assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

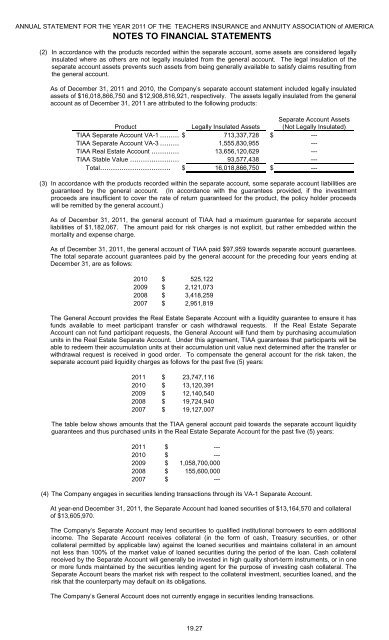

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS(2) In accordance with the products recorded within the separate account, some <strong>assets</strong> are considered legallyinsulated where as others are not legally insulated from the general account. The legal insulation of theseparate account <strong>assets</strong> prevents such <strong>assets</strong> from being generally available to satisfy claims resulting fromthe general account.As of December 31, 2011 and 2010, the Company’s separate account statement included legally insulated<strong>assets</strong> of $16,018,866,750 and $12,908,816,921, respectively. The <strong>assets</strong> legally insulated from the generalaccount as of December 31, 2011 are attributed to the following products:ProductLegally Insulated AssetsSeparate Account Assets(Not Legally Insulated)<strong>TIAA</strong> Separate Account VA-1 ...........$ 713,337,728 $ ---<strong>TIAA</strong> Separate Account VA-3 ........... 1,555,830,955 ---<strong>TIAA</strong> Real Estate Account ............... 13,656,120,629 ---<strong>TIAA</strong> Stable Value ......................... 93,577,438 ---Total................................. $ 16,018,866,750 $ ---(3) In accordance with the products recorded within the separate account, some separate account liabilities areguaranteed by the general account. (In accordance with the guarantees provided, if the investmentproceeds are insufficient to cover the rate of return guaranteed for the product, the policy holder proceedswill be remitted by the general account.)As of December 31, 2011, the general account of <strong>TIAA</strong> had a maximum guarantee for separate accountliabilities of $1,182,067. The amount paid for risk charges is not explicit, but rather embedded within themortality and expense charge.As of December 31, 2011, the general account of <strong>TIAA</strong> paid $97,959 towards separate account guarantees.The total separate account guarantees paid by the general account for the preceding four years ending atDecember 31, are as follows:2010 $ 525,1222009 $ 2,121,0732008 $ 3,418,2592007 $ 2,951,819The General Account provides the Real Estate Separate Account with a liquidity guarantee to ensure it hasfunds available to meet participant transfer or cash withdrawal requests. If the Real Estate SeparateAccount can not fund participant requests, the General Account will fund them by purchasing accumulationunits in the Real Estate Separate Account. Under this agreement, <strong>TIAA</strong> guarantees that participants will beable to redeem their accumulation units at their accumulation unit value next determined after the transfer orwithdrawal request is received in good order. To compensate the general account for the risk taken, theseparate account paid liquidity charges as follows for the past five (5) years:2011 $ 23,747,1162010 $ 13,120,3912009 $ 12,140,5402008 $ 19,724,9402007 $ 19,127,007The table below shows amounts that the <strong>TIAA</strong> general account paid towards the separate account liquidityguarantees and thus purchased units in the Real Estate Separate Account for the past five (5) years:2011 $ ---2010 $ ---2009 $ 1,058,700,0002008 $ 155,600,0002007 $ ---(4) The Company engages in securities lending transactions through its VA-1 Separate Account.At year-end December 31, 2011, the Separate Account had loaned securities of $13,164,570 and collateralof $13,605,970.The Company’s Separate Account may lend securities to qualified institutional borrowers to earn additionalincome. The Separate Account receives collateral (in the form of cash, Treasury securities, or othercollateral permitted by applicable law) against the loaned securities and maintains collateral in an amountnot less than 100% of the market value of loaned securities during the period of the loan. Cash collateralreceived by the Separate Account will generally be invested in high quality short-term instruments, or in oneor more funds maintained by the securities lending agent for the purpose of investing cash collateral. TheSeparate Account bears the market risk with respect to the collateral investment, securities loaned, and therisk that the counterparty may default on its obligations.The Company’s General Account does not currently engage in securities lending transactions.19.27