The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -51- Legg Mason Wood Walker, Inc.<br />

U.S. Farm Commodity Export and <strong>Inflation</strong> Prospects, <strong>2002</strong> <strong>to</strong> <strong>2015</strong>E<br />

U.S. Farm Commodity <strong>Price</strong> <strong>Cycle</strong>s<br />

In Exhibit 40, we show the seven inflationary or deflationary price cycles <strong>of</strong> the PPI for Farm Products<br />

(PPI-Farm) index from 1870 <strong>to</strong> present. <strong>The</strong> cycles have lasted an average <strong>of</strong> 19 years, with prices<br />

in the average inflation cycle rising 8.0% per year, in a range <strong>of</strong> 6.2% <strong>to</strong> 9.8% per year. <strong>Price</strong>s in the average<br />

deflation cycle declined 2.6% per year, in a range <strong>of</strong> minus 8.7% <strong>to</strong> positive 1.6%. We find it interesting<br />

that inflation cycles are more uniform and regular than cycles <strong>of</strong> deflation in the farm industry. As Exhibit<br />

40 shows, some <strong>of</strong> the determinants <strong>of</strong> those cycles have been rising or falling input costs, farm productivity,<br />

and acreage, but one <strong>of</strong> the most important determinants has been the growth <strong>of</strong> exports. For clues as <strong>to</strong><br />

the direction <strong>of</strong> U.S. agricultural export growth we turn <strong>to</strong> the U.S. dollar. <strong>The</strong> declines in the agricultural<br />

trade-weighted U.S. dollar from 1970 <strong>to</strong> 1978 and 1985 <strong>to</strong> 1993 were associated with a surge in the export<br />

<strong>of</strong> U.S. agricultural products, just as U.S. dollar strength in 1978 <strong>to</strong> 1985 and 1995 <strong>to</strong> <strong>2002</strong> pressured U.S.<br />

food exports. An important difference between agricultural exports and oil exports is that the latter is denominated<br />

in U.S. dollars worldwide, whereas the fluctuations in home currency have a disproportionate<br />

effect on farmers (and numerous other commodity producers, for that matter).<br />

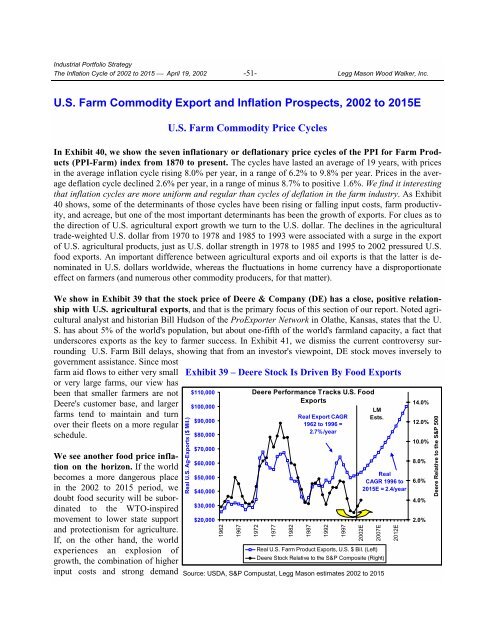

We show in Exhibit 39 that the s<strong>to</strong>ck price <strong>of</strong> Deere & Company (DE) has a close, positive relationship<br />

with U.S. agricultural exports, and that is the primary focus <strong>of</strong> this section <strong>of</strong> our report. Noted agricultural<br />

analyst and his<strong>to</strong>rian Bill Hudson <strong>of</strong> the ProExporter Network in Olathe, Kansas, states that the U.<br />

S. has about 5% <strong>of</strong> the world's population, but about one-fifth <strong>of</strong> the world's farmland capacity, a fact that<br />

underscores exports as the key <strong>to</strong> farmer success. In Exhibit 41, we dismiss the current controversy surrounding<br />

U.S. Farm Bill delays, showing that from an inves<strong>to</strong>r's viewpoint, DE s<strong>to</strong>ck moves inversely <strong>to</strong><br />

government assistance. Since most<br />

farm aid flows <strong>to</strong> either very small<br />

or very large farms, our view has<br />

been that smaller farmers are not<br />

Deere's cus<strong>to</strong>mer base, and larger<br />

farms tend <strong>to</strong> maintain and turn<br />

over their fleets on a more regular<br />

schedule.<br />

We see another food price inflation<br />

on the horizon. If the world<br />

becomes a more dangerous place<br />

in the <strong>2002</strong> <strong>to</strong> <strong>2015</strong> period, we<br />

doubt food security will be subordinated<br />

<strong>to</strong> the WTO-inspired<br />

movement <strong>to</strong> lower state support<br />

and protectionism for agriculture.<br />

If, on the other hand, the world<br />

experiences an explosion <strong>of</strong><br />

growth, the combination <strong>of</strong> higher<br />

input costs and strong demand<br />

Exhibit 39 – Deere S<strong>to</strong>ck Is Driven By Food Exports<br />

Real U.S. Ag-Exports ($ Mil.)<br />

$110,000<br />

$100,000<br />

$90,000<br />

$80,000<br />

$70,000<br />

$60,000<br />

$50,000<br />

$40,000<br />

$30,000<br />

$20,000<br />

1962<br />

1967<br />

Deere Performance Tracks U.S. Food<br />

Exports<br />

1972<br />

1977<br />

Source: USDA, S&P Compustat, Legg Mason estimates <strong>2002</strong> <strong>to</strong> <strong>2015</strong><br />

1982<br />

Real Export CAGR<br />

1962 <strong>to</strong> 1996 =<br />

2.7%/year<br />

1987<br />

1992<br />

1997<br />

<strong>2002</strong>E<br />

LM<br />

Ests.<br />

Real U.S. Farm Product Exports, U.S. $ Bil. (Left)<br />

2007E<br />

Deere S<strong>to</strong>ck Relative <strong>to</strong> the S&P Composite (Right)<br />

Real<br />

CAGR 1996 <strong>to</strong><br />

<strong>2015</strong>E = 2.4/year<br />

2012E<br />

14.0%<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

Deere Relative <strong>to</strong> the S&P 500