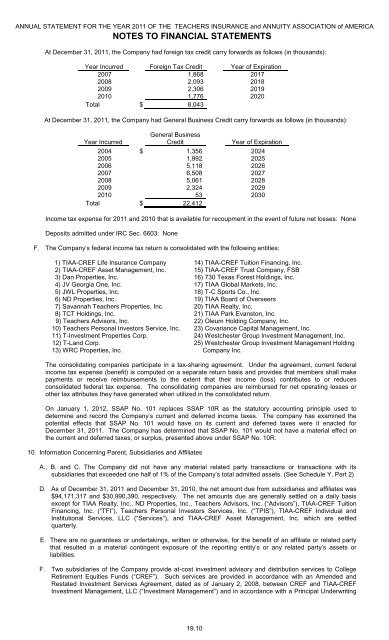

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSAt December 31, 2011, the Company had foreign tax credit carry forwards as follows (in thousands):Year Incurred Foreign Tax Credit Year of Expiration2007 1,868 20172008 2,093 20182009 2,306 20192010 1,776 2020Total $ 8,043At December 31, 2011, the Company had General Business Credit carry forwards as follows (in thousands):Year IncurredGeneral BusinessCreditYear of Expiration2004 $ 1,356 20242005 1,992 20252006 5,118 20262007 6,508 20272008 5,061 20282009 2,324 20292010 53 2030Total $ 22,412Income tax expense for 2011 and 2010 that is available for recoupment in the event of future net losses: NoneDeposits admitted under IRC Sec. 6603: NoneF. The Company’s federal income tax return is consolidated with the following entities:1) <strong>TIAA</strong>-<strong>CREF</strong> Life Insurance Company 14) <strong>TIAA</strong>-<strong>CREF</strong> Tuition Financing, Inc.2) <strong>TIAA</strong>-<strong>CREF</strong> Asset Management, Inc. 15) <strong>TIAA</strong>-<strong>CREF</strong> Trust Company, FSB3) Dan Properties, Inc. 16) 730 Texas Forest Holdings, Inc.4) JV Georgia One, Inc. 17) <strong>TIAA</strong> Global Markets, Inc.5) JWL Properties, Inc. 18) T-C Sports Co., Inc.6) ND Properties, Inc. 19) <strong>TIAA</strong> Board of Overseers7) Savannah Teachers Properties, Inc. 20) <strong>TIAA</strong> Realty, Inc.8) TCT Holdings, Inc. 21) <strong>TIAA</strong> Park Evanston, Inc.9) Teachers Advisors, Inc. 22) Oleum Holding Company, Inc.10) Teachers Personal Investors Service, Inc. 23) Covariance Capital Management, Inc.11) T-Investment Properties Corp. 24) Westchester Group Investment Management, Inc.12) T-Land Corp. 25) Westchester Group Investment Management Holding13) WRC Properties, Inc. Company Inc.The consolidating companies participate in a tax-sharing agreement. Under the agreement, current federalincome tax expense (benefit) is computed on a separate return basis and provides that members shall makepayments or receive reimbursements to the extent that their income (loss) contributes to or reducesconsolidated federal tax expense. The consolidating companies are reimbursed for net operating losses orother tax attributes they have generated when utilized in the consolidated return.On January 1, 2012, SSAP No. 101 replaces SSAP 10R as the statutory accounting principle used todetermine and record the Company’s current and deferred income taxes. The company has examined thepotential effects that SSAP No. 101 would have on its current and deferred taxes were it enacted forDecember 31, 2011. The Company has determined that SSAP No. 101 would not have a material effect onthe current and deferred taxes, or surplus, presented above under SSAP No. 10R.10. Information Concerning Parent, Subsidiaries and AffiliatesA., B. and C. The Company did not have any material related party transactions or transactions with itssubsidiaries that exceeded one half of 1% of the Company’s total admitted <strong>assets</strong>. (See Schedule Y, Part 2)D. As of December 31, 2011 and December 31, 2010, the net amount due from subsidiaries and affiliates was$94,171,317 and $30,990,390, respectively. The net amounts due are generally settled on a daily basisexcept for <strong>TIAA</strong> Realty, Inc., ND Properties, Inc., Teachers Advisors, Inc. (“Advisors”), <strong>TIAA</strong>-<strong>CREF</strong> TuitionFinancing, Inc. (“TFI”), Teachers Personal Investors Services, Inc. (“TPIS”), <strong>TIAA</strong>-<strong>CREF</strong> Individual andInstitutional Services, LLC (“Services”), and <strong>TIAA</strong>-<strong>CREF</strong> Asset Management, Inc. which are settledquarterly.E. There are no guarantees or undertakings, written or otherwise, for the benefit of an affiliate or related partythat resulted in a material contingent exposure of the reporting entity’s or any related party’s <strong>assets</strong> orliabilities.F. Two subsidiaries of the Company provide at-cost investment advisory and distribution services to CollegeRetirement Equities Funds (“<strong>CREF</strong>”). Such services are provided in accordance with an Amended andRestated Investment Services Agreement, dated as of January 2, 2008, between <strong>CREF</strong> and <strong>TIAA</strong>-<strong>CREF</strong>Investment Management, LLC (“Investment Management”) and in accordance with a Principal Underwriting19.10

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSand Distribution Services Agreement for <strong>CREF</strong>, dated as of January 1, 2009, between <strong>CREF</strong> and Services.The Company also performs administrative services for <strong>CREF</strong> on an at-cost basis.Advisors provides investment advisory services for VA-1, the <strong>TIAA</strong>-<strong>CREF</strong> Funds, the <strong>TIAA</strong>-<strong>CREF</strong> Life Fundsand other separately managed portfolios in accordance with investment management agreements. TPISand Services distribute variable annuity contracts for VA-1 and VA-3, as well as registered securities for the<strong>TIAA</strong>-<strong>CREF</strong> Funds, the <strong>TIAA</strong>-<strong>CREF</strong> Life Separate Accounts, <strong>TIAA</strong>-<strong>CREF</strong> Asset Management Funds,Brokerage Accounts, TFI and non-proprietary mutual funds.All services necessary for the operation of the <strong>TIAA</strong> Real Estate Separate Account (“REA”) are provided, atcost,by the Company and Services. The Company provides investment management and advisory servicesand administrative services for REA. Distribution services are provided in accordance with a DistributionServices Agreement between REA and Services. The Company and Services provide these services atcostto REA.The Company provides investment services at-cost for <strong>TIAA</strong>-<strong>CREF</strong> Life in accordance with an InvestmentManagement Agreement between the Company and <strong>TIAA</strong>-<strong>CREF</strong> Life. Administrative services for <strong>TIAA</strong>-<strong>CREF</strong> Life are provided by the Company in accordance with an Administrative Services Agreement betweenthe Company and <strong>TIAA</strong>-<strong>CREF</strong> Life.G. All of the outstanding common stock of the Company is collectively held by the <strong>TIAA</strong> Board of Overseers, anon-profit corporation created to hold the stock of the Company.H. The Company does not own shares of common stock of its parent, the <strong>TIAA</strong> Board of Overseers.I. No investment in a subsidiary or affiliate exceeds 10% of the Company’s admitted <strong>assets</strong>.J. During 2011, the Company recognized $98,456,956 in OTTI for investments in subsidiary, controlled andaffiliated companies. These impairments relate to a decline in the equity value and the impairment of thegoodwill of subsidiaries for which the carrying value is not expected to recover.K. The Company does not have any investment in foreign insurance subsidiaries.L. The Company holds investments in downstream non-insurance holding companies, which are valued by theCompany utilizing the look-through approach. The financial statements for the downstream non-insuranceholding companies listed in the table below are not audited and <strong>TIAA</strong> has limited the value of its investmentin these non-insurance holding companies to the value contained in the financial statements of theunderlying investments, which will be audited. All liabilities, commitments, contingencies, guarantees orobligations of these subsidiaries, which are required to be recorded as liabilities, commitments,contingencies, guarantees or obligations under applicable accounting guidance, are reflected in <strong>TIAA</strong>’sdetermination of the carrying value of the investment in these subsidiaries, if not already recorded in thesubsidiaries’ financial statements. The following table summarizes the Company’s carrying value in eachunaudited downstream non-insurance holding company as of December 31:11. Debt2011 2010Subsidiary Carrying Value Carrying ValueMansilla Participacoes LTDA.......................... $ 399,247,843 $ 433,135,952<strong>TIAA</strong> Super Regional Mall Member Sub, LLC..... 235,355,371 ---Dionysus Properties, LLC .............................. 226,725,813 ---Infra Alpha, LLC .......................................... 210,306,683 ---Occator Agricultural Properties, LLC ................ 177,667,626 37,546,867<strong>TIAA</strong> Oil & Gas Investments, LLC.................... 170,490,994 ---<strong>TIAA</strong> Global Ag Holdco LLC........................... 106,126,417 ---T-C 685 Third Avenue Member, LLC................ 99,201,915 192,021,942<strong>TIAA</strong>-<strong>CREF</strong> Asset Management, Inc. .............. 58,614,695 37,422,940I-595 Toll Road, LLC .................................... 39,435,000 ---<strong>TIAA</strong>-<strong>CREF</strong> Redwood, LLC............................ 39,051,930 22,485,603T-C SMA II, LLC.......................................... 26,275,564 17,853,459<strong>TIAA</strong> SynGas, LLC....................................... 24,610,466 ---<strong>TIAA</strong> Union Place Phase I, LLC ...................... 19,749,168 19,867,763<strong>TIAA</strong> The Reserve II Member, LLC.................. 4,030,002 4,023,409730 Texas Forest Holdings, Inc....................... 867,192 865,532<strong>TIAA</strong> Diamond Investor, LLC.......................... 523,158 ---Demeter Agricultural Properties, LLC ............... 402,104 433,136T-C SMA I, LLC........................................... 244,335 275,060Almond Processors, LLC............................... 204,000 ---<strong>TIAA</strong> Stonepeak Fund I, LLC.......................... 193,175 ---<strong>TIAA</strong> Eurpoean Funding Trust ........................ --- 40,555,438Total ..................................................... $ 1,839,323,451 $ 806,487,101The Company does not have any debt.19.11