assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

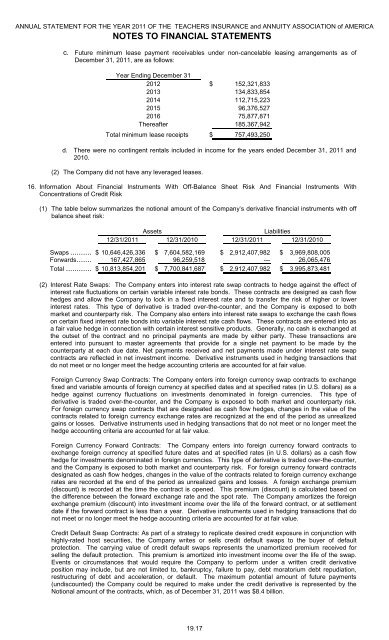

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSc. Future minimum lease payment receivables under non-cancelable leasing arrangements as ofDecember 31, 2011, are as follows:Year Ending December 312012 $ 152,321,8332013 134,833,8542014 112,715,2232015 96,376,5272016 75,877,871Thereafter 185,367,942Total minimum lease receipts $ 757,493,250d. There were no contingent rentals included in income for the years ended December 31, 2011 and2010.(2) The Company did not have any leveraged leases.16. Information About Financial Instruments With Off-Balance Sheet Risk And Financial Instruments WithConcentrations of Credit Risk(1) The table below summarizes the notional amount of the Company’s derivative financial instruments with offbalance sheet risk:AssetsLiabilities12/31/2011 12/31/2010 12/31/2011 12/31/2010Swaps .......... $ 10,646,426,336 $ 7,604,582,169 $ 2,912,407,982 $ 3,969,808,005Forwards....... 167,427,865 96,259,518 --- 26,065,476Total ............ $ 10,813,854,201 $ 7,700,841,687 $ 2,912,407,982 $ 3,995,873,481(2) Interest Rate Swaps: The Company enters into interest rate swap contracts to hedge against the effect ofinterest rate fluctuations on certain variable interest rate bonds. These contracts are designed as cash flowhedges and allow the Company to lock in a fixed interest rate and to transfer the risk of higher or lowerinterest rates. This type of derivative is traded over-the-counter, and the Company is exposed to bothmarket and counterparty risk. The Company also enters into interest rate swaps to exchange the cash flowson certain fixed interest rate bonds into variable interest rate cash flows. These contracts are entered into asa fair value hedge in connection with certain interest sensitive products. Generally, no cash is exchanged atthe outset of the contract and no principal payments are made by either party. These transactions areentered into pursuant to master agreements that provide for a single net payment to be made by thecounterparty at each due date. Net payments received and net payments made under interest rate swapcontracts are reflected in net investment income. Derivative instruments used in hedging transactions thatdo not meet or no longer meet the hedge accounting criteria are accounted for at fair value.Foreign Currency Swap Contracts: The Company enters into foreign currency swap contracts to exchangefixed and variable amounts of foreign currency at specified dates and at specified rates (in U.S. dollars) as ahedge against currency fluctuations on investments denominated in foreign currencies. This type ofderivative is traded over-the-counter, and the Company is exposed to both market and counterparty risk.For foreign currency swap contracts that are designated as cash flow hedges, changes in the value of thecontracts related to foreign currency exchange rates are recognized at the end of the period as unrealizedgains or losses. Derivative instruments used in hedging transactions that do not meet or no longer meet thehedge accounting criteria are accounted for at fair value.Foreign Currency Forward Contracts: The Company enters into foreign currency forward contracts toexchange foreign currency at specified future dates and at specified rates (in U.S. dollars) as a cash flowhedge for investments denominated in foreign currencies. This type of derivative is traded over-the-counter,and the Company is exposed to both market and counterparty risk. For foreign currency forward contractsdesignated as cash flow hedges, changes in the value of the contracts related to foreign currency exchangerates are recorded at the end of the period as unrealized gains and losses. A foreign exchange premium(discount) is recorded at the time the contract is opened. This premium (discount) is calculated based onthe difference between the forward exchange rate and the spot rate. The Company amortizes the foreignexchange premium (discount) into investment income over the life of the forward contract, or at settlementdate if the forward contract is less than a year. Derivative instruments used in hedging transactions that donot meet or no longer meet the hedge accounting criteria are accounted for at fair value.Credit Default Swap Contracts: As part of a strategy to replicate desired credit exposure in conjunction withhighly-rated host securities, the Company writes or sells credit default swaps to the buyer of defaultprotection. The carrying value of credit default swaps represents the unamortized premium received forselling the default protection. This premium is amortized into investment income over the life of the swap.Events or circumstances that would require the Company to perform under a written credit derivativeposition may include, but are not limited to, bankruptcy, failure to pay, debt moratorium debt repudiation,restructuring of debt and acceleration, or default. The maximum potential amount of future payments(undiscounted) the Company could be required to make under the credit derivative is represented by theNotional amount of the contracts, which, as of December 31, 2011 was $8.4 billion.19.17