assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

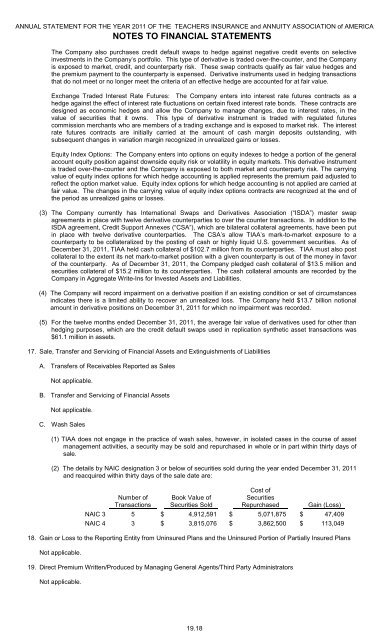

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTSThe Company also purchases credit default swaps to hedge against negative credit events on selectiveinvestments in the Company’s portfolio. This type of derivative is traded over-the-counter, and the Companyis exposed to market, credit, and counterparty risk. These swap contracts qualify as fair value hedges andthe premium payment to the counterparty is expensed. Derivative instruments used in hedging transactionsthat do not meet or no longer meet the criteria of an effective hedge are accounted for at fair value.Exchange Traded Interest Rate Futures: The Company enters into interest rate futures contracts as ahedge against the effect of interest rate fluctuations on certain fixed interest rate bonds. These contracts aredesigned as economic hedges and allow the Company to manage changes, due to interest rates, in thevalue of securities that it owns. This type of derivative instrument is traded with regulated futurescommission merchants who are members of a trading exchange and is exposed to market risk. The interestrate futures contracts are initially carried at the amount of cash margin deposits outstanding, withsubsequent changes in variation margin recognized in unrealized gains or losses.Equity Index Options: The Company enters into options on equity indexes to hedge a portion of the generalaccount equity position against downside equity risk or volatility in equity markets. This derivative instrumentis traded over-the-counter and the Company is exposed to both market and counterparty risk. The carryingvalue of equity index options for which hedge accounting is applied represents the premium paid adjusted toreflect the option market value. Equity index options for which hedge accounting is not applied are carried atfair value. The changes in the carrying value of equity index options contracts are recognized at the end ofthe period as unrealized gains or losses.(3) The Company currently has International Swaps and Derivatives Association (“ISDA”) master swapagreements in place with twelve derivative counterparties to over the counter transactions. In addition to theISDA agreement, Credit Support Annexes (“CSA”), which are bilateral collateral agreements, have been putin place with twelve derivative counterparties. The CSA’s allow <strong>TIAA</strong>’s mark-to-market exposure to acounterparty to be collateralized by the posting of cash or highly liquid U.S. government securities. As ofDecember 31, 2011, <strong>TIAA</strong> held cash collateral of $102.7 million from its counterparties. <strong>TIAA</strong> must also postcollateral to the extent its net mark-to-market position with a given counterparty is out of the money in favorof the counterparty. As of December 31, 2011, the Company pledged cash collateral of $13.5 million andsecurities collateral of $15.2 million to its counterparties. The cash collateral amounts are recorded by theCompany in Aggregate Write-Ins for Invested Assets and Liabilities.(4) The Company will record impairment on a derivative position if an existing condition or set of circumstancesindicates there is a limited ability to recover an unrealized loss. The Company held $13.7 billion notionalamount in derivative positions on December 31, 2011 for which no impairment was recorded.(5) For the twelve months ended December 31, 2011, the average fair value of derivatives used for other thanhedging purposes, which are the credit default swaps used in replication synthetic asset transactions was$61.1 million in <strong>assets</strong>.17. Sale, Transfer and Servicing of Financial Assets and Extinguishments of LiabilitiesA. Transfers of Receivables Reported as SalesNot applicable.B. Transfer and Servicing of Financial AssetsNot applicable.C. Wash Sales(1) <strong>TIAA</strong> does not engage in the practice of wash sales, however, in isolated cases in the course of assetmanagement activities, a security may be sold and repurchased in whole or in part within thirty days ofsale.(2) The details by NAIC designation 3 or below of securities sold during the year ended December 31, 2011and reacquired within thirty days of the sale date are:Number ofTransactionsBook Value ofSecurities SoldCost ofSecuritiesRepurchasedGain (Loss)NAIC 3 5 $ 4,912,591 $ 5,071,875 $ 47,409NAIC 4 3 $ 3,815,076 $ 3,862,500 $ 113,04918. Gain or Loss to the Reporting Entity from Uninsured Plans and the Uninsured Portion of Partially Insured PlansNot applicable.19. Direct Premium Written/Produced by Managing General Agents/Third Party AdministratorsNot applicable.19.18