The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -56- Legg Mason Wood Walker, Inc.<br />

ports, where demand is believed <strong>to</strong> be<br />

greater and less subject <strong>to</strong> political<br />

considerations.<br />

Despite the competitive pressure,<br />

we believe Chinese agriculture<br />

should not be underestimated. Chinese<br />

production <strong>of</strong> corn, wheat and<br />

rice grew from about 100 MMT in the<br />

early 1960s, just before a disastrous<br />

famine, <strong>to</strong> 200 MMT in the late 1970s,<br />

as labor and land were applied <strong>to</strong> the<br />

shortage problem. Since China introduced<br />

certain agricultural market reforms<br />

in 1978, followed by an additional<br />

round in the mid-1990s termed<br />

the "Governor's Grain Bag" policy,<br />

<strong>to</strong>tal agricultural staples production<br />

rose <strong>to</strong> about 390 MMT in the late<br />

1990s, an increase <strong>of</strong> 90% in two decades.<br />

China set its tariff rate quotas<br />

(TRQs) high enough for corn and<br />

wheat that they are unlikely <strong>to</strong> be a<br />

problem for exporters <strong>to</strong> China in<br />

FY02, and notably absent is a TRQ<br />

for soybeans, <strong>of</strong> which China has<br />

been a prodigious importer. In fact,<br />

Chinese imports <strong>of</strong> soybeans represent<br />

about 20% <strong>of</strong> the global oilseed<br />

trade, and China imported approximately<br />

14 MMT <strong>of</strong> soybeans last<br />

year. China has maintained a liberal<br />

import policy with respect <strong>to</strong> soybean<br />

imports <strong>to</strong> feed its growing domestic<br />

needs, so we are not alarmed by the<br />

genetically modified organism (GMO)<br />

talk, which may simply be posturing<br />

<strong>to</strong> protect other segments <strong>of</strong> the Chinese<br />

farming sec<strong>to</strong>r.<br />

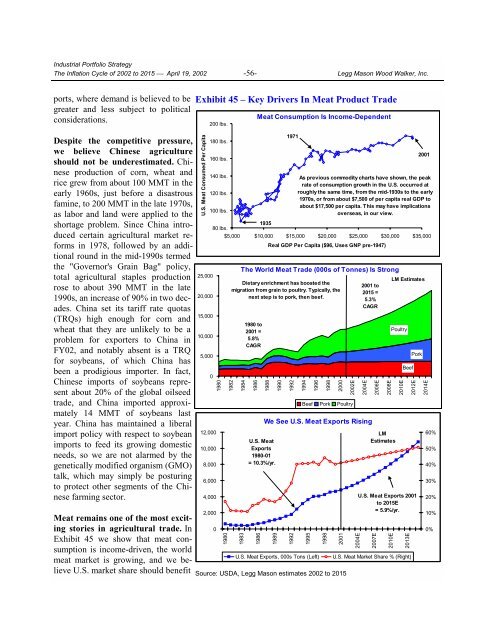

Exhibit 45 – Key Drivers In Meat Product Trade<br />

U.S. Meat Consumed Per Capita<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

200 lbs.<br />

180 lbs.<br />

160 lbs.<br />

140 lbs.<br />

120 lbs.<br />

100 lbs.<br />

Meat Consumption Is Income-Dependent<br />

1935<br />

80 lbs.<br />

$5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000<br />

Real GDP Per Capita ($96, Uses GNP pre-1947)<br />

Meat remains one <strong>of</strong> the most exciting<br />

s<strong>to</strong>ries in agricultural trade. In 0<br />

Exhibit 45 we show that meat consumption<br />

is income-driven, the world<br />

U.S. Meat Exports, 000s Tons (Left)<br />

meat market is growing, and we believe<br />

U.S. market share should benefit Source: USDA, Legg Mason estimates <strong>2002</strong> <strong>to</strong> <strong>2015</strong><br />

5,000<br />

0<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

1980<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1971<br />

1992<br />

2001<br />

As previous commodity charts have shown, the peak<br />

rate <strong>of</strong> consumption growth in the U.S. occurred at<br />

roughly the same time, from the mid-1930s <strong>to</strong> the early<br />

1970s, or from about $7,500 <strong>of</strong> per capita real GDP <strong>to</strong><br />

about $17,500 per capita. This may have implications<br />

overseas, in our view.<br />

<strong>The</strong> World Meat Trade (000s <strong>of</strong> Tonnes) Is Strong<br />

LM Estimates<br />

Dietary enrichment has boosted the<br />

2001 <strong>to</strong><br />

migration from grain <strong>to</strong> poultry. Typically, the<br />

<strong>2015</strong> =<br />

next step is <strong>to</strong> pork, then beef.<br />

5.3%<br />

CAGR<br />

1983<br />

1980 <strong>to</strong><br />

2001 =<br />

5.8%<br />

CAGR<br />

U.S. Meat<br />

Exports<br />

1980-01<br />

= 10.3%/yr.<br />

1986<br />

1994<br />

1996<br />

1998<br />

2000<br />

<strong>2002</strong>E<br />

Beef Pork Poultry<br />

2004E<br />

We See U.S. Meat Exports Rising<br />

1989<br />

1992<br />

1995<br />

1998<br />

2001<br />

2004E<br />

2006E<br />

2008E<br />

LM<br />

Estimates<br />

2007E<br />

2010E<br />

Poultry<br />

2010E<br />

Beef<br />

2013E<br />

Pork<br />

2012E<br />

U.S. Meat Exports 2001<br />

<strong>to</strong> <strong>2015</strong>E<br />

= 5.9%/yr.<br />

U.S. Meat Market Share % (Right)<br />

2014E<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%