assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

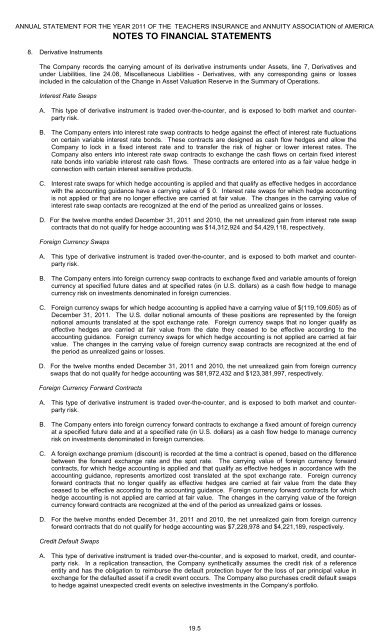

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA8. Derivative InstrumentsNOTES TO FINANCIAL STATEMENTSThe Company records the carrying amount of its derivative instruments under Assets, line 7, Derivatives andunder Liabilities, line 24.08, Miscellaneous Liabilities - Derivatives, with any corresponding gains or lossesincluded in the calculation of the Change in Asset Valuation Reserve in the Summary of Operations.Interest Rate SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into interest rate swap contracts to hedge against the effect of interest rate fluctuationson certain variable interest rate bonds. These contracts are designed as cash flow hedges and allow theCompany to lock in a fixed interest rate and to transfer the risk of higher or lower interest rates. TheCompany also enters into interest rate swap contracts to exchange the cash flows on certain fixed interestrate bonds into variable interest rate cash flows. These contracts are entered into as a fair value hedge inconnection with certain interest sensitive products.C. Interest rate swaps for which hedge accounting is applied and that qualify as effective hedges in accordancewith the accounting guidance have a carrying value of $ 0. Interest rate swaps for which hedge accountingis not applied or that are no longer effective are carried at fair value. The changes in the carrying value ofinterest rate swap contacts are recognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from interest rate swapcontracts that do not qualify for hedge accounting was $14,312,924 and $4,429,118, respectively.Foreign Currency SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into foreign currency swap contracts to exchange fixed and variable amounts of foreigncurrency at specified future dates and at specified rates (in U.S. dollars) as a cash flow hedge to managecurrency risk on investments denominated in foreign currencies.C. Foreign currency swaps for which hedge accounting is applied have a carrying value of $(119,109,605) as ofDecember 31, 2011. The U.S. dollar notional amounts of these positions are represented by the foreignnotional amounts translated at the spot exchange rate. Foreign currency swaps that no longer qualify aseffective hedges are carried at fair value from the date they ceased to be effective according to theaccounting guidance. Foreign currency swaps for which hedge accounting is not applied are carried at fairvalue. The changes in the carrying value of foreign currency swap contracts are recognized at the end ofthe period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from foreign currencyswaps that do not qualify for hedge accounting was $81,972,432 and $123,381,997, respectively.Foreign Currency Forward ContractsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into foreign currency forward contracts to exchange a fixed amount of foreign currencyat a specified future date and at a specified rate (in U.S. dollars) as a cash flow hedge to manage currencyrisk on investments denominated in foreign currencies.C. A foreign exchange premium (discount) is recorded at the time a contract is opened, based on the differencebetween the forward exchange rate and the spot rate. The carrying value of foreign currency forwardcontracts, for which hedge accounting is applied and that qualify as effective hedges in accordance with theaccounting guidance, represents amortized cost translated at the spot exchange rate. Foreign currencyforward contracts that no longer qualify as effective hedges are carried at fair value from the date theyceased to be effective according to the accounting guidance. Foreign currency forward contracts for whichhedge accounting is not applied are carried at fair value. The changes in the carrying value of the foreigncurrency forward contracts are recognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from foreign currencyforward contracts that do not qualify for hedge accounting was $7,228,978 and $4,221,189, respectively.Credit Default SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to market, credit, and counterpartyrisk. In a replication transaction, the Company synthetically assumes the credit risk of a referenceentity and has the obligation to reimburse the default protection buyer for the loss of par principal value inexchange for the defaulted asset if a credit event occurs. The Company also purchases credit default swapsto hedge against unexpected credit events on selective investments in the Company’s portfolio.19.5