assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

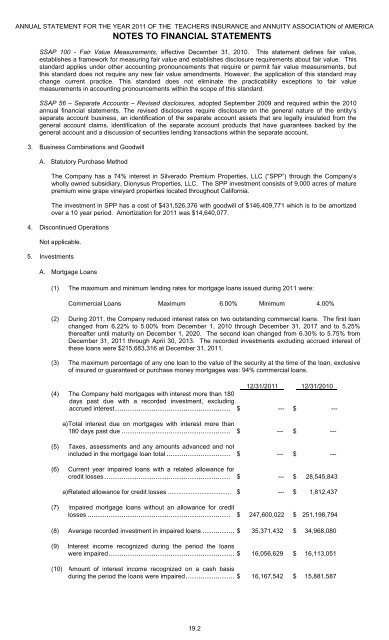

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSSSAP 100 - Fair Value Measurements, effective December 31, 2010. This statement defines fair value,establishes a framework for measuring fair value and establishes disclosure requirements about fair value. Thisstandard applies under other accounting pronouncements that require or permit fair value measurements, butthis standard does not require any new fair value amendments. However, the application of this standard maychange current practice. This standard does not eliminate the practicability exceptions to fair valuemeasurements in accounting pronouncements within the scope of this standard.SSAP 56 – Separate Accounts – Revised disclosures, adopted September 2009 and required within the 2010annual financial statements. The revised disclosures require disclosure on the general nature of the entity’sseparate account business, an identification of the separate account <strong>assets</strong> that are legally insulated from thegeneral account claims, identification of the separate account products that have guarantees backed by thegeneral account and a discussion of securities lending transactions within the separate account.3. Business Combinations and GoodwillA. Statutory Purchase MethodThe Company has a 74% interest in Silverado Premium Properties, LLC (“SPP”) through the Company’swholly owned subsidiary, Dionysus Properties, LLC. The SPP investment consists of 9,000 acres of maturepremium wine grape vineyard properties located throughout California.The investment in SPP has a cost of $431,526,376 with goodwill of $146,409,771 which is to be amortizedover a 10 year period. Amortization for 2011 was $14,640,077.4. Discontinued OperationsNot applicable.5. InvestmentsA. Mortgage Loans(1) The maximum and minimum lending rates for mortgage loans issued during 2011 were:Commercial Loans Maximum 6.00 % Minimum 4.00%(2) During 2011, the Company reduced interest rates on two outstanding commercial loans. The first loanchanged from 6.22% to 5.00% from December 1, 2010 through December 31, 2017 and to 5.25%thereafter until maturity on December 1, 2020. The second loan changed from 6.30% to 5.75% fromDecember 31, 2011 through April 30, 2013. The recorded investments excluding accrued interest ofthese loans were $215,683,316 at December 31, 2011.(3) The maximum percentage of any one loan to the value of the security at the time of the loan, exclusiveof insured or guaranteed or purchase money mortgages was: 94% commercial loans.12/31/2011 12/31/2010(4) The Company held mortgages with interest more than 180days past due with a recorded investment, excludingaccrued interest...................................................... $ --- $ ---a) Total interest due on mortgages with interest more than180 days past due ................................................... $ --- $ ---(5) Taxes, assessments and any amounts advanced and notincluded in the mortgage loan total .............................. $ --- $ ---(6) Current year impaired loans with a related allowance forcredit losses........................................................... $ --- $ 28,545,843a) Related allowance for credit losses .................................... $ --- $ 1,812,437(7) Impaired mortgage loans without an allowance for creditlosses ................................................................... $ 247,600,022 $ 251,198,794(8) Average recorded investment in impaired loans .................. $ 35,371,432 $ 34,968,080(9) Interest income recognized during the period the loanswere impaired........................................................... $ 16,056,629 $ 16,113,051(10) Amount of interest income recognized on a cash basisduring the period the loans were impaired....................... $ 16,167,542 $ 15,881,58719.2