assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

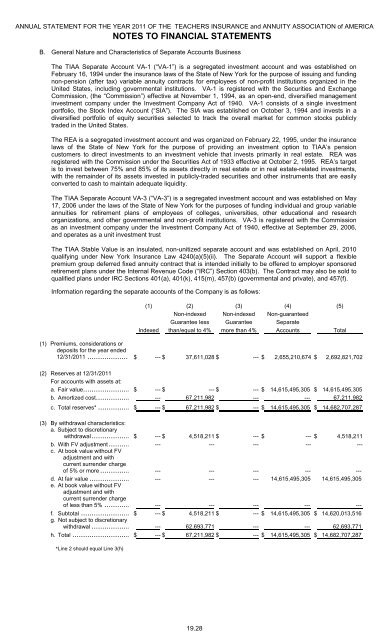

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSB. General Nature and Characteristics of Separate Accounts BusinessThe <strong>TIAA</strong> Separate Account VA-1 (“VA-1”) is a segregated investment account and was established onFebruary 16, 1994 under the insurance laws of the State of New York for the purpose of issuing and fundingnon-pension (after tax) variable annuity contracts for employees of non-profit institutions organized in theUnited States, including governmental institutions. VA-1 is registered with the Securities and ExchangeCommission, (the “Commission”) effective at November 1, 1994, as an open-end, diversified managementinvestment company under the Investment Company Act of 1940. VA-1 consists of a single investmentportfolio, the Stock Index Account (“SIA”). The SIA was established on October 3, 1994 and invests in adiversified portfolio of equity securities selected to track the overall market for common stocks publiclytraded in the United States.The REA is a segregated investment account and was organized on February 22, 1995, under the insurancelaws of the State of New York for the purpose of providing an investment option to <strong>TIAA</strong>’s pensioncustomers to direct investments to an investment vehicle that invests primarily in real estate. REA wasregistered with the Commission under the Securities Act of 1933 effective at October 2, 1995. REA’s targetis to invest between 75% and 85% of its <strong>assets</strong> directly in real estate or in real estate-related investments,with the remainder of its <strong>assets</strong> invested in publicly-traded securities and other instruments that are easilyconverted to cash to maintain adequate liquidity.The <strong>TIAA</strong> Separate Account VA-3 (“VA-3”) is a segregated investment account and was established on May17, 2006 under the laws of the State of New York for the purposes of funding individual and group variableannuities for retirement plans of employees of colleges, universities, other educational and researchorganizations, and other governmental and non-profit institutions. VA-3 is registered with the Commissionas an investment company under the Investment Company Act of 1940, effective at September 29, 2006,and operates as a unit investment trustThe <strong>TIAA</strong> Stable Value is an insulated, non-unitized separate account and was established on April, 2010qualifying under New York Insurance Law 4240(a)(5)(ii). The Separate Account will support a flexiblepremium group deferred fixed annuity contract that is intended initially to be offered to employer sponsoredretirement plans under the Internal Revenue Code (“IRC”) Section 403(b). The Contract may also be sold toqualified plans under IRC Sections 401(a), 401(k), 415(m), 457(b) (governmental and private), and 457(f).Information regarding the separate accounts of the Company is as follows:(1) (2) (3) (4) (5)Non-indexed Non-indexed Non-guaranteedGuarantee less Guarantee SeparateIndexed than/equal to 4% more than 4% Accounts Total(1) Premiums, considerations ordeposits for the year ended12/31/2011 ................... $ --- $ 37,611,028 $ --- $ 2,655,210,674 $ 2,692,821,702(2) Reserves at 12/31/2011For accounts with <strong>assets</strong> at:a. Fair value........................$ --- $ --- $ --- $ 14,615,495,305 $ 14,615,495,305b. Amortized cost.................. --- 67,211,982 --- --- 67,211,982c. Total reserves* .................$ --- $ 67,211,982 $ --- $ 14,615,495,305 $ 14,682,707,287(3) By withdrawal characteristics:a. Subject to discretionarywithdrawal....................$ --- $ 4,518,211 $ --- $ --- $ 4,518,211b. With FV adjustment............ --- --- --- --- ---c. At book value without FVadjustment and withcurrent surrender chargeof 5% or more................ --- --- --- --- ---d. At fair value ..................... --- --- --- 14,615,495,305 14,615,495,305e. At book value without FVadjustment and withcurrent surrender chargeof less than 5% .............. --- --- --- --- ---f. Subtotal .........................$ --- $ 4,518,211 $ --- $ 14,615,495,305 $ 14,620,013,516g. Not subject to discretionarywithdrawal .................. --- 62,693,771 --- --- 62,693,771h. Total ........................... $ --- $ 67,211,982 $ --- $ 14,615,495,305 $ 14,682,707,287*Line 2 should equal Line 3(h)19.28