The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -47- Legg Mason Wood Walker, Inc.<br />

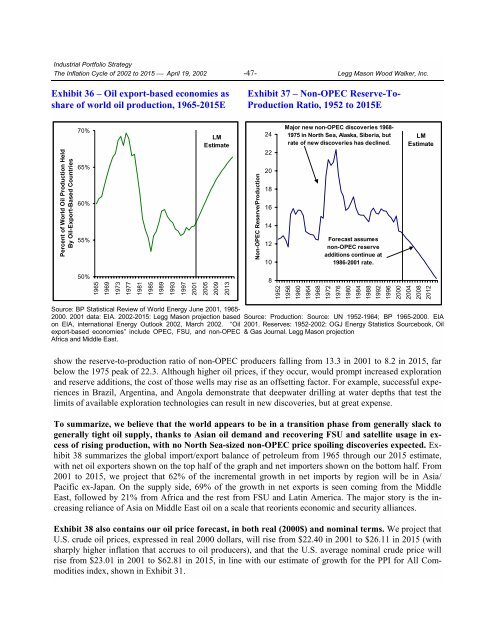

Exhibit 36 – Oil export-based economies as<br />

share <strong>of</strong> world oil production, 1965-<strong>2015</strong>E<br />

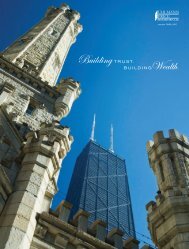

Exhibit 37 – Non-OPEC Reserve-To-<br />

Production Ratio, 1952 <strong>to</strong> <strong>2015</strong>E<br />

Percent <strong>of</strong> World Oil Production Held<br />

By Oil-Export-Based Countries<br />

70%<br />

65%<br />

60%<br />

55%<br />

LM<br />

Estimate<br />

Non-OPEC Reserve/Production<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

Major new non-OPEC discoveries 1968-<br />

1975 in North Sea, Alaska, Siberia, but<br />

rate <strong>of</strong> new discoveries has declined.<br />

Forecast assumes<br />

non-OPEC reserve<br />

additions continue at<br />

1986-2001 rate.<br />

LM<br />

Estimate<br />

50%<br />

1965<br />

1969<br />

1973<br />

1977<br />

1981<br />

1985<br />

1989<br />

1993<br />

1997<br />

2001<br />

2005<br />

2009<br />

2013<br />

8<br />

1952<br />

1956<br />

1960<br />

1964<br />

1968<br />

1972<br />

1976<br />

1980<br />

1984<br />

1988<br />

1992<br />

1996<br />

2000<br />

2004<br />

2008<br />

2012<br />

Source: BP Statistical Review <strong>of</strong> World Energy June 2001, 1965-<br />

2000. 2001 data: EIA. <strong>2002</strong>-<strong>2015</strong>: Legg Mason projection based<br />

on EIA, international Energy Outlook <strong>2002</strong>, March <strong>2002</strong>. “Oil<br />

export-based economies” include OPEC, FSU, and non-OPEC<br />

Africa and Middle East.<br />

Source: Production: Source: UN 1952-1964; BP 1965-2000. EIA<br />

2001. Reserves: 1952-<strong>2002</strong>: OGJ Energy Statistics Sourcebook, Oil<br />

& Gas Journal. Legg Mason projection<br />

show the reserve-<strong>to</strong>-production ratio <strong>of</strong> non-OPEC producers falling from 13.3 in 2001 <strong>to</strong> 8.2 in <strong>2015</strong>, far<br />

below the 1975 peak <strong>of</strong> 22.3. Although higher oil prices, if they occur, would prompt increased exploration<br />

and reserve additions, the cost <strong>of</strong> those wells may rise as an <strong>of</strong>fsetting fac<strong>to</strong>r. For example, successful experiences<br />

in Brazil, Argentina, and Angola demonstrate that deepwater drilling at water depths that test the<br />

limits <strong>of</strong> available exploration technologies can result in new discoveries, but at great expense.<br />

To summarize, we believe that the world appears <strong>to</strong> be in a transition phase from generally slack <strong>to</strong><br />

generally tight oil supply, thanks <strong>to</strong> Asian oil demand and recovering FSU and satellite usage in excess<br />

<strong>of</strong> rising production, with no North Sea-sized non-OPEC price spoiling discoveries expected. Exhibit<br />

38 summarizes the global import/export balance <strong>of</strong> petroleum from 1965 through our <strong>2015</strong> estimate,<br />

with net oil exporters shown on the <strong>to</strong>p half <strong>of</strong> the graph and net importers shown on the bot<strong>to</strong>m half. From<br />

2001 <strong>to</strong> <strong>2015</strong>, we project that 62% <strong>of</strong> the incremental growth in net imports by region will be in Asia/<br />

Pacific ex-Japan. On the supply side, 69% <strong>of</strong> the growth in net exports is seen coming from the Middle<br />

East, followed by 21% from Africa and the rest from FSU and Latin America. <strong>The</strong> major s<strong>to</strong>ry is the increasing<br />

reliance <strong>of</strong> Asia on Middle East oil on a scale that reorients economic and security alliances.<br />

Exhibit 38 also contains our oil price forecast, in both real (2000$) and nominal terms. We project that<br />

U.S. crude oil prices, expressed in real 2000 dollars, will rise from $22.40 in 2001 <strong>to</strong> $26.11 in <strong>2015</strong> (with<br />

sharply higher inflation that accrues <strong>to</strong> oil producers), and that the U.S. average nominal crude price will<br />

rise from $23.01 in 2001 <strong>to</strong> $62.81 in <strong>2015</strong>, in line with our estimate <strong>of</strong> growth for the PPI for All Commodities<br />

index, shown in Exhibit 31.