ANNUAL REPORT 2012 - TiGenix

ANNUAL REPORT 2012 - TiGenix

ANNUAL REPORT 2012 - TiGenix

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

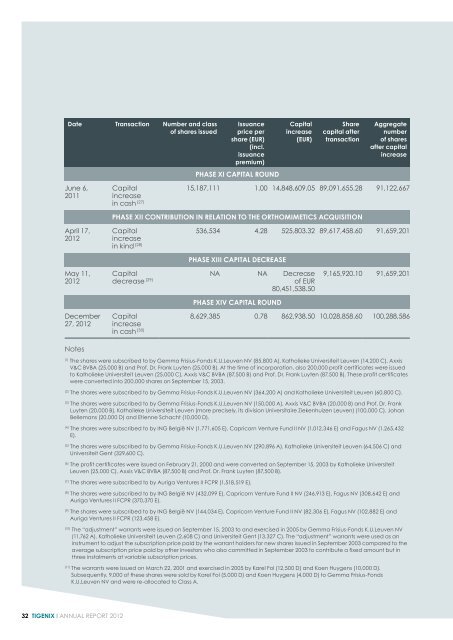

Date Transaction Number and class<br />

of shares issued<br />

Issuance<br />

price per<br />

share (EUR)<br />

(incl.<br />

issuance<br />

premium)<br />

Capital<br />

increase<br />

(EUR)<br />

Share<br />

capital after<br />

transaction<br />

Aggregate<br />

number<br />

of shares<br />

after capital<br />

increase<br />

PHASE XI CAPITAL ROUND<br />

June 6,<br />

2011<br />

Capital<br />

15,187,111 1.00 14,848,609.05 89,091,655.28 91,122,667<br />

in cash (27)<br />

increase<br />

PHASE XII CONTRIBUTION IN RELATION TO THE ORTHOMIMETICS ACQUISITION<br />

April 17,<br />

<strong>2012</strong><br />

Capital<br />

536,534 4.28 525,803.32 89,617,458.60 91,659,201<br />

in kind (28)<br />

increase<br />

PHASE XIII CAPITAL DECREASE<br />

May 11,<br />

<strong>2012</strong><br />

Capital<br />

decrease (29)<br />

NA NA Decrease<br />

of EUR<br />

80,451,538.50<br />

9,165,920.10 91,659,201<br />

PHASE XIV CAPITAL ROUND<br />

December<br />

27, <strong>2012</strong><br />

Capital<br />

8,629,385 0.78 862,938.50 10,028,858.60 100,288,586<br />

in cash (30)<br />

increase<br />

Notes<br />

(1)<br />

The shares were subscribed to by Gemma Frisius-Fonds K.U.Leuven NV (85,800 A), Katholieke Universiteit Leuven (14,200 C), Axxis<br />

V&C BVBA (25,000 B) and Prof. Dr. Frank Luyten (25,000 B). At the time of incorporation, also 200,000 profit certificates were issued<br />

to Katholieke Universiteit Leuven (25,000 C), Axxis V&C BVBA (87,500 B) and Prof. Dr. Frank Luyten (87,500 B). These profit certificates<br />

were converted into 200,000 shares on September 15, 2003.<br />

(2)<br />

The shares were subscribed to by Gemma Frisius-Fonds K.U.Leuven NV (364,200 A) and Katholieke Universiteit Leuven (60,800 C).<br />

(3)<br />

The shares were subscribed to by Gemma Frisius-Fonds K.U.Leuven NV (150,000 A), Axxis V&C BVBA (20,000 B) and Prof. Dr. Frank<br />

Luyten (20,000 B), Katholieke Universiteit Leuven (more precisely, its division Universitaire Ziekenhuizen Leuven) (100,000 C), Johan<br />

Bellemans (20,000 D) and Etienne Schacht (10,000 D).<br />

(4)<br />

The shares were subscribed to by ING België NV (1,771,605 E), Capricorn Venture Fund II NV (1,012,346 E) and Fagus NV (1,265,432<br />

E).<br />

(5)<br />

The shares were subscribed to by Gemma Frisius-Fonds K.U.Leuven NV (290,896 A), Katholieke Universiteit Leuven (64,506 C) and<br />

Universiteit Gent (329,600 C).<br />

(6)<br />

The profit certificates were issued on February 21, 2000 and were converted on September 15, 2003 by Katholieke Universiteit<br />

Leuven (25,000 C), Axxis V&C BVBA (87,500 B) and Prof. Dr. Frank Luyten (87,500 B).<br />

(7)<br />

The shares were subscribed to by Auriga Ventures II FCPR (1,518,519 E).<br />

(8)<br />

The shares were subscribed to by ING België NV (432,099 E), Capricorn Venture Fund II NV (246,913 E), Fagus NV (308,642 E) and<br />

Auriga Ventures II FCPR (370,370 E).<br />

(9)<br />

The shares were subscribed to by ING België NV (144,034 E), Capricorn Venture Fund II NV (82,306 E), Fagus NV (102,882 E) and<br />

Auriga Ventures II FCPR (123,458 E).<br />

(10)<br />

The “adjustment” warrants were issued on September 15, 2003 to and exercised in 2005 by Gemma Frisius-Fonds K.U.Leuven NV<br />

(11,762 A), Katholieke Universiteit Leuven (2,608 C) and Universiteit Gent (13,327 C). The “adjustment” warrants were used as an<br />

instrument to adjust the subscription price paid by the warrant holders for new shares issued in September 2003 compared to the<br />

average subscription price paid by other investors who also committed in September 2003 to contribute a fixed amount but in<br />

three instalments at variable subscription prices.<br />

(11)<br />

The warrants were issued on March 22, 2001 and exercised in 2005 by Karel Fol (12,500 D) and Koen Huygens (10,000 D).<br />

Subsequently, 9,000 of these shares were sold by Karel Fol (5,000 D) and Koen Huygens (4,000 D) to Gemma Frisius-Fonds<br />

K.U.Leuven NV and were re-allocated to Class A.<br />

32 <strong>TiGenix</strong> I annual report <strong>2012</strong>