Republic of Montenegro: Public Expenditure and ... - Vlada Crne Gore

Republic of Montenegro: Public Expenditure and ... - Vlada Crne Gore

Republic of Montenegro: Public Expenditure and ... - Vlada Crne Gore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 2: Composition <strong>of</strong> <strong>Public</strong> <strong>Expenditure</strong> <strong>and</strong><br />

Key Sources <strong>of</strong> Fiscal Pressure 15<br />

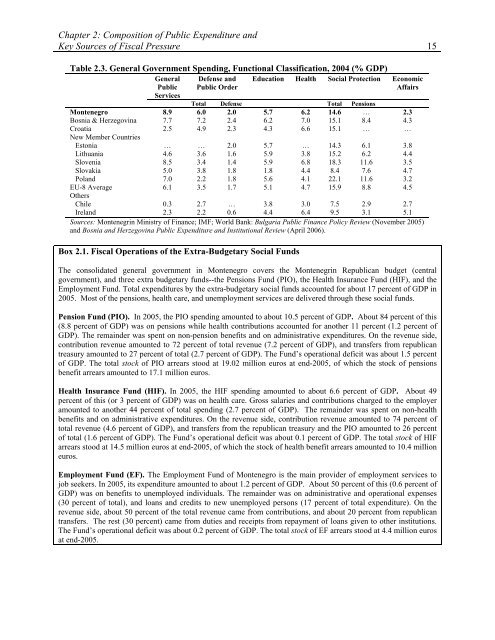

Table 2.3. General Government Spending, Functional Classification, 2004 (% GDP)<br />

General<br />

<strong>Public</strong><br />

Defense <strong>and</strong><br />

<strong>Public</strong> Order<br />

Education Health Social Protection Economic<br />

Affairs<br />

Services<br />

Total Defense Total Pensions<br />

<strong>Montenegro</strong> 8.9 6.0 2.0 5.7 6.2 14.6 … 2.3<br />

Bosnia & Herzegovina 7.7 7.2 2.4 6.2 7.0 15.1 8.4 4.3<br />

Croatia 2.5 4.9 2.3 4.3 6.6 15.1 … …<br />

New Member Countries<br />

Estonia … … 2.0 5.7 … 14.3 6.1 3.8<br />

Lithuania 4.6 3.6 1.6 5.9 3.8 15.2 6.2 4.4<br />

Slovenia 8.5 3.4 1.4 5.9 6.8 18.3 11.6 3.5<br />

Slovakia 5.0 3.8 1.8 1.8 4.4 8.4 7.6 4.7<br />

Pol<strong>and</strong> 7.0 2.2 1.8 5.6 4.1 22.1 11.6 3.2<br />

EU-8 Average 6.1 3.5 1.7 5.1 4.7 15.9 8.8 4.5<br />

Others<br />

Chile 0.3 2.7 … 3.8 3.0 7.5 2.9 2.7<br />

Irel<strong>and</strong> 2.3 2.2 0.6 4.4 6.4 9.5 3.1 5.1<br />

Sources: Montenegrin Ministry <strong>of</strong> Finance; IMF; World Bank: Bulgaria <strong>Public</strong> Finance Policy Review (November 2005)<br />

<strong>and</strong> Bosnia <strong>and</strong> Herzegovina <strong>Public</strong> <strong>Expenditure</strong> <strong>and</strong> Institutional Review (April 2006).<br />

Box 2.1. Fiscal Operations <strong>of</strong> the Extra-Budgetary Social Funds<br />

The consolidated general government in <strong>Montenegro</strong> covers the Montenegrin <strong>Republic</strong>an budget (central<br />

government), <strong>and</strong> three extra budgetary funds--the Pensions Fund (PIO), the Health Insurance Fund (HIF), <strong>and</strong> the<br />

Employment Fund. Total expenditures by the extra-budgetary social funds accounted for about 17 percent <strong>of</strong> GDP in<br />

2005. Most <strong>of</strong> the pensions, health care, <strong>and</strong> unemployment services are delivered through these social funds.<br />

Pension Fund (PIO). In 2005, the PIO spending amounted to about 10.5 percent <strong>of</strong> GDP. About 84 percent <strong>of</strong> this<br />

(8.8 percent <strong>of</strong> GDP) was on pensions while health contributions accounted for another 11 percent (1.2 percent <strong>of</strong><br />

GDP). The remainder was spent on non-pension benefits <strong>and</strong> on administrative expenditures. On the revenue side,<br />

contribution revenue amounted to 72 percent <strong>of</strong> total revenue (7.2 percent <strong>of</strong> GDP), <strong>and</strong> transfers from republican<br />

treasury amounted to 27 percent <strong>of</strong> total (2.7 percent <strong>of</strong> GDP). The Fund’s operational deficit was about 1.5 percent<br />

<strong>of</strong> GDP. The total stock <strong>of</strong> PIO arrears stood at 19.02 million euros at end-2005, <strong>of</strong> which the stock <strong>of</strong> pensions<br />

benefit arrears amounted to 17.1 million euros.<br />

Health Insurance Fund (HIF). In 2005, the HIF spending amounted to about 6.6 percent <strong>of</strong> GDP. About 49<br />

percent <strong>of</strong> this (or 3 percent <strong>of</strong> GDP) was on health care. Gross salaries <strong>and</strong> contributions charged to the employer<br />

amounted to another 44 percent <strong>of</strong> total spending (2.7 percent <strong>of</strong> GDP). The remainder was spent on non-health<br />

benefits <strong>and</strong> on administrative expenditures. On the revenue side, contribution revenue amounted to 74 percent <strong>of</strong><br />

total revenue (4.6 percent <strong>of</strong> GDP), <strong>and</strong> transfers from the republican treasury <strong>and</strong> the PIO amounted to 26 percent<br />

<strong>of</strong> total (1.6 percent <strong>of</strong> GDP). The Fund’s operational deficit was about 0.1 percent <strong>of</strong> GDP. The total stock <strong>of</strong> HIF<br />

arrears stood at 14.5 million euros at end-2005, <strong>of</strong> which the stock <strong>of</strong> health benefit arrears amounted to 10.4 million<br />

euros.<br />

Employment Fund (EF). The Employment Fund <strong>of</strong> <strong>Montenegro</strong> is the main provider <strong>of</strong> employment services to<br />

job seekers. In 2005, its expenditure amounted to about 1.2 percent <strong>of</strong> GDP. About 50 percent <strong>of</strong> this (0.6 percent <strong>of</strong><br />

GDP) was on benefits to unemployed individuals. The remainder was on administrative <strong>and</strong> operational expenses<br />

(30 percent <strong>of</strong> total), <strong>and</strong> loans <strong>and</strong> credits to new unemployed persons (17 percent <strong>of</strong> total expenditure). On the<br />

revenue side, about 50 percent <strong>of</strong> the total revenue came from contributions, <strong>and</strong> about 20 percent from republican<br />

transfers. The rest (30 percent) came from duties <strong>and</strong> receipts from repayment <strong>of</strong> loans given to other institutions.<br />

The Fund’s operational deficit was about 0.2 percent <strong>of</strong> GDP. The total stock <strong>of</strong> EF arrears stood at 4.4 million euros<br />

at end-2005.