assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

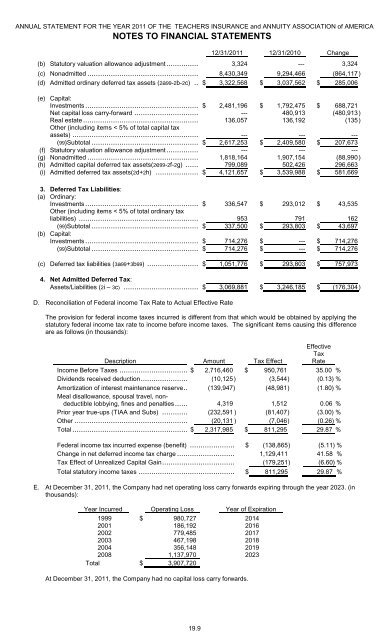

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS12/31/2011 12/31/2010 Change(b) Statutory valuation allowance adjustment........................ 3,324 --- 3,324(c) Nonadmitted ............................................................. 8,430,349 9,294,466 (864,117 )(d) Admitted ordinary deferred tax <strong>assets</strong> (2a99-2b-2c) ........... $ 3,322,568 $ 3,037,562 $ 285,006(e) Capital:Investments..................................................... $ 2,481,196 $ 1,792,475 $ 688,721Net capital loss carry-forward .............................. --- 480,913 (480,913 )Real estate...................................................... 136,057 136,192 (135 )Other (including items < 5% of total capital tax<strong>assets</strong>) ........................................................... --- --- ---(99)Subtotal .................................................. $ 2,617,253 $ 2,409,580 $ 207,673(f) Statutory valuation allowance adjustment............... --- --- ---(g) Nonadmitted .................................................... 1,818,164 1,907,154 (88,990 )(h) Admitted capital deferred tax <strong>assets</strong>(2e99-2f-2g) ...... 799,089 502,426 296,663(i) Admitted deferred tax <strong>assets</strong>(2d+2h) .................... $ 4,121,657 $ 3,539,988 $ 581,6693. Deferred Tax Liabilities:(a) Ordinary:Investments........................................................$ 336,547 $ 293,012 $ 43,535Other (including items < 5% of total ordinary taxliabilities) ........................................................... 953 791 162(99)Subtotal .....................................................$ 337,500 $ 293,803 $ 43,697(b) Capital:Investments........................................................$ 714,276 $ --- $ 714,276(99)Subtotal .....................................................$ 714,276 $ --- $ 714,276(c) Deferred tax liabilities (3a99+3b99) .............................. $ 1,051,776 $ 293,803 $ 757,9734. Net Admitted Deferred Tax:Assets/Liabilities (2i – 3c) ......................................$ 3,069,881 $ 3,246,185 $ (176,304 )D. Reconciliation of Federal income Tax Rate to Actual Effective RateThe provision for federal income taxes incurred is different from that which would be obtained by applying thestatutory federal income tax rate to income before income taxes. The significant items causing this differenceare as follows (in thousands):Description Amount Tax EffectEffectiveTaxRateIncome Before Taxes ................................ $ 2,716,460 $ 950,761 35.00 %Dividends received deduction...................... (10,125) (3,544) (0.13) %Amortization of interest maintenance reserve.. (139,947) (48,981) (1.80) %Meal disallowance, spousal travel, nondeductiblelobbying, fines and penalties...... 4,319 1,512 0.06 %Prior year true-ups (<strong>TIAA</strong> and Subs) ............ (232,591 ) (81,407) (3.00) %Other ..................................................... (20,131 ) (7,046) (0.26) %Total ...................................................... $ 2,317,985 $ 811,295 29.87 %Federal income tax incurred expense (benefit) ............................. $ (138,865) (5.11) %Change in net deferred income tax charge ................................ 1,129,411 41.58 %Tax Effect of Unrealized Capital Gain.......................................... (179,251) (6.60) %Total statutory income taxes ..................................................... $ 811,295 29.87 %E. At December 31, 2011, the Company had net operating loss carry forwards expiring through the year 2023. (inthousands):Year Incurred Operating Loss Year of Expiration1999 $ 980,727 20142001 186,192 20162002 779,485 20172003 467,198 20182004 356,148 20192008 1,137,970 2023Total $ 3,907,720At December 31, 2011, the Company had no capital loss carry forwards.19.9