Global Players from Emerging Markets: Strengthening ... - Unctad

Global Players from Emerging Markets: Strengthening ... - Unctad

Global Players from Emerging Markets: Strengthening ... - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malaysian firms to go abroad (e.g. Royal<br />

Selangor and Press Metal). The rise of China<br />

has been instrumental in pushing Malaysian<br />

OFDI. China’s huge market and ample low cost<br />

labour have attracted many Malaysian firms.<br />

Other low cost neighbouring countries such as<br />

Viet Nam have also pressured Malaysian firms<br />

to venture abroad to improve competitiveness<br />

as well as taking advantage of investment<br />

opportunities provided by these countries.<br />

D. OFDI and implications for<br />

enterprise competitiveness<br />

There is no systematic documentation of<br />

information on the performance of OFDI by Malaysian<br />

firms. This hampers reliable assessment on the<br />

competitiveness of Malaysian firms abroad and the<br />

extent in which investing overseas had contributed<br />

to the overall competitiveness of Malaysian firms.<br />

However, available information indicates that there<br />

have been some mixed performances. Some firms<br />

have reported that they have increased production<br />

and are expanding, implying that their overseas<br />

operations are competitive; and have increased their<br />

corporate image as international firms. Top Glove and<br />

Ingress, which were once small firms, have reached a<br />

critical size thanks to the overseas operations. Some<br />

businesses overseas have failed. The main implications<br />

on competitiveness are examined below:<br />

• Market expansion. Many Malaysian firms<br />

have expanded and are making plans to expand<br />

their capacities overseas. These firms are<br />

optimistic in increasing their market shares<br />

abroad. Plantation companies such as Guthrie,<br />

Golden Hope Plantations and IOI have made<br />

significant investments overseas. Their long<br />

experience in plantation activities in Malaysia<br />

and the exploitation of these advantages<br />

contributed to developing their operations<br />

abroad. Royal Selangor - a company that has<br />

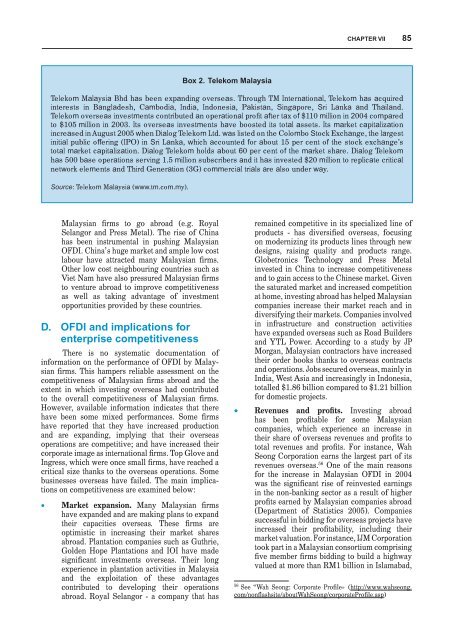

Box 2. Telekom Malaysia<br />

CHAPTER VII 85<br />

Telekom Malaysia Bhd has been expanding overseas. Through TM International, Telekom has acquired<br />

interests in Bangladesh, Cambodia, India, Indonesia, Pakistan, Singapore, Sri Lanka and Thailand.<br />

Telekom overseas investments contributed an operational profit after tax of $110 million in 2004 compared<br />

to $105 million in 2003. Its overseas investments have boosted its total assets. Its market capitalization<br />

increased in August 2005 when Dialog Telekom Ltd. was listed on the Colombo Stock Exchange, the largest<br />

initial public offering (IPO) in Sri Lanka, which accounted for about 15 per cent of the stock exchange’s<br />

total market capitalization. Dialog Telekom holds about 60 per cent of the market share. Dialog Telekom<br />

has 500 base operations serving 1.5 million subscribers and it has invested $20 million to replicate critical<br />

network elements and Third Generation (3G) commercial trials are also under way.<br />

Source: Telekom Malaysia (www.tm.com.my).<br />

remained competitive in its specialized line of<br />

products - has diversified overseas, focusing<br />

on modernizing its products lines through new<br />

designs, raising quality and products range.<br />

Globetronics Technology and Press Metal<br />

invested in China to increase competitiveness<br />

and to gain access to the Chinese market. Given<br />

the saturated market and increased competition<br />

at home, investing abroad has helped Malaysian<br />

companies increase their market reach and in<br />

diversifying their markets. Companies involved<br />

in infrastructure and construction activities<br />

have expanded overseas such as Road Builders<br />

and YTL Power. According to a study by JP<br />

Morgan, Malaysian contractors have increased<br />

their order books thanks to overseas contracts<br />

and operations. Jobs secured overseas, mainly in<br />

India, West Asia and increasingly in Indonesia,<br />

totalled $1.86 billion compared to $1.21 billion<br />

for domestic projects.<br />

• Revenues and profits. Investing abroad<br />

has been profitable for some Malaysian<br />

companies, which experience an increase in<br />

their share of overseas revenues and profits to<br />

total revenues and profits. For instance, Wah<br />

Seong Corporation earns the largest part of its<br />

revenues overseas. 56 One of the main reasons<br />

for the increase in Malaysian OFDI in 2004<br />

was the significant rise of reinvested earnings<br />

in the non-banking sector as a result of higher<br />

profits earned by Malaysian companies abroad<br />

(Department of Statistics 2005). Companies<br />

successful in bidding for overseas projects have<br />

increased their profitability, including their<br />

market valuation. For instance, IJM Corporation<br />

took part in a Malaysian consortium comprising<br />

five member firms bidding to build a highway<br />

valued at more than RM1 billion in Islamabad,<br />

56 See “Wah Seong: Corporate Profile» (http://www.wahseong.<br />

com/nonflashsite/aboutWahSeong/corporateProfile.asp)