The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -42- Legg Mason Wood Walker, Inc.<br />

• Deflation 1951 <strong>to</strong> 1965: Postwar peace dividend, with overseas oil production growth that caused<br />

U.S. oil imports <strong>to</strong> grow at a rate <strong>of</strong> 6.8% per year. Also, U.S. vehicle growth matured.<br />

• <strong>Inflation</strong> 1965 <strong>to</strong> 1981: OPEC supply embargoes, U.S. oil output peaked in 1970, U.S. oil imports<br />

grew 8.2% annually, there were cold winters. Energy prices rose 13.2% per annum from 1965 <strong>to</strong> 1981.<br />

• Deflation 1981 <strong>to</strong> 2001: Conservation, non-OPEC supply, a utility power glut, Gulf and Cold War<br />

peace dividends; $1 million <strong>of</strong> real GDP in 2000 used 765 barrels <strong>of</strong> oil, versus 1,537 barrels in 1972.<br />

We believe that the price mechanism still drives the energy market, and prices periodically inflate<br />

and deflate. For one <strong>to</strong> accept the argument that oil prices will perennially deflate (recall that disinflation is<br />

relative deflation) from the last cyclical peak in 1981 <strong>to</strong> infinity, then one must also believe that the price<br />

mechanism resulting from the push-pull relationship <strong>of</strong> supply and demand, and the effect it has on oil producer<br />

investment in new technologies,<br />

has been suspended.<br />

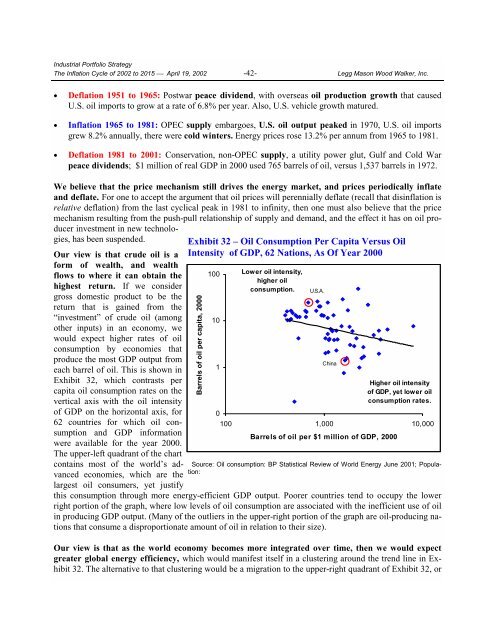

Our view is that crude oil is a<br />

form <strong>of</strong> wealth, and wealth<br />

flows <strong>to</strong> where it can obtain the<br />

highest return. If we consider<br />

gross domestic product <strong>to</strong> be the<br />

return that is gained from the<br />

“investment” <strong>of</strong> crude oil (among<br />

other inputs) in an economy, we<br />

would expect higher rates <strong>of</strong> oil<br />

consumption by economies that<br />

produce the most GDP output from<br />

each barrel <strong>of</strong> oil. This is shown in<br />

Exhibit 32, which contrasts per<br />

capita oil consumption rates on the<br />

vertical axis with the oil intensity<br />

<strong>of</strong> GDP on the horizontal axis, for<br />

62 countries for which oil consumption<br />

and GDP information<br />

were available for the year 2000.<br />

<strong>The</strong> upper-left quadrant <strong>of</strong> the chart<br />

contains most <strong>of</strong> the world’s advanced<br />

economies, which are the<br />

largest oil consumers, yet justify<br />

Exhibit 32 – Oil Consumption Per Capita Versus Oil<br />

Intensity <strong>of</strong> GDP, 62 Nations, As Of Year 2000<br />

Barrels <strong>of</strong> oil per capita, 2000<br />

100<br />

10<br />

1<br />

Lower oil intensity,<br />

higher oil<br />

consumption.<br />

Higher oil intensity<br />

<strong>of</strong> GDP, yet lower oil<br />

consumption rates.<br />

0<br />

100 1,000 10,000<br />

Barrels <strong>of</strong> oil per $1 million <strong>of</strong> GDP, 2000<br />

Source: Oil consumption: BP Statistical Review <strong>of</strong> World Energy June 2001; Population:<br />

this consumption through more energy-efficient GDP output. Poorer countries tend <strong>to</strong> occupy the lower<br />

right portion <strong>of</strong> the graph, where low levels <strong>of</strong> oil consumption are associated with the inefficient use <strong>of</strong> oil<br />

in producing GDP output. (Many <strong>of</strong> the outliers in the upper-right portion <strong>of</strong> the graph are oil-producing nations<br />

that consume a disproportionate amount <strong>of</strong> oil in relation <strong>to</strong> their size).<br />

Our view is that as the world economy becomes more integrated over time, then we would expect<br />

greater global energy efficiency, which would manifest itself in a clustering around the trend line in Exhibit<br />

32. <strong>The</strong> alternative <strong>to</strong> that clustering would be a migration <strong>to</strong> the upper-right quadrant <strong>of</strong> Exhibit 32, or<br />

U.S.A.<br />

China