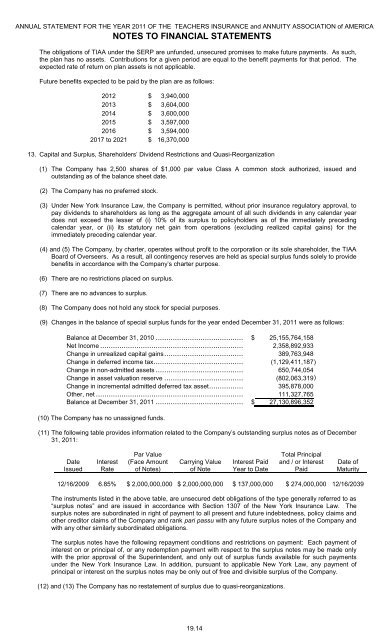

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSThe obligations of <strong>TIAA</strong> under the SERP are unfunded, unsecured promises to make future payments. As such,the plan has no <strong>assets</strong>. Contributions for a given period are equal to the benefit payments for that period. Theexpected rate of return on plan <strong>assets</strong> is not applicable.Future benefits expected to be paid by the plan are as follows:2012 $ 3,940,0002013 $ 3,604,0002014 $ 3,600,0002015 $ 3,597,0002016 $ 3,594,0002017 to 2021 $ 16,370,00013. Capital and Surplus, Shareholders’ Dividend Restrictions and Quasi-Reorganization(1) The Company has 2,500 shares of $1,000 par value Class A common stock authorized, issued andoutstanding as of the balance sheet date.(2) The Company has no preferred stock.(3) Under New York Insurance Law, the Company is permitted, without prior insurance regulatory approval, topay dividends to shareholders as long as the aggregate amount of all such dividends in any calendar yeardoes not exceed the lesser of (i) 10% of its surplus to policyholders as of the immediately precedingcalendar year, or (ii) its statutory net gain from operations (excluding realized capital gains) for theimmediately preceding calendar year.(4) and (5) The Company, by charter, operates without profit to the corporation or its sole shareholder, the <strong>TIAA</strong>Board of Overseers. As a result, all contingency reserves are held as special surplus funds solely to providebenefits in accordance with the Company’s charter purpose.(6) There are no restrictions placed on surplus.(7) There are no advances to surplus.(8) The Company does not hold any stock for special purposes.(9) Changes in the balance of special surplus funds for the year ended December 31, 2011 were as follows:Balance at December 31, 2010 .............................................$ 25,155,764,158Net Income ....................................................................... 2,358,892,933Change in unrealized capital gains......................................... 389,763,948Change in deferred income tax.............................................. (1,129,411,187)Change in non-admitted <strong>assets</strong> ............................................. 650,744,054Change in asset valuation reserve ......................................... (802,063,319)Change in incremental admitted deferred tax asset.................... 395,878,000Other, net ......................................................................... 111,327,765Balance at December 31, 2011 .............................................$ 27,130,896,352(10) The Company has no unassigned funds.(11) The following table provides information related to the Company’s outstanding surplus notes as of December31, 2011:DateIssuedInterestRatePar Value(Face Amountof Notes)Carrying Valueof NoteInterest PaidYear to DateTotal Principaland / or InterestPaidDate ofMaturity12/16/2009 6.85% $ 2,000,000,000 $ 2,000,000,000 $ 137,000,000 $ 274,000,000 12/16/2039The instruments listed in the above table, are unsecured debt obligations of the type generally referred to as“surplus notes” and are issued in accordance with Section 1307 of the New York Insurance Law. Thesurplus notes are subordinated in right of payment to all present and future indebtedness, policy claims andother creditor claims of the Company and rank pari passu with any future surplus notes of the Company andwith any other similarly subordinated obligations.The surplus notes have the following repayment conditions and restrictions on payment: Each payment ofinterest on or principal of, or any redemption payment with respect to the surplus notes may be made onlywith the prior approval of the Superintendent, and only out of surplus funds available for such paymentsunder the New York Insurance Law. In addition, pursuant to applicable New York Law, any payment ofprincipal or interest on the surplus notes may be only out of free and divisible surplus of the Company.(12) and (13) The Company has no restatement of surplus due to quasi-reorganizations.19.14

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA14. ContingenciesA. Contingent CommitmentsNOTES TO FINANCIAL STATEMENTS(1) At December 31, 2011, outstanding commitments for future real estate investments were $1,734,693 andare scheduled for disbursement in 2012. The funding of real estate investment obligations is contingentupon the properties meeting specified requirements, including construction, leasing and occupancy.At December 31, 2011, outstanding commitments for equity investments were $4,555,844,104. Of this,$1,453,921,192 is scheduled for disbursement in 2012 and $3,101,922,912 in later years. Equityinvestments represent fund investments and stocks.(2) a. The Company has a financial support agreement with <strong>TIAA</strong>-<strong>CREF</strong> Life Insurance Company (“<strong>TIAA</strong>-<strong>CREF</strong> Life”). Under this agreement, the Company agrees that it shall cause <strong>TIAA</strong>-<strong>CREF</strong> Life to have atall times the greater of:• capital and surplus of $250.0 million; or• the amount of capital and surplus necessary to maintain <strong>TIAA</strong>-<strong>CREF</strong> Life’s capital and surplus at alevel not less than 150% of the NAIC RBC model; or• such other amounts as necessary to maintain <strong>TIAA</strong>-<strong>CREF</strong> Life’s financial strength rating the sameor better than the Company’s rating at all times.The Company also agrees that it will cause <strong>TIAA</strong>-<strong>CREF</strong> Life to be sufficiently funded at all times in orderto meet all its contractual obligations on a timely basis including, but not limited to, obligations to paypolicy benefits and to provide policyholder services. This agreement is not an evidence of indebtednessor an obligation or liability of the Company and does not provide any creditor of <strong>TIAA</strong>-<strong>CREF</strong> Life withrecourse to or against any of the <strong>assets</strong> of the Company.The Company provides a $100.0 million unsecured 364-day revolving line of credit to <strong>TIAA</strong>-<strong>CREF</strong> Life.As of December 31, 2011, $30.0 million of this facility was maintained on a committed basis for whichthe Company received a commitment fee of 10 bps on the undrawn committed amount. During 2011,there were 4 draw downs totaling $17.0 million that were repaid by December 31, 2011. As ofDecember 31, 2011, outstanding principal amount plus accrued interest was $ 0.b. <strong>TIAA</strong> Global Markets, Inc. (“TGM”), a wholly-owned subsidiary, was formed for the purpose of issuingnotes and other debt instruments and investing the proceeds in compliance with the investmentguidelines approved by the Board of Directors of TGM. TGM is authorized to issue up to $5.0 billion indebt and <strong>TIAA</strong>’s Board of Trustees authorized the Company to guarantee up to $5.0 billion of TGM’sdebt. As of December 31, 2011, TGM had $1.52 billion of outstanding debt and accrued interest, with afair value of $1.56 billion.On July 12, 2010, The Company increased the size of the uncommitted and unsecured 364-dayrevolving line of credit to TGM from $750.0 million to $1.0 billion. During 2011, there were 2 drawdowns or repayments on the line. As of December 31, 2011, outstanding principal plus accrued interestwas $ 0. In January, 2011, TGM borrowed a total of $610.0 million which was repaid in full onNovember 2, 2011.c. The Company also provides a $1.0 billion uncommitted line of credit to certain <strong>CREF</strong> accounts andcertain <strong>TIAA</strong>-<strong>CREF</strong> Funds (“Funds”). Loans under this revolving credit facility are for a maximum of 60days and are made solely at the discretion of the Company to fund shareholder redemption requests orother temporary or emergency needs of <strong>CREF</strong> and the Funds. It is the intent of the Company, <strong>CREF</strong>and the Funds to use this facility as a supplemental liquidity facility, which would only be used after<strong>CREF</strong> and the Funds have exhausted the availability of the current $1.5 billion committed credit facilitymaintained with a group of banks.d. The Company provides guarantees to the <strong>CREF</strong> accounts, for which it is compensated, for certainmortality and expense risks, pursuant to an Immediate Annuity Purchase Rate Guarantee Agreement.e. The Company provides a $100.0 million committed and unsecured 364-day revolving line of credit to<strong>TIAA</strong>-<strong>CREF</strong> Asset Management Commingled Funds Trust I (“TCAM”), a real estate fund managed byAdvisors, in which the Company has a minority indirect equity ownership interest. On November 15,2011, the line of credit was terminated.f. On October 1, 2010, the Company provided to the Office of Thrift Supervision a written commitment tomaintain <strong>TIAA</strong>-<strong>CREF</strong> Trust Company as a “Well Capitalized” institution for Prompt Corrective Actionpurposes for at least three years.(3) Aggregate maximum potential of future payments of all guarantees was $1,522,732,639.B. Assessments(1) The Company is subject to Guaranty Fund Assessments from the states in which it is licensed. Aliability of $1,287,508 was accrued for the Company’s guaranty fund obligation at December 31, 2011.19.15