaired 266 – 266 153 – 153<br />

Up to 180 days overdue and impaired – – – 1 (1) –<br />

Past 180 days overdue and not impaired 58 – 58 66 – 66<br />

Past 180 days overdue and impaired 28 (28) – 26 (26) –<br />

963 (28) 935 1,165 (27) 1,138<br />

Movements on the provision for bad debts are as follows:<br />

At 1 January 27 31<br />

Created 15 14<br />

Utilised (4) (2)<br />

Released (11) (16)<br />

Foreign exchange adjustments 1 –<br />

At 31 December 28 27<br />

<strong>2014</strong><br />

£m<br />

Net<br />

£m<br />

2013<br />

£m<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

151