Annual Report 2009 - Husqvarna Group

Annual Report 2009 - Husqvarna Group

Annual Report 2009 - Husqvarna Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 <strong>Husqvarna</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

The <strong>Husqvarna</strong> share<br />

Listing and trading volume<br />

<strong>Husqvarna</strong> shares were listed on NASDAQ OMX Stockholm on<br />

13 June 2006.<br />

A total of 631 million (484) <strong>Husqvarna</strong> shares were traded in<br />

<strong>2009</strong>, with a total value of SEK 27.5 billion (27.8), corresponding<br />

to an average daily trading volume of 2.5 million (1.9) shares or<br />

SEK 110m. The trading volume corresponded to 0.8% of the<br />

total volume of shares traded on NASDAQ OMX Stockholm<br />

in <strong>2009</strong>.<br />

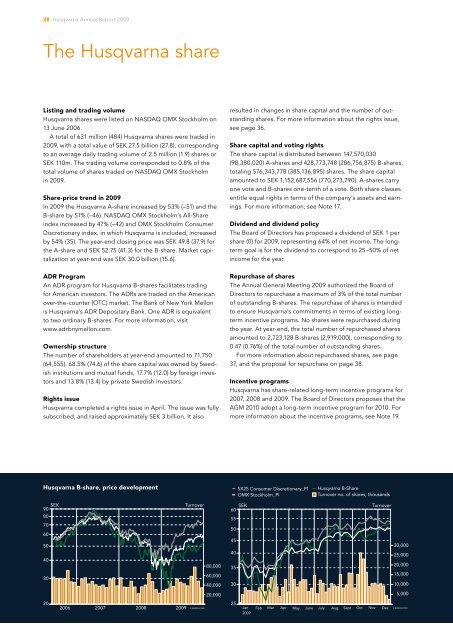

Share-price trend in <strong>2009</strong><br />

In <strong>2009</strong> the <strong>Husqvarna</strong> A-share increased by 53% (–51) and the<br />

B-share by 51% (–46). NASDAQ OMX Stockholm’s All-Share<br />

index increased by 47% (–42) and OMX Stockholm Consumer<br />

Discretionary index, in which <strong>Husqvarna</strong> is included, increased<br />

by 54% (35). The year-end closing price was SEK 49.8 (37.9) for<br />

the A-share and SEK 52.75 (41.3) for the B-share. Market capitalization<br />

at year-end was SEK 30.0 billion (15.6).<br />

ADR Program<br />

An ADR program for <strong>Husqvarna</strong> B-shares facilitates trading<br />

for American investors. The ADRs are traded on the American<br />

over-the-counter (OTC) market. The Bank of New York Mellon<br />

is <strong>Husqvarna</strong>’s ADR Depositary Bank. One ADR is equivalent<br />

to two ordinary B-shares. For more information, visit<br />

www.adrbnymellon.com.<br />

Ownership structure<br />

The number of shareholders at year-end amounted to 71,750<br />

(64,555). 68.5% (74.6) of the share capital was owned by Swedish<br />

institutions and mutual funds, 17.7% (12.0) by foreign investors<br />

and 13.8% (13.4) by private Swedish investors.<br />

Rights issue<br />

<strong>Husqvarna</strong> completed a rights issue in April. The issue was fully<br />

subscribed, and raised approximately SEK 3 billion. It also<br />

resulted in changes in share capital and the number of outstanding<br />

shares. For more information about the rights issue,<br />

see page 36.<br />

Share capital and voting rights<br />

The share capital is distributed between 147,570,030<br />

(98,380,020) A-shares and 428,773,748 (286,756,875) B-shares,<br />

totaling 576,343,778 (385,136,895) shares. The share capital<br />

amounted to SEK 1,152,687,556 (770,273,790). A-shares carry<br />

one vote and B-shares one-tenth of a vote. Both share classes<br />

entitle equal rights in terms of the company’s assets and earnings.<br />

For more information, see Note 17.<br />

Dividend and dividend policy<br />

The Board of Directors has proposed a dividend of SEK 1 per<br />

share (0) for <strong>2009</strong>, representing 64% of net income. The longterm<br />

goal is for the dividend to correspond to 25–50% of net<br />

income for the year.<br />

Repurchase of shares<br />

The <strong>Annual</strong> General Meeting <strong>2009</strong> authorized the Board of<br />

Directors to repurchase a maximum of 3% of the total number<br />

of outstanding B-shares. The repurchase of shares is intended<br />

to ensure <strong>Husqvarna</strong>’s commitments in terms of existing longterm<br />

incentive programs. No shares were repurchased during<br />

the year. At year-end, the total number of repurchased shares<br />

amounted to 2,723,128 B-shares (2,919,000), corresponding to<br />

0.47 (0.76%) of the total number of outstanding shares.<br />

For more information about repurchased shares, see page<br />

37, and the proposal for repurchase on page 38.<br />

Incentive programs<br />

<strong>Husqvarna</strong> has share-related long-term incentive programs for<br />

2007, 2008 and <strong>2009</strong>. The Board of Directors proposes that the<br />

AGM 2010 adopt a long-term incentive program for 2010. For<br />

more information about the incentive programs, see Note 19.<br />

<strong>Husqvarna</strong> B-share, price development<br />

SX25 Consumer Discretionary_PI<br />

OMX Stockholm_PI<br />

<strong>Husqvarna</strong> B-Share<br />

Turnover no. of shares, thousands<br />

SEK<br />

Turnover<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

80,000<br />

60,000<br />

30<br />

40,000<br />

20,000<br />

20<br />

2006 2007 2008 <strong>2009</strong><br />

SEK<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

Turnover<br />

Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec<br />

<strong>2009</strong><br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000