ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSLevel 1 Level 2 Level 3 TotalDerivatives:Foreign Exchange Contracts...... $ --- $ 112,992,670 $ --- $ 112,992,670Interest Rate Contracts .............. --- 33,175,444 --- 33,175,444Credit Default Swaps.................. --- 28,214,203 --- 28,214,203Total Derivatives ..................... $ --- $ 174,382,317 $ --- $ 174,382,317Separate Accounts Assets, Net.... 3,197,025,640 2,896,401,388 9,925,439,722 16,018,866,750Total <strong>assets</strong> at fair value............... $ 3,886,651,530 $ 3,154,217,646 $ 10,753,714,310 $ 17,794,583,486Liabilities at fair value:DerivativesForeign Exchange Contracts ...... $ --- $ (154,370,794 ) $ --- $ (154,370,794 )Credit Default Swaps .................. --- (32,721,370 ) --- (32,721,370 )Total liabilities at fair value............ $ --- $ (187,092,164 ) $ --- $ (187,092,164 )Level 1 financial instrumentsUnadjusted quoted prices for these securities are provided to the Company by independent pricing services.Common stock and separate account <strong>assets</strong> in Level 1 primarily include mutual fund investments valued by therespective mutual fund companies and exchange listed equities.Level 2 financial instrumentsCommon stocks included in Level 2 include those which are traded in an inactive market or for which prices foridentical securities are not available. Valuations are based principally on observable inputs including quotedprices in markets that are not considered active.Derivative <strong>assets</strong> and liabilities classified in Level 2 represent over-the-counter instruments that include, but arenot limited to, fair value hedges using foreign currency swaps, foreign currency forwards, interest rate swaps andcredit default swaps. Fair values for these instruments are determined internally using market observable inputsthat include, but are not limited to, forward currency rates, interest rates, credit default rates and publishedobservable market indices.Separate account <strong>assets</strong> in Level 2 consist principally of short term government agency notes and commercialpaper.Level 3 financial instrumentsTypical inputs to models used by independent pricing services for fixed maturity securities include but are notlimited to benchmark yields, reported trades, broker-dealer quotes, issuer spreads, benchmark securities, bids,offers, reference data, and industry and economic events. Because most bonds and preferred stocks do nottrade daily, independent pricing services regularly derive fair values using recent trades of securities with similarfeatures. When recent trades are not available, pricing models are used to estimate the fair values of securitiesby discounting future cash flows at estimated market interest rates.If an independent pricing service is unable to provide the fair value for a security due to insufficient marketinformation, such as for a private placement transaction, the Company will determine the fair value internallyusing a matrix pricing model. This model estimates fair value using discounted cash flows at a market yieldconsidering the appropriate treasury rate plus a spread. The spread is derived by reference to similar securities,and may be adjusted based on specific characteristics of the security, including inputs that are not readilyobservable in the market. The Company assesses the significance of unobservable inputs for each securitypriced internally and classifies that security in Level 3 as a result of the significance of unobservable inputs.Common Stock included in Level 3 includes equity investments with privately held entities where valuations areprincipally derived from a matrix pricing model.Separate account <strong>assets</strong> classified as Level 3 primarily include directly owned real estate properties, real estatejoint ventures and real estate limited partnerships. Directly owned real estate properties are valued on aquarterly basis based on independent third party appraisals. Real estate joint venture interests are valued basedon the fair value of the underlying real estate, any related mortgage loans payable and other factors such asownership percentage, ownership rights, buy/sell agreements, distribution provisions and capital call obligations.Real estate limited partnership interests are valued based on the most recent net asset value of the partnership.Transfers between Level 1 and Level 2Periodically, the Company has transfers between Levels 1 and Level 2 due to the availability of quoted prices foridentical <strong>assets</strong> in active markets at the measurement date. The Company’s policy is to recognize transfersbetween levels as of the actual date of the event or change in circumstances that caused the transfer.During 2011, the Company transferred $78,716,610 of common stock from Level 2 to Level 1 and $28,191,000from Level 1 to Level 2 due to changes in the availability of quoted prices in active markets for identical <strong>assets</strong> atthe quarterly measurement dates throughout the year.19.20

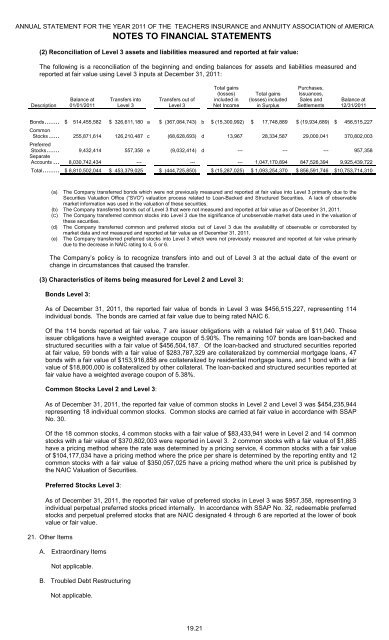

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS(2) Reconciliation of Level 3 <strong>assets</strong> and liabilities measured and reported at fair value:The following is a reconciliation of the beginning and ending balances for <strong>assets</strong> and liabilities measured andreported at fair value using Level 3 inputs at December 31, 2011:DescriptionBalance at01/01/2011Transfers intoLevel 3Transfers out ofLevel 3Total gains(losses)included inNet IncomeTotal gains(losses) includedin SurplusPurchases,Issuances,Sales andSettlementsBalance at12/31/2011Bonds....... $ 514,455,582 $ 326,611,180 a $ (367,064,743) b $ (15,300,992) $ 17,748,889 $ (19,934,689) $ 456,515,227CommonStocks..... 255,871,614 126,210,487 c (68,628,693) d 13,967 28,334,587 29,000,041 370,802,003PreferredStocks...... 9,432,414 557,358 e (9,032,414) d --- --- --- 957,358SeparateAccounts ... 8,030,742,434 --- --- --- 1,047,170,894 847,526,394 9,925,439,722Total........ $ 8,810,502,044 $ 453,379,025 $ (444,725,850) $ (15,287,025) $ 1,093,254,370 $ 856,591,746 $10,753,714,310(a) The Company transferred bonds which were not previously measured and reported at fair value into Level 3 primarily due to theSecurities Valuation Office (“SVO”) valuation process related to Loan-Backed and Structured Securities. A lack of observablemarket information was used in the valuation of these securities.(b) The Company transferred bonds out of Level 3 that were not measured and reported at fair value as of December 31, 2011.(C) The Company transferred common stocks into Level 3 due the significance of unobservable market data used in the valuation ofthese securities.(d) The Company transferred common and preferred stocks out of Level 3 due the availability of observable or corroborated bymarket data and not measured and reported at fair value as of December 31, 2011.(e) The Company transferred preferred stocks into Level 3 which were not previously measured and reported at fair value primarilydue to the decrease in NAIC rating to 4, 5 or 6.The Company’s policy is to recognize transfers into and out of Level 3 at the actual date of the event orchange in circumstances that caused the transfer.(3) Characteristics of items being measured for Level 2 and Level 3:Bonds Level 3:As of December 31, 2011, the reported fair value of bonds in Level 3 was $456,515,227, representing 114individual bonds. The bonds are carried at fair value due to being rated NAIC 6.Of the 114 bonds reported at fair value, 7 are issuer obligations with a related fair value of $11,040. Theseissuer obligations have a weighted average coupon of 5.90%. The remaining 107 bonds are loan-backed andstructured securities with a fair value of $456,504,187. Of the loan-backed and structured securities reportedat fair value, 59 bonds with a fair value of $283,787,329 are collateralized by commercial mortgage loans, 47bonds with a fair value of $153,916,858 are collateralized by residential mortgage loans, and 1 bond with a fairvalue of $18,800,000 is collateralized by other collateral. The loan-backed and structured securities reported atfair value have a weighted average coupon of 5.38%.Common Stocks Level 2 and Level 3:As of December 31, 2011, the reported fair value of common stocks in Level 2 and Level 3 was $454,235,944representing 18 individual common stocks. Common stocks are carried at fair value in accordance with SSAPNo. 30.Of the 18 common stocks, 4 common stocks with a fair value of $83,433,941 were in Level 2 and 14 commonstocks with a fair value of $370,802,003 were reported in Level 3. 2 common stocks with a fair value of $1,885have a pricing method where the rate was determined by a pricing service, 4 common stocks with a fair valueof $104,177,034 have a pricing method where the price per share is determined by the reporting entity and 12common stocks with a fair value of $350,057,025 have a pricing method where the unit price is published bythe NAIC Valuation of Securities.Preferred Stocks Level 3:As of December 31, 2011, the reported fair value of preferred stocks in Level 3 was $957,358, representing 3individual perpetual preferred stocks priced internally. In accordance with SSAP No. 32, redeemable preferredstocks and perpetual preferred stocks that are NAIC designated 4 through 6 are reported at the lower of bookvalue or fair value.21. Other ItemsA. Extraordinary ItemsNot applicable.B. Troubled Debt RestructuringNot applicable.19.21