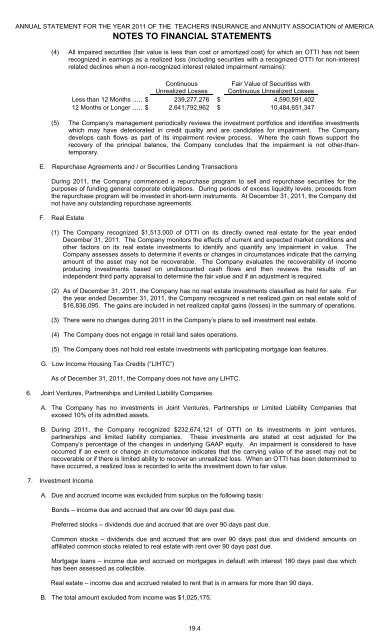

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS(4) All impaired securities (fair value is less than cost or amortized cost) for which an OTTI has not beenrecognized in earnings as a realized loss (including securities with a recognized OTTI for non-interestrelated declines when a non-recognized interest related impairment remains):ContinuousUnrealized LossesFair Value of Securities withContinuous Unrealized LossesLess than 12 Months ..... $ 239,277,276 $ 4,590,591,40212 Months or Longer ..... $ 2,641,792,962 $ 10,484,651,347(5) The Company’s management periodically reviews the investment portfolios and identifies investmentswhich may have deteriorated in credit quality and are candidates for impairment. The Companydevelops cash flows as part of its impairment review process. Where the cash flows support therecovery of the principal balance, the Company concludes that the impairment is not other-thantemporary.E. Repurchase Agreements and / or Securities Lending TransactionsDuring 2011, the Company commenced a repurchase program to sell and repurchase securities for thepurposes of funding general corporate obligations. During periods of excess liquidity levels, proceeds fromthe repurchase program will be invested in short-term instruments. At December 31, 2011, the Company didnot have any outstanding repurchase agreements.F. Real Estate(1) The Company recognized $1,513,000 of OTTI on its directly owned real estate for the year endedDecember 31, 2011. The Company monitors the effects of current and expected market conditions andother factors on its real estate investments to identify and quantify any impairment in value. TheCompany assesses <strong>assets</strong> to determine if events or changes in circumstances indicate that the carryingamount of the asset may not be recoverable. The Company evaluates the recoverability of incomeproducing investments based on undiscounted cash flows and then reviews the results of anindependent third party appraisal to determine the fair value and if an adjustment is required.(2) As of December 31, 2011, the Company has no real estate investments classified as held for sale. Forthe year ended December 31, 2011, the Company recognized a net realized gain on real estate sold of$16,836,095. The gains are included in net realized capital gains (losses) in the summary of operations.(3) There were no changes during 2011 in the Company’s plans to sell investment real estate.(4) The Company does not engage in retail land sales operations.(5) The Company does not hold real estate investments with participating mortgage loan features.G. Low Income Housing Tax Credits (“LIHTC”)As of December 31, 2011, the Company does not have any LIHTC.6. Joint Ventures, Partnerships and Limited Liability CompaniesA. The Company has no investments in Joint Ventures, Partnerships or Limited Liability Companies thatexceed 10% of its admitted <strong>assets</strong>.B. During 2011, the Company recognized $232,674,121 of OTTI on its investments in joint ventures,partnerships and limited liability companies. These investments are stated at cost adjusted for theCompany’s percentage of the changes in underlying GAAP equity. An impairment is considered to haveoccurred if an event or change in circumstance indicates that the carrying value of the asset may not berecoverable or if there is limited ability to recover an unrealized loss. When an OTTI has been determined tohave occurred, a realized loss is recorded to write the investment down to fair value.7. Investment IncomeA. Due and accrued income was excluded from surplus on the following basis:Bonds – income due and accrued that are over 90 days past due.Preferred stocks – dividends due and accrued that are over 90 days past due.Common stocks – dividends due and accrued that are over 90 days past due and dividend amounts onaffiliated common stocks related to real estate with rent over 90 days past due.Mortgage loans – income due and accrued on mortgages in default with interest 180 days past due whichhas been assessed as collectible.Real estate – income due and accrued related to rent that is in arrears for more than 90 days.B. The total amount excluded from income was $1,025,175.19.4

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA8. Derivative InstrumentsNOTES TO FINANCIAL STATEMENTSThe Company records the carrying amount of its derivative instruments under Assets, line 7, Derivatives andunder Liabilities, line 24.08, Miscellaneous Liabilities - Derivatives, with any corresponding gains or lossesincluded in the calculation of the Change in Asset Valuation Reserve in the Summary of Operations.Interest Rate SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into interest rate swap contracts to hedge against the effect of interest rate fluctuationson certain variable interest rate bonds. These contracts are designed as cash flow hedges and allow theCompany to lock in a fixed interest rate and to transfer the risk of higher or lower interest rates. TheCompany also enters into interest rate swap contracts to exchange the cash flows on certain fixed interestrate bonds into variable interest rate cash flows. These contracts are entered into as a fair value hedge inconnection with certain interest sensitive products.C. Interest rate swaps for which hedge accounting is applied and that qualify as effective hedges in accordancewith the accounting guidance have a carrying value of $ 0. Interest rate swaps for which hedge accountingis not applied or that are no longer effective are carried at fair value. The changes in the carrying value ofinterest rate swap contacts are recognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from interest rate swapcontracts that do not qualify for hedge accounting was $14,312,924 and $4,429,118, respectively.Foreign Currency SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into foreign currency swap contracts to exchange fixed and variable amounts of foreigncurrency at specified future dates and at specified rates (in U.S. dollars) as a cash flow hedge to managecurrency risk on investments denominated in foreign currencies.C. Foreign currency swaps for which hedge accounting is applied have a carrying value of $(119,109,605) as ofDecember 31, 2011. The U.S. dollar notional amounts of these positions are represented by the foreignnotional amounts translated at the spot exchange rate. Foreign currency swaps that no longer qualify aseffective hedges are carried at fair value from the date they ceased to be effective according to theaccounting guidance. Foreign currency swaps for which hedge accounting is not applied are carried at fairvalue. The changes in the carrying value of foreign currency swap contracts are recognized at the end ofthe period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from foreign currencyswaps that do not qualify for hedge accounting was $81,972,432 and $123,381,997, respectively.Foreign Currency Forward ContractsA. This type of derivative instrument is traded over-the-counter, and is exposed to both market and counterpartyrisk.B. The Company enters into foreign currency forward contracts to exchange a fixed amount of foreign currencyat a specified future date and at a specified rate (in U.S. dollars) as a cash flow hedge to manage currencyrisk on investments denominated in foreign currencies.C. A foreign exchange premium (discount) is recorded at the time a contract is opened, based on the differencebetween the forward exchange rate and the spot rate. The carrying value of foreign currency forwardcontracts, for which hedge accounting is applied and that qualify as effective hedges in accordance with theaccounting guidance, represents amortized cost translated at the spot exchange rate. Foreign currencyforward contracts that no longer qualify as effective hedges are carried at fair value from the date theyceased to be effective according to the accounting guidance. Foreign currency forward contracts for whichhedge accounting is not applied are carried at fair value. The changes in the carrying value of the foreigncurrency forward contracts are recognized at the end of the period as unrealized gains or losses.D. For the twelve months ended December 31, 2011 and 2010, the net unrealized gain from foreign currencyforward contracts that do not qualify for hedge accounting was $7,228,978 and $4,221,189, respectively.Credit Default SwapsA. This type of derivative instrument is traded over-the-counter, and is exposed to market, credit, and counterpartyrisk. In a replication transaction, the Company synthetically assumes the credit risk of a referenceentity and has the obligation to reimburse the default protection buyer for the loss of par principal value inexchange for the defaulted asset if a credit event occurs. The Company also purchases credit default swapsto hedge against unexpected credit events on selective investments in the Company’s portfolio.19.5