The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -9- Legg Mason Wood Walker, Inc.<br />

moderately attractive because <strong>of</strong> their leverage <strong>to</strong> the environment we expect in the coming years. For example,<br />

Caterpillar is the leading provider <strong>of</strong> engines used in the production and movement <strong>of</strong> hydrocarbons, as<br />

well as the leading provider <strong>of</strong> heavy machinery used <strong>to</strong> extract minerals or build basic infrastructure in<br />

many emerging markets, a number <strong>of</strong> which are commodity producers. Deere & Company is the leading provider<br />

<strong>of</strong> farm machinery in the world, and Joy Global has a leading position in electric shovels and underground<br />

coal mining equipment. Our posture since 2000 with respect <strong>to</strong> CAT and DE has been <strong>to</strong> trade the<br />

s<strong>to</strong>cks within a price range until EPS began <strong>to</strong> recover. Both CAT and DE have performed well since 3Q00,<br />

around the same time the price <strong>of</strong> the S&P 500 began <strong>to</strong> decline, which we do not believe is coincidental<br />

since that is around the same time the secular changes we outline in this report began <strong>to</strong> emerge. We turned<br />

neutral on CAT and DE in December 2001 as a result <strong>of</strong> macroeconomic “balance sheet” concerns that have<br />

since been overshadowed by aggressive (preinflationary?) policy bandages applied <strong>to</strong> the “cash flow” side <strong>of</strong><br />

the economy.<br />

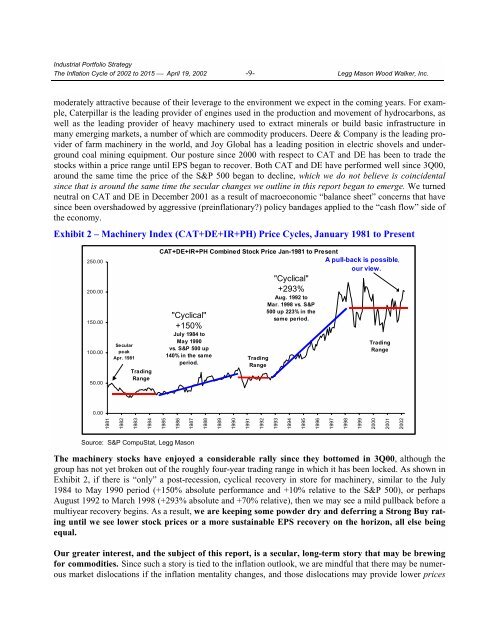

Exhibit 2 – Machinery Index (CAT+DE+IR+PH) <strong>Price</strong> <strong>Cycle</strong>s, January 1981 <strong>to</strong> Present<br />

250.00<br />

200.00<br />

150.00<br />

100.00<br />

50.00<br />

Secular<br />

peak<br />

Apr. 1981<br />

Trading<br />

Range<br />

CAT+DE+IR+PH Combined S<strong>to</strong>ck <strong>Price</strong> Jan-1981 <strong>to</strong> Present<br />

A pull-back is possible,<br />

our view.<br />

"Cyclical"<br />

+150%<br />

July 1984 <strong>to</strong><br />

May 1990<br />

vs. S&P 500 up<br />

140% in the same<br />

period.<br />

Trading<br />

Range<br />

"Cyclical"<br />

+293%<br />

Aug. 1992 <strong>to</strong><br />

Mar. 1998 vs. S&P<br />

500 up 223% in the<br />

same period.<br />

Trading<br />

Range<br />

0.00<br />

1981<br />

1982<br />

1983<br />

1984<br />

1985<br />

1986<br />

1987<br />

1988<br />

1989<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

<strong>2002</strong><br />

Source: S&P CompuStat, Legg Mason<br />

<strong>The</strong> machinery s<strong>to</strong>cks have enjoyed a considerable rally since they bot<strong>to</strong>med in 3Q00, although the<br />

group has not yet broken out <strong>of</strong> the roughly four-year trading range in which it has been locked. As shown in<br />

Exhibit 2, if there is “only” a post-recession, cyclical recovery in s<strong>to</strong>re for machinery, similar <strong>to</strong> the July<br />

1984 <strong>to</strong> May 1990 period (+150% absolute performance and +10% relative <strong>to</strong> the S&P 500), or perhaps<br />

August 1992 <strong>to</strong> March 1998 (+293% absolute and +70% relative), then we may see a mild pullback before a<br />

multiyear recovery begins. As a result, we are keeping some powder dry and deferring a Strong Buy rating<br />

until we see lower s<strong>to</strong>ck prices or a more sustainable EPS recovery on the horizon, all else being<br />

equal.<br />

Our greater interest, and the subject <strong>of</strong> this report, is a secular, long-term s<strong>to</strong>ry that may be brewing<br />

for commodities. Since such a s<strong>to</strong>ry is tied <strong>to</strong> the inflation outlook, we are mindful that there may be numerous<br />

market dislocations if the inflation mentality changes, and those dislocations may provide lower prices