assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

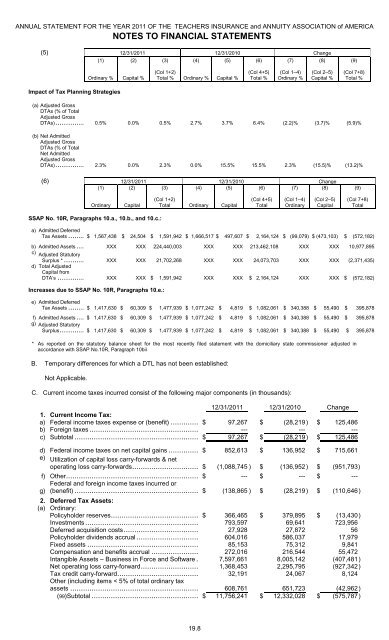

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS(5) 12/31/2011 12/31/2010 Change(1) (2) (3) (4) (5) (6) (7) (8)(9)Ordinary %Capital %(Col 1+2)Total %Ordinary %Capital %(Col 4+5)Total %(Col 1–4)Ordinary %(Col 2–5)Capital %(Col 7+8)Total %Impact of Tax Planning Strategies(a) Adjusted GrossDTAs (% of TotalAdjusted GrossDTAs).............. 0.5% 0.0% 0.5% 2.7% 3.7% 6.4% (2.2)% (3.7)% (5.9)%(b) Net AdmittedAdjusted GrossDTAs (% of TotalNet AdmittedAdjusted GrossDTAs).............. 2.3% 0.0% 2.3% 0.0% 15.5% 15.5% 2.3% (15.5)% (13.2)%(6) 12/31/2011 12/31/2010 Change(1) (2) (3) (4) (5) (6) (7) (8)(9)OrdinaryCapital(Col 1+2)TotalOrdinaryCapital(Col 4+5)Total(Col 1–4)Ordinary(Col 2–5)Capital(Col 7+8)TotalSSAP No. 10R, Paragraphs 10.a., 10.b., and 10.c.:a) Admitted DeferredTax Assets ........ $ 1,567,438 $ 24,504 $ 1,591,942 $ 1,666,517 $ 497,607 $ 2,164,124 $ (99,079) $ (473,103) $ (572,182)b) Admitted Assets .... XXX XXX 224,440,003 XXX XXX 213,462,108 XXX XXX 10,977,895c) Adjusted StatutorySurplus * .......... XXX XXX 21,702,268 XXX XXX 24,073,703 XXX XXX (2,371,435)d) Total AdjustedCapital fromDTA’s ................... XXX XXX $ 1,591,942 XXX XXX $ 2,164,124 XXX XXX $ (572,182)Increases due to SSAP No. 10R, Paragraphs 10.e.:e) Admitted DeferredTax Assets ..............$ 1,417,630 $ 60,309 $ 1,477,939 $ 1,077,242 $ 4,819 $ 1,082,061 $ 340,388 $ 55,490 $ 395,878f) Admitted Assets .......... $ 1,417,630 $ 60,309 $ 1,477,939 $ 1,077,242 $ 4,819 $ 1,082,061 $ 340,388 $ 55,490 $ 395,878g) Adjusted StatutorySurplus.................. $ 1,417,630 $ 60,309 $ 1,477,939 $ 1,077,242 $ 4,819 $ 1,082,061 $ 340,388 $ 55,490 $ 395,878* As reported on the statutory balance sheet for the most recently filed statement with the domiciliary state commissioner adjusted inaccordance with SSAP No.10R, Paragraph 10biiB. Temporary differences for which a DTL has not been established:Not Applicable.C. Current income taxes incurred consist of the following major components (in thousands):12/31/2011 12/31/2010 Change1. Current Income Tax:a) Federal income taxes expense or (benefit) ................... $ 97,267 $ (28,219 ) $ 125,486b) Foreign taxes......................................................... --- --- ---c) Subtotal ................................................................ $ 97,267 $ (28,219 ) $ 125,486d) Federal income taxes on net capital gains .................$ 852,613 $ 136,952 $ 715,661e) Utilization of capital loss carry-forwards & netoperating loss carry-forwards................................ $ (1,088,745 ) $ (136,952 ) $ (951,793)f) Other................................................................$ --- $ --- $ ---g)Federal and foreign income taxes incurred or(benefit) .............................................................$ (138,865 ) $ (28,219 ) $ (110,646 )2. Deferred Tax Assets:(a) Ordinary:Policyholder reserves.................................................. $ 366,465 $ 379,895 $ (13,430 )Investments.............................................................. 793,597 69,641 723,956Deferred acquisition costs............................................ 27,928 27,872 56Policyholder dividends accrual................................ 604,016 586,037 17,979Fixed <strong>assets</strong> ............................................................. 85,153 75,312 9,841Compensation and benefits accrual ............................... 272,016 216,544 55,472Intangible Assets – Business in Force and Software .......... 7,597,661 8,005,142 (407,481 )Net operating loss carry-forward................................ 1,368,453 2,295,795 (927,342 )Tax credit carry-forward............................................... 32,191 24,067 8,124Other (including items < 5% of total ordinary tax<strong>assets</strong> ................................................................ 608,761 651,723 (42,962 )(99)Subtotal ........................................................... $ 11,756,241 $ 12,332,028 $ (575,787 )19.8