The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -29- Legg Mason Wood Walker, Inc.<br />

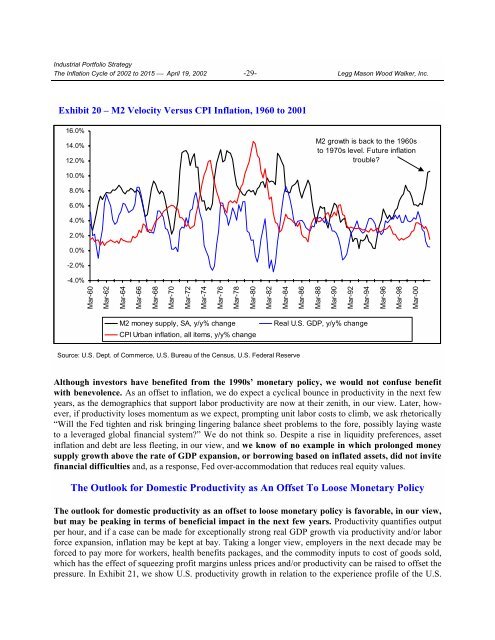

Exhibit 20 – M2 Velocity Versus CPI <strong>Inflation</strong>, 1960 <strong>to</strong> 2001<br />

16.0%<br />

14.0%<br />

12.0%<br />

M2 growth is back <strong>to</strong> the 1960s<br />

<strong>to</strong> 1970s level. Future inflation<br />

trouble?<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

-2.0%<br />

-4.0%<br />

Mar-60<br />

Mar-62<br />

Mar-64<br />

Mar-66<br />

Mar-68<br />

Mar-70<br />

Mar-72<br />

Mar-74<br />

Mar-76<br />

Mar-78<br />

Mar-80<br />

Mar-82<br />

Mar-84<br />

Mar-86<br />

Mar-88<br />

Mar-90<br />

Mar-92<br />

Mar-94<br />

Mar-96<br />

Mar-98<br />

Mar-00<br />

M2 money supply, SA, y/y% change<br />

CPI Urban inflation, all items, y/y% change<br />

Real U.S. GDP, y/y% change<br />

Source: U.S. Dept. <strong>of</strong> Commerce, U.S. Bureau <strong>of</strong> the Census, U.S. Federal Reserve<br />

Although inves<strong>to</strong>rs have benefited from the 1990s’ monetary policy, we would not confuse benefit<br />

with benevolence. As an <strong>of</strong>fset <strong>to</strong> inflation, we do expect a cyclical bounce in productivity in the next few<br />

years, as the demographics that support labor productivity are now at their zenith, in our view. Later, however,<br />

if productivity loses momentum as we expect, prompting unit labor costs <strong>to</strong> climb, we ask rhe<strong>to</strong>rically<br />

“Will the Fed tighten and risk bringing lingering balance sheet problems <strong>to</strong> the fore, possibly laying waste<br />

<strong>to</strong> a leveraged global financial system?” We do not think so. Despite a rise in liquidity preferences, asset<br />

inflation and debt are less fleeting, in our view, and we know <strong>of</strong> no example in which prolonged money<br />

supply growth above the rate <strong>of</strong> GDP expansion, or borrowing based on inflated assets, did not invite<br />

financial difficulties and, as a response, Fed over-accommodation that reduces real equity values.<br />

<strong>The</strong> Outlook for Domestic Productivity as An Offset To Loose Monetary Policy<br />

<strong>The</strong> outlook for domestic productivity as an <strong>of</strong>fset <strong>to</strong> loose monetary policy is favorable, in our view,<br />

but may be peaking in terms <strong>of</strong> beneficial impact in the next few years. Productivity quantifies output<br />

per hour, and if a case can be made for exceptionally strong real GDP growth via productivity and/or labor<br />

force expansion, inflation may be kept at bay. Taking a longer view, employers in the next decade may be<br />

forced <strong>to</strong> pay more for workers, health benefits packages, and the commodity inputs <strong>to</strong> cost <strong>of</strong> goods sold,<br />

which has the effect <strong>of</strong> squeezing pr<strong>of</strong>it margins unless prices and/or productivity can be raised <strong>to</strong> <strong>of</strong>fset the<br />

pressure. In Exhibit 21, we show U.S. productivity growth in relation <strong>to</strong> the experience pr<strong>of</strong>ile <strong>of</strong> the U.S.