The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

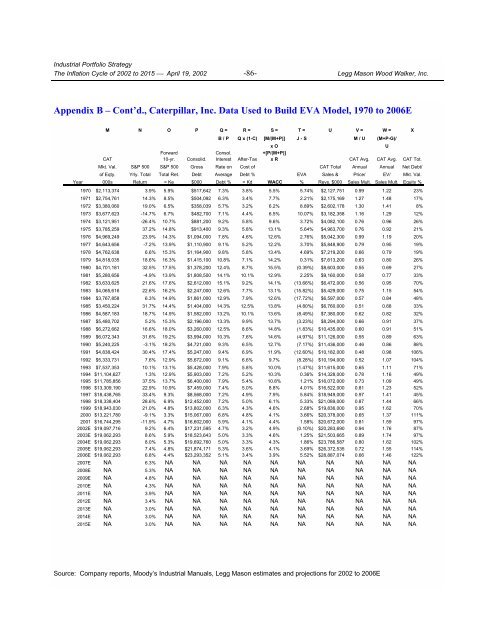

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -86- Legg Mason Wood Walker, Inc.<br />

Appendix B – Cont’d., Caterpillar, Inc. Data Used <strong>to</strong> Build EVA Model, 1970 <strong>to</strong> 2006E<br />

M N O P Q = R = S = T = U V = W = X<br />

B / P Q x (1-C) [M/(M+P)] J - S M / U (M+P-G)/<br />

x O U<br />

Forward Consol. +[P/(M+P)]<br />

CAT 10-yr. Consolid. Interest After-Tax x R CAT Avg. CAT Avg. CAT Tot.<br />

Mkt. Val. S&P 500 S&P 500 Gross Rate on Cost <strong>of</strong> CAT Total Annual Annual Net Debt/<br />

<strong>of</strong> Eqty. Yrly. Total Total Ret. Debt Average Debt % EVA Sales & <strong>Price</strong>/ EV/ Mkt. Val.<br />

Year 000s Return = Ke $000 Debt % = Kd WACC % Revs. $000 Sales Mult. Sales Mult. Equity %<br />

1970 $2,113,374 3.9% 5.9% $517,642 7.3% 3.8% 5.5% 5.74% $2,127,751 0.99 1.22 23%<br />

1971 $2,754,761 14.3% 8.5% $504,092 6.3% 3.4% 7.7% 2.21% $2,175,169 1.27 1.48 17%<br />

1972 $3,380,060 19.0% 6.5% $358,039 5.7% 3.2% 6.2% 8.89% $2,602,178 1.30 1.41 8%<br />

1973 $3,677,623 -14.7% 6.7% $482,700 7.1% 4.4% 6.5% 10.07% $3,182,358 1.16 1.29 12%<br />

1974 $3,121,951 -26.4% 10.7% $881,200 9.2% 5.8% 9.6% 3.72% $4,082,100 0.76 0.96 26%<br />

1975 $3,785,259 37.2% 14.8% $913,400 9.3% 5.8% 13.1% 5.64% $4,963,700 0.76 0.92 21%<br />

1976 $4,969,249 23.9% 14.3% $1,094,000 7.8% 4.6% 12.6% 2.76% $5,042,300 0.99 1.19 20%<br />

1977 $4,643,656 -7.2% 13.9% $1,110,900 9.1% 5.2% 12.2% 3.70% $5,848,900 0.79 0.95 19%<br />

1978 $4,762,638 6.6% 15.3% $1,164,900 9.8% 5.8% 13.4% 4.69% $7,219,200 0.66 0.79 19%<br />

1979 $4,818,035 18.6% 16.3% $1,415,100 10.8% 7.1% 14.2% 0.31% $7,613,200 0.63 0.80 26%<br />

1980 $4,701,181 32.5% 17.5% $1,378,200 12.4% 8.7% 15.5% (0.39%) $8,603,000 0.55 0.69 27%<br />

1981 $5,280,656 -4.9% 13.9% $1,808,500 14.1% 10.1% 12.9% 2.25% $9,160,000 0.58 0.77 33%<br />

1982 $3,633,625 21.6% 17.6% $2,612,000 15.1% 9.2% 14.1% (13.66%) $6,472,000 0.56 0.95 70%<br />

1983 $4,065,616 22.6% 16.2% $2,247,000 12.6% 7.7% 13.1% (15.82%) $5,429,000 0.75 1.15 54%<br />

1984 $3,767,858 6.3% 14.9% $1,861,000 12.9% 7.9% 12.6% (17.72%) $6,597,000 0.57 0.84 48%<br />

1985 $3,450,224 31.7% 14.4% $1,404,000 14.3% 12.5% 13.8% (4.80%) $6,760,000 0.51 0.68 33%<br />

1986 $4,587,183 18.7% 14.9% $1,582,000 13.2% 10.1% 13.6% (8.49%) $7,380,000 0.62 0.82 32%<br />

1987 $5,480,702 5.2% 15.3% $2,196,000 13.3% 9.9% 13.7% (3.23%) $8,294,000 0.66 0.91 37%<br />

1988 $6,272,662 16.6% 18.0% $3,260,000 12.5% 8.6% 14.8% (1.83%) $10,435,000 0.60 0.91 51%<br />

1989 $6,072,343 31.6% 19.2% $3,994,000 10.3% 7.6% 14.6% (4.97%) $11,126,000 0.55 0.89 63%<br />

1990 $5,240,225 -3.1% 18.2% $4,721,000 9.3% 6.5% 12.7% (7.17%) $11,436,000 0.46 0.86 88%<br />

1991 $4,838,424 30.4% 17.4% $5,247,000 9.4% 6.9% 11.9% (12.60%) $10,182,000 0.48 0.98 106%<br />

1992 $5,333,731 7.6% 12.9% $5,672,000 9.1% 6.6% 9.7% (8.28%) $10,194,000 0.52 1.07 104%<br />

1993 $7,537,353 10.1% 13.1% $5,428,000 7.9% 5.8% 10.0% (1.47%) $11,615,000 0.65 1.11 71%<br />

1994 $11,104,627 1.3% 12.9% $5,903,000 7.2% 5.2% 10.3% 0.36% $14,328,000 0.78 1.16 49%<br />

1995 $11,785,856 37.5% 13.7% $6,400,000 7.9% 5.4% 10.8% 1.21% $16,072,000 0.73 1.09 49%<br />

1996 $13,309,190 22.9% 10.9% $7,459,000 7.4% 5.0% 8.8% 4.01% $16,522,000 0.81 1.23 52%<br />

1997 $18,438,765 33.4% 9.3% $8,568,000 7.2% 4.9% 7.9% 5.84% $18,949,000 0.97 1.41 45%<br />

1998 $18,338,404 28.6% 6.9% $12,452,000 7.2% 5.0% 6.1% 5.33% $21,089,000 0.87 1.44 66%<br />

1999 $18,943,030 21.0% 4.8% $13,802,000 6.3% 4.3% 4.6% 2.68% $19,836,000 0.95 1.62 70%<br />

2000 $13,221,780 -9.1% 3.3% $15,067,000 6.8% 4.8% 4.1% 3.66% $20,378,000 0.65 1.37 111%<br />

2001 $16,744,295 -11.9% 4.7% $16,602,000 5.9% 4.1% 4.4% 1.58% $20,672,000 0.81 1.59 97%<br />

<strong>2002</strong>E $19,097,716 9.2% 6.4% $17,231,595 4.7% 3.2% 4.9% (0.10%) $20,283,690 0.94 1.76 87%<br />

2003E $19,062,293 8.6% 5.9% $18,523,643 5.0% 3.3% 4.6% 1.25% $21,503,665 0.89 1.74 97%<br />

2004E $19,062,293 8.0% 5.3% $19,692,760 5.0% 3.3% 4.3% 1.86% $23,786,587 0.80 1.62 102%<br />

2005E $19,062,293 7.4% 4.8% $21,874,171 5.3% 3.6% 4.1% 3.69% $26,372,535 0.72 1.55 114%<br />

2006E $19,062,293 6.8% 4.4% $23,293,352 5.1% 3.4% 3.9% 5.52% $28,887,074 0.66 1.46 122%<br />

2007E NA 6.3% NA NA NA NA NA NA NA NA NA NA<br />

2008E NA 5.3% NA NA NA NA NA NA NA NA NA NA<br />

2009E NA 4.8% NA NA NA NA NA NA NA NA NA NA<br />

2010E NA 4.3% NA NA NA NA NA NA NA NA NA NA<br />

2011E NA 3.9% NA NA NA NA NA NA NA NA NA NA<br />

2012E NA 3.4% NA NA NA NA NA NA NA NA NA NA<br />

2013E NA 3.0% NA NA NA NA NA NA NA NA NA NA<br />

2014E NA 3.0% NA NA NA NA NA NA NA NA NA NA<br />

<strong>2015</strong>E NA 3.0% NA NA NA NA NA NA NA NA NA NA<br />

Source: Company reports, Moody’s Industrial Manuals, Legg Mason estimates and projections for <strong>2002</strong> <strong>to</strong> 2006E