assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

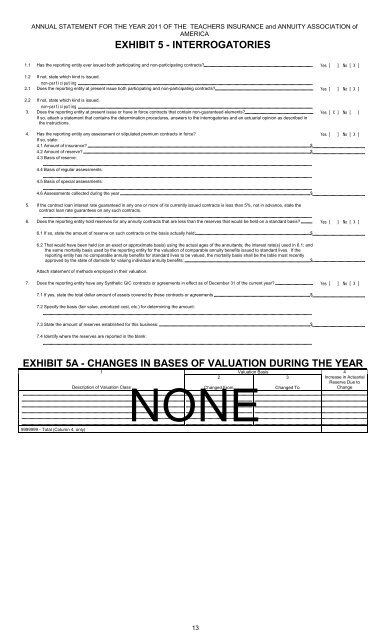

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION ofAMERICAEXHIBIT 5 - INTERROGATORIES1.1 Has the reporting entity ever issued both participating and non-participating contracts? 1.2 If not, state which kind is issued.2.1 Does the reporting entity at present issue both participating and non-participating contracts? 2.2 If not, state which kind is issued.3. Does the reporting entity at present issue or have in force contracts that contain non-guaranteed elements? If so, attach a statement that contains the determination procedures, answers to the interrogatories and an actuarial opinion as described inthe instructions.4. Has the reporting entity any assessment or stipulated premium contracts in force? If so, state:4.1 Amount of insurance? $ 4.2 Amount of reserve? $ 4.3 Basis of reserve:4.4 Basis of regular assessments:4.5 Basis of special assessments:4.6 Assessments collected during the year $ 5. If the contract loan interest rate guaranteed in any one or more of its currently issued contracts is less than 5%, not in advance, state thecontract loan rate guarantees on any such contracts.6. Does the reporting entity hold reserves for any annuity contracts that are less than the reserves that would be held on a standard basis? 6.1 If so, state the amount of reserve on such contracts on the basis actually held: $ 6.2 That would have been held (on an exact or approximate basis) using the actual ages of the annuitants; the interest rate(s) used in 6.1; andthe same mortality basis used by the reporting entity for the valuation of comparable annuity benefits issued to standard lives. If thereporting entity has no comparable annuity benefits for standard lives to be valued, the mortality basis shall be the table most recentlyapproved by the state of domicile for valuing individual annuity benefits: $ Attach statement of methods employed in their valuation.7. Does the reporting entity have any Synthetic GIC contracts or agreements in effect as of December 31 of the current year? 7.1 If yes, state the total dollar amount of <strong>assets</strong> covered by these contracts or agreements $ 7.2 Specify the basis (fair value, amortized cost, etc.) for determining the amount:7.3 State the amount of reserves established for this business: $ 7.4 Identify where the reserves are reported in the blank:EXHIBIT 5A - CHANGES IN BASES OF VALUATION DURING THE YEAR1 Valuation Basis 423Increase in ActuarialReserve Due toDescription of Valuation ClassNONEChanged FromChanged ToChange9999999 - Total (Column 4, only)13