The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -39- Legg Mason Wood Walker, Inc.<br />

Scenario (2) Rapid Developing Country Modernization And Global Economic<br />

Growth Leading <strong>to</strong> a Sustained and <strong>Inflation</strong>ary Boom in Commodity<br />

Demand: Probability: 60%<br />

Will Surging Demand Create Peacetime Commodity <strong>Inflation</strong>?<br />

In a peacetime scenario, we believe that the U.S.’s need for sustainable growth <strong>to</strong> service its debts will<br />

require the creation <strong>of</strong> new markets <strong>to</strong> sell its goods and services, primarily in the developing world.<br />

In an unusual twist versus the his<strong>to</strong>rical norm <strong>of</strong> trade-based deflation, we believe that there is a 60% probability<br />

that the post-Communist, World Trade Organization-inspired, fertile mix <strong>of</strong> cheap labor, freeflowing<br />

capital, and technology transfer will create extraordinarily rapid global economic growth that<br />

places stresses on key raw material markets. Many raw materials producers have scaled back their internal<br />

investment as they have incurred poor returns since the previous inflation cycle, which ended approximately<br />

20 years ago. <strong>The</strong> combination <strong>of</strong> sustained, strong demand plus relatively inelastic supply, along with a<br />

Fed that remains somewhat accommodative as a result <strong>of</strong> the financial and political stresses discussed earlier,<br />

could spur a demand-led price inflation cycle in the <strong>2002</strong> <strong>to</strong> <strong>2015</strong> period.<br />

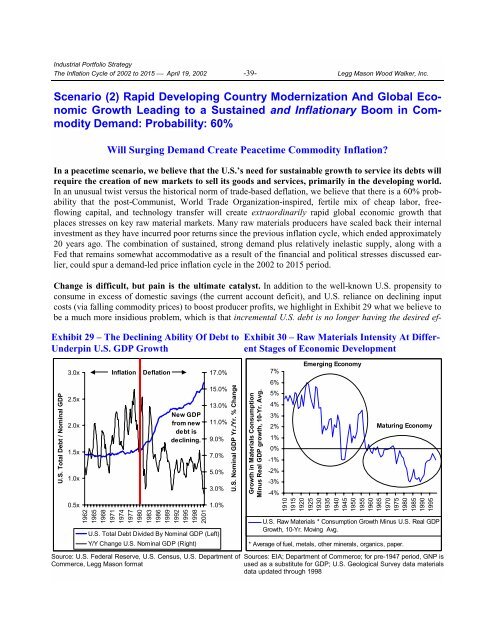

Change is difficult, but pain is the ultimate catalyst. In addition <strong>to</strong> the well-known U.S. propensity <strong>to</strong><br />

consume in excess <strong>of</strong> domestic savings (the current account deficit), and U.S. reliance on declining input<br />

costs (via falling commodity prices) <strong>to</strong> boost producer pr<strong>of</strong>its, we highlight in Exhibit 29 what we believe <strong>to</strong><br />

be a much more insidious problem, which is that incremental U.S. debt is no longer having the desired ef-<br />

Exhibit 29 – <strong>The</strong> Declining Ability Of Debt <strong>to</strong><br />

Underpin U.S. GDP Growth<br />

U.S. Total Debt / Nominal GDP<br />

3.0x<br />

2.5x<br />

2.0x<br />

1.5x<br />

1.0x<br />

0.5x<br />

<strong>Inflation</strong><br />

Deflation<br />

New GDP<br />

from new<br />

debt is<br />

declining.<br />

1962<br />

1965<br />

1968<br />

1971<br />

1974<br />

1977<br />

1980<br />

1983<br />

1986<br />

1989<br />

1992<br />

1995<br />

1998<br />

2001<br />

17.0%<br />

15.0%<br />

13.0%<br />

11.0%<br />

9.0%<br />

7.0%<br />

5.0%<br />

3.0%<br />

1.0%<br />

U.S. Total Debt Divided By Nominal GDP (Left)<br />

Y/Y Change U.S. Nominal GDP (Right)<br />

Source: U.S. Federal Reserve, U.S. Census, U.S. Department <strong>of</strong><br />

Commerce, Legg Mason format<br />

U.S. Nominal GDP Yr./Yr. % Change<br />

Exhibit 30 – Raw Materials Intensity At Different<br />

Stages <strong>of</strong> Economic Development<br />

Growth in Materials Consumption<br />

Minus Real GDP growth, 10-Yr. Avg.<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

-1%<br />

-2%<br />

-3%<br />

-4%<br />

Emerging Economy<br />

Maturing Economy<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

1980<br />

1985<br />

1990<br />

1995<br />

U.S. Raw Materials * Consumption Growth Minus U.S. Real GDP<br />

Growth, 10-Yr. Moving Avg.<br />

* Average <strong>of</strong> fuel, metals, other minerals, organics, paper.<br />

Sources: EIA; Department <strong>of</strong> Commerce; for pre-1947 period, GNP is<br />

used as a substitute for GDP; U.S. Geological Survey data materials<br />

data updated through 1998