BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

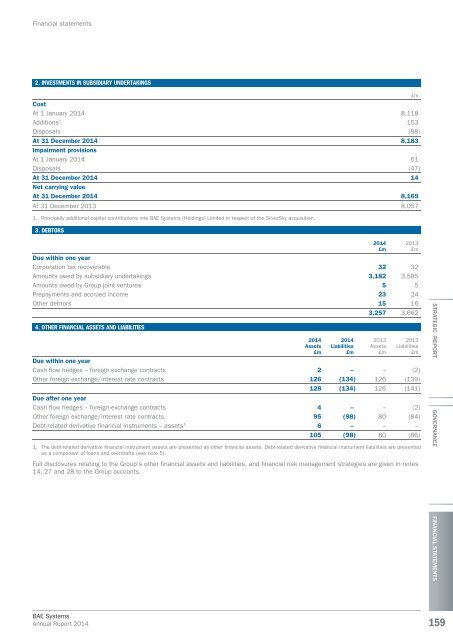

2. INVESTMENTS IN SUBSIDIARY UNDERTAKINGS<br />

£m<br />

Cost<br />

At 1 January <strong>2014</strong> 8,118<br />

Additions 1 153<br />

Disposals (88)<br />

At 31 December <strong>2014</strong> 8,183<br />

Impairment provisions<br />

At 1 January <strong>2014</strong> 61<br />

Disposals (47)<br />

At 31 December <strong>2014</strong> 14<br />

Net carrying value<br />

At 31 December <strong>2014</strong> 8,169<br />

At 31 December 2013 8,057<br />

1. Principally additional capital contributions into <strong>BAE</strong> Systems (Holdings) Limited in respect of the SilverSky acquisition.<br />

3. DEBTORS<br />

Due within one year<br />

Corporation tax recoverable 32 32<br />

Amounts owed by subsidiary undertakings 3,182 3,585<br />

Amounts owed by Group joint ventures 5 5<br />

Prepayments and accrued income 23 24<br />

Other debtors 15 16<br />

3,257 3,662<br />

4. OTHER FINANCIAL ASSETS AND LIABILITIES<br />

<strong>2014</strong><br />

Assets<br />

£m<br />

<strong>2014</strong><br />

Liabilities<br />

£m<br />

<strong>2014</strong><br />

£m<br />

2013<br />

Assets<br />

£m<br />

2013<br />

£m<br />

2013<br />

Liabilities<br />

£m<br />

Due within one year<br />

Cash flow hedges – foreign exchange contracts 2 – – (2)<br />

Other foreign exchange/interest rate contracts 126 (134) 126 (139)<br />

128 (134) 126 (141)<br />

Due after one year<br />

Cash flow hedges – foreign exchange contracts 4 – – (2)<br />

Other foreign exchange/interest rate contracts 95 (98) 80 (84)<br />

Debt-related derivative financial instruments – assets 1 6 – – –<br />

105 (98) 80 (86)<br />

1. The debt-related derivative financial instrument assets are presented as other financial assets. Debt-related derivative financial instrument liabilities are presented<br />

as a component of loans and overdrafts (see note 5).<br />

Full disclosures relating to the Group’s other financial assets and liabilities, and financial risk management strategies are given in notes<br />

14, 27 and 28 to the Group accounts.<br />

STRATEGIC REPORT GOVERNANCE<br />

FINANCIAL STATEMENTS<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong><br />

159