ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSB. The Company writes (sells) credit default swaps providing default protection to the buyer as part of areplication strategy. Additionally, the Company pays a premium to counterparties for default protection tohedge the risk of a negative credit event on selective investments in the Company’s portfolio. These swapcontracts are entered into as fair value hedges.C. The carrying value of credit default swaps represents the premium received for selling the default protectionamortized into investment income over the life of the swap. When the Company purchases credit defaultswap protection, the premium payment to the counterparty is expensed. Credit default swaps for whichhedge accounting is not applied are carried at fair value. The changes in the carrying value of such creditdefault swap contracts are recognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from Credit DefaultSwap contracts that do not qualify for hedge accounting treatment was $48,184,633 and $10,565,335,respectively.Equity Index OptionsA. This derivative instrument is traded over-the-counter and the Company is exposed to market and counterpartyrisk.B. The Company enters into options on the equity indexes to hedge a portion of the General Account equityposition against downside equity risk or volatility in equity markets.C. The carrying value of equity index options for which hedge accounting is applied represents the premiumpaid adjusted to reflect the option market value. Equity index options for which hedge accounting is notapplied are carried at fair value. The changes in the carrying value of equity index options contracts arerecognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain or loss from equityindex options that do not qualify for hedge accounting was $ 0.Exchange Traded Interest Rate FuturesA. This type of derivative instrument is traded with regulated futures commission merchants who are membersof a trading exchange and is exposed to market risk. In an exchange traded futures transaction, theCompany agrees to purchase or sell a specified number of contracts, the value of which is determined bythe different classes of interest rate securities, and to post variation margin on a daily basis in an amountequal to the difference in the daily market values of those contracts.B. The Company enters into interest rate futures contracts as a hedge against the effect of interest ratefluctuations on certain fixed interest rate bonds. These contracts are designed as economic hedges andallow the Company to manage changes due to interest rates in the value of securities that it owns.C. The interest rate futures contracts are initially carried at the amount of cash margin deposits outstanding.Subsequent changes in variation margin are recognized in unrealized gains or losses. As of December 31,2011, the amount of initial margin pledged by the Company for exchange traded futures was $ 0.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain or loss from interestrate futures contracts that do not qualify for hedge accounting was $ 0.9. Federal Income TaxThe application of SSAP No. 10R requires a company to evaluate the recoverability of deferred tax <strong>assets</strong> and toestablish a valuation allowance if necessary to reduce the deferred tax asset to an amount which is more likelythan not to be realized. Considerable judgment is required in determining whether a valuation allowance isnecessary, and if so, the amount of such valuation allowance. The Company has recorded a valuationallowance of $3.3 million as of December 31, 2011.A. Components of Net Deferred Tax Assets (“DTA”) and Deferred Tax Liabilities (“DTL”) (in thousands):(1) 12/31/2011 12/31/2010 Change(1)Ordinary(2)Capital(3)(Col 1+2)Total(4)Ordinary(5)Capital(6)(Col 4+5)Total(7)(Col 1–4)Ordinary(8)(Col 2–5)Capital(9)(Col 7+8)Totala) Gross Deferred TaxAssets............. $ 11,756,241 $ 2,617,253 $14,373,494 $ 12,332,028 $ 2,409,580 $ 14,741,608 $ (575,787) $ 207,673 $ (368,114)b) Statutory ValuationAllowanceAdjustment.......... 3,324 --- 3,324 --- --- --- 3,324 --- 3,324c) Adjusted GrossDeferred TaxAssets (1a – 1b) .... 11,752,917 2,617,253 14,370,170 12,332,028 2,409,580 14,741,608 (579,111) 207,673 (371,438)d) Deferred TaxLiabilities............ 337,500 714,276 1,051,776 293,803 --- 293,803 43,697 714,276 757,973e) Subtotal (NetDeferred TaxAssets) (1c –1d ).... 11,415,417 1,902,977 13,318,394 12,038,225 2,409,580 14,447,805 (622,808) (506,603 ) (1,129,411)f) Deferred TaxAssetsNonadmitted ..... 8,430,349 1,818,164 10,248,513 9,294,466 1,907,154 11,201,620 (864,117) (88,990 ) (953,107)g) Net AdmittedDeferred TaxAssets (1e – 1f).. $ 2,985,068 $ 84,813 $ 3,069,881 $ 2,743,759 $ 502,426 $ 3,246,185 $ 241,309 $ (417,613) $ (176,304)19.6

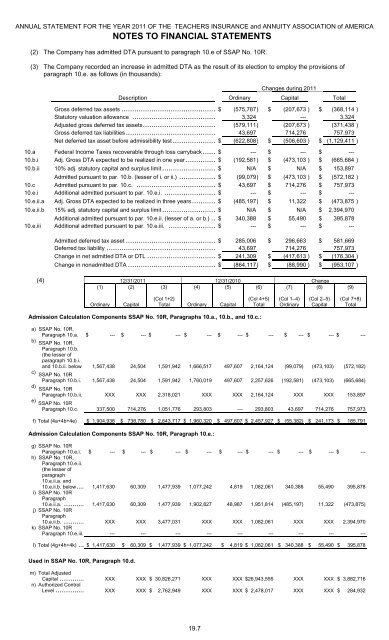

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS(2) The Company has admitted DTA pursuant to paragraph 10.e of SSAP No. 10R.(3) The Company recorded an increase in admitted DTA as the result of its election to employ the provisions ofparagraph 10.e. as follows (in thousands):Changes during 2011Description Ordinary Capital TotalGross deferred tax <strong>assets</strong> ............................................ $ (575,787) $ (207,673 ) $ (368,114 )Statutory valuation allowance ....................................... 3,324 --- 3,324Adjusted gross deferred tax <strong>assets</strong>.................................. (579,111) (207,673 ) (371,438 )Gross deferred tax liabilities.......................................... 43,697 714,276 757,973Net deferred tax asset before admissibility test.................... $ (622,808) $ (506,603 ) $ (1,129,411 )10.a Federal Income Taxes recoverable through loss carryback...... $ --- $ --- $ ---10.b.i Adj. Gross DTA expected to be realized in one year.............. $ (192,581) $ (473,103 ) $ (665,684 )10.b.ii 10% adj. statutory capital and surplus limit......................... $ N/A $ N/A $ 153,897Admitted pursuant to par. 10.b. (lesser of i. or ii.) ................. $ (99,079) $ (473,103 ) $ (572,182 )10.c Admitted pursuant to par. 10.c. ..................................... $ 43,697 $ 714,276 $ 757,97310.e.i Additional admitted pursuant to par. 10.e.i. ........................ $ --- $ --- $ ---10.e.ii.a Adj. Gross DTA expected to be realized in three years........... $ (485,197 ) $ 11,322 $ (473,875 )10.e.ii.b 15% adj. statutory capital and surplus limit......................... $ N/A $ N/A $ 2,394,970Additional admitted pursuant to par. 10.e.ii. (lesser of a. or b.) .. $ 340,388 $ 55,490 $ 395,87810.e.iii Additional admitted pursuant to par. 10.e.iii. ...................... $ --- $ --- $ ---Admitted deferred tax asset ...........................................$ 285,006 $ 296,663 $ 581,669Deferred tax liability .................................................... 43,697 714,276 757,973Change in net admitted DTA or DTL ................................ $ 241,309 $ (417,613 ) $ (176,304 )Change in nonadmitted DTA ..........................................$ (864,117 ) $ (88,990 ) $ (953,107 )(4) 12/31/2011 12/31/2010 Change(1) (2) (3) (4) (5) (6) (7) (8)(9)OrdinaryCapital(Col 1+2)TotalOrdinaryCapital(Col 4+5)Total(Col 1–4)Ordinary(Col 2–5)Capital(Col 7+8)TotalAdmission Calculation Components SSAP No. 10R, Paragraphs 10.a., 10.b., and 10.c.:a) SSAP No. 10R,Paragraph 10.a. $ --- $ --- $ --- $ --- $ --- $ --- $ --- $ --- $ ---b) SSAP No. 10R,Paragraph 10.b.(the lesser ofparagraph 10.b.i.and 10.b.ii. below 1,567,438 24,504 1,591,942 1,666,517 497,607 2,164,124 (99,079) (473,103) (572,182)c) SSAP No. 10RParagraph 10.b.i. 1,567,438 24,504 1,591,942 1,760,019 497,607 2,257,626 (192,581) (473,103) (665,684)d) SSAP No. 10RParagraph 10.b.ii. XXX XXX 2,318,021 XXX XXX 2,164,124 XXX XXX 153,897e) SSAP No. 10RParagraph 10.c. 337,500 714,276 1,051,776 293,803 --- 293,803 43,697 714,276 757,973f) Total (4a+4b+4e) $ 1,904,938 $ 738,780 $ 2,643,717 $ 1,960,320 $ 497,607 $ 2,457,927 $ (55,382) $ 241,173 $ 185,791Admission Calculation Components SSAP No. 10R, Paragraph 10.e.:g) SSAP No. 10RParagraph 10.e.i. $ --- $ --- $ --- $ --- $ --- $ --- $ --- $ --- $ ---h) SSAP No. 10R,Paragraph 10.e.ii.(the lesser ofparagraph10.e.ii.a. and10.e.ii.b. below.......1,417,630 60,309 1,477,939 1,077,242 4,819 1,082,061 340,388 55,490 395,878i) SSAP No. 10RParagraph10.e.ii.a. .............1,417,630 60,309 1,477,939 1,902,827 48,987 1,951,814 (485,197) 11,322 (473,875)j) SSAP No. 10RParagraph10.e.ii.b. .......... XXX XXX 3,477,031 XXX XXX 1,082,061 XXX XXX 2,394,970k) SSAP No. 10RParagraph 10.e.iii. --- --- --- --- --- --- --- --- ---I) Total (4g+4h+4k) ...... $ 1,417,630 $ 60,309 $ 1,477,939 $ 1,077,242 $ 4,819 $ 1,082,061 $ 340,388 $ 55,490 $ 395,878Used in SSAP No. 10R, Paragraph 10.d.m) Total AdjustedCapital ............... XXX XXX $ 30,826,271 XXX XXX $26,943,555 XXX XXX $ 3,882,716n) Authorized ControlLevel ................. XXX XXX $ 2,762,949 XXX XXX $ 2,478,017 XXX XXX $ 284,93219.7