Annual Report 2009 - Husqvarna Group

Annual Report 2009 - Husqvarna Group

Annual Report 2009 - Husqvarna Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34 <strong>Husqvarna</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> <strong>Report</strong> by the Board of Directors<br />

Major R&D projects during the year referred mainly to the<br />

products mentioned above.<br />

During <strong>2009</strong> the <strong>Group</strong> has also capitalized SEK 60m (12)<br />

mainly referring to software.<br />

Financial position<br />

Operating working capital<br />

Operating working capital at year-end decreased to SEK 7,237m<br />

(9,460). Inventories declined to SEK 6,706m (8,556) and trade<br />

receivables to SEK 3,385m (4,184). Trade payables declined to<br />

SEK 2,854m (3,280).<br />

Change in operating working capital<br />

SEKm<br />

31 December 2008 9,460<br />

Changes in exchange rates –226<br />

Other changes –1,997<br />

31 December <strong>2009</strong> 7,237<br />

Equity<br />

<strong>Group</strong> equity as of 31 December <strong>2009</strong>, excluding minority<br />

interests, rose to SEK 12,082m (8,772), corresponding to<br />

SEK 22.0 (19.3) per share. The increase is mainly a result of the<br />

rights issue. Equity per share for 2008 has been adjusted to<br />

reflect the rights issue in <strong>2009</strong>.<br />

Net debt<br />

Net debt at year-end decreased to SEK 6,349m (13,552). Liquid<br />

funds were largely unchanged at SEK 2,745m (2 735), while<br />

interest-bearing debt decreased to SEK 9,094m (16,287). The<br />

reduction in net debt is mainly a result of the rights issue that<br />

was completed in April and the improvement in cash flow during<br />

the year.<br />

At year-end the <strong>Group</strong> had unutilized committed credit facilities<br />

of SEK 10,000m (6,500).<br />

For more information about the <strong>Group</strong>’s funding, see Note 2.<br />

The net debt/equity ratio improved to 0.52 (1.54) and the<br />

equity/assets ratio to 40.1% (25.7). The improvement in both<br />

ratios resulted mainly from the rights issue and a reduction of<br />

working capital.<br />

Net debt<br />

SEKm <strong>2009</strong> 2008<br />

Interest-bearing liabilities 9,094 16,287<br />

Liquid funds 2,745 2,735<br />

Net debt 6,349 13,552<br />

Net debt/equity ratio, times 0.52 1.54<br />

Equity/assets ratio, % 40.1 25.7<br />

Seasonality in sales and income<br />

The majority of <strong>Group</strong> sales are garden products, which show<br />

a pronounced seasonality in terms of sales and income. The<br />

first half of the year normally accounts for about two thirds of<br />

<strong>Group</strong> sales, with the second quarter usually being the strongest.<br />

This refers particularly to Consumer Products, but also to<br />

Lawn and Garden within Professional Products. Irrigation<br />

products have a larger share of sales and operating income in<br />

the first half of the year, and particularly in the second quarter,<br />

than the rest of the <strong>Group</strong>’s consumer products.<br />

Forestry products show stronger demand and somewhat<br />

higher sales during the second half of the year, while equipment<br />

for the construction industry normally shows a more<br />

even distribution of sales throughout the year.<br />

Demand for the <strong>Group</strong>’s products is also dependent on<br />

weather conditions. Dry weather tends to reduce demand for<br />

such products as lawn mowers and tractors, but to increase<br />

demand for irrigation products. Demand for chainsaws normally<br />

increases after storms.<br />

Performance by business area<br />

Until year-end <strong>2009</strong>, operations in <strong>Husqvarna</strong> comprised two<br />

business areas – Consumer Products and Professional Products.<br />

Consumer Products includes two geographical areas, i.e.<br />

North America and Rest of the world. Professional Products<br />

includes three product areas, i.e. Forestry, Lawn and Garden,<br />

and Construction.<br />

As of 1 January 2010, the <strong>Group</strong> has a new organization,<br />

which will involve a change of the <strong>Group</strong>’s reporting structure<br />

as of the first quarter of 2010 (see page 96).<br />

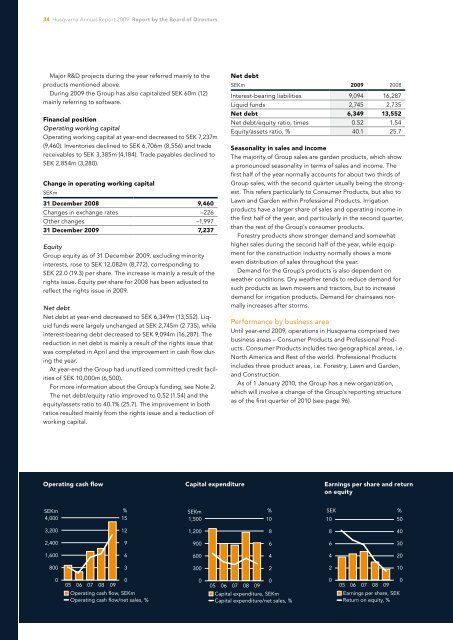

Operating cash flow<br />

Capital expenditure<br />

Earnings per share and return<br />

on equity<br />

SEKm<br />

4,000<br />

%<br />

15<br />

SEKm<br />

1,500<br />

%<br />

10<br />

SEK<br />

10<br />

%<br />

50<br />

3,200<br />

12<br />

1,200<br />

8<br />

8<br />

40<br />

2,400<br />

9<br />

900<br />

6<br />

6<br />

30<br />

1,600<br />

6<br />

600<br />

4<br />

4<br />

20<br />

800<br />

3<br />

300<br />

2<br />

2<br />

10<br />

0<br />

05 06 07 08 09<br />

Operating cash flow, SEKm<br />

Operating cash flow/net sales, %<br />

0<br />

0<br />

05 06 07 08 09<br />

Capital expenditure, SEKm<br />

Capital expenditure/net sales, %<br />

0<br />

0<br />

05 06 07 08 09<br />

Earnings per share, SEK<br />

Return on equity, %<br />

0