assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

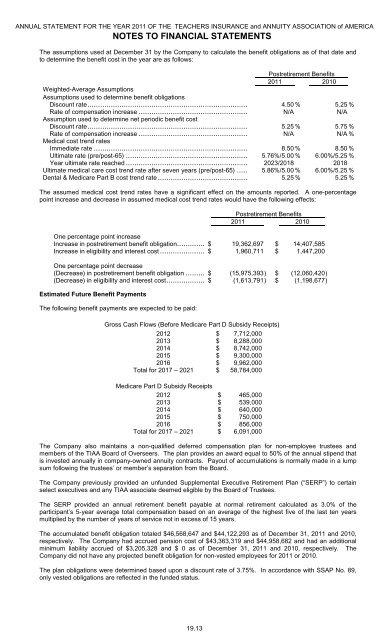

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSThe assumptions used at December 31 by the Company to calculate the benefit obligations as of that date andto determine the benefit cost in the year are as follows:Postretirement Benefits2011 2010Weighted-Average AssumptionsAssumptions used to determine benefit obligationsDiscount rate............................................................................. 4.50 % 5.25 %Rate of compensation increase ..................................................... N/A N/AAssumption used to determine net periodic benefit costDiscount rate............................................................................. 5.25 % 5.75 %Rate of compensation increase ..................................................... N/A N/A %Medical cost trend ratesImmediate rate .......................................................................... 8.50 % 8.50 %Ultimate rate (pre/post-65) ........................................................... 5.76%/5.00 % 6.00%/5.25 %Year ultimate rate reached ........................................................... 2023/2018 2018Ultimate medical care cost trend rate after seven years (pre/post-65) ....... 5.86%/5.00 % 6.00%/5.25 %Dental & Medicare Part B cost trend rate............................................ 5.25 % 5.25 %The assumed medical cost trend rates have a significant effect on the amounts reported. A one-percentagepoint increase and decrease in assumed medical cost trend rates would have the following effects:Postretirement Benefits2011 2010One percentage point increaseIncrease in postretirement benefit obligation............. $ 19,362,697 $ 14,407,585Increase in eligibility and interest cost..................... $ 1,960,711 $ 1,447,200One percentage point decrease(Decrease) in postretirement benefit obligation ...........$ (15,975,393 ) $ (12,060,420 )(Decrease) in eligibility and interest cost....................$ (1,613,791 ) $ (1,198,677 )Estimated Future Benefit PaymentsThe following benefit payments are expected to be paid:Gross Cash Flows (Before Medicare Part D Subsidy Receipts)2012 $ 7,712,0002013 $ 8,288,0002014 $ 8,742,0002015 $ 9,300,0002016 $ 9,962,000Total for 2017 – 2021 $ 58,784,000Medicare Part D Subsidy Receipts2012 $ 465,0002013 $ 539,0002014 $ 640,0002015 $ 750,0002016 $ 856,000Total for 2017 – 2021 $ 6,091,000The Company also maintains a non-qualified deferred compensation plan for non-employee trustees andmembers of the <strong>TIAA</strong> Board of Overseers. The plan provides an award equal to 50% of the annual stipend thatis invested annually in company-owned annuity contracts. Payout of accumulations is normally made in a lumpsum following the trustees’ or member’s separation from the Board.The Company previously provided an unfunded Supplemental Executive Retirement Plan (“SERP”) to certainselect executives and any <strong>TIAA</strong> associate deemed eligible by the Board of Trustees.The SERP provided an annual retirement benefit payable at normal retirement calculated as 3.0% of theparticipant’s 5-year average total compensation based on an average of the highest five of the last ten yearsmultiplied by the number of years of service not in excess of 15 years.The accumulated benefit obligation totaled $46,568,647 and $44,122,293 as of December 31, 2011 and 2010,respectively. The Company had accrued pension cost of $43,363,319 and $44,958,682 and had an additionalminimum liability accrued of $3,205,328 and $ 0 as of December 31, 2011 and 2010, respectively. TheCompany did not have any projected benefit obligation for non-vested employees for 2011 or 2010.The plan obligations were determined based upon a discount rate of 3.75%. In accordance with SSAP No. 89,only vested obligations are reflected in the funded status.19.13