ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICAC. Other DisclosuresNOTES TO FINANCIAL STATEMENTSEffective March 2009, <strong>TIAA</strong> was authorized to execute investment transactions under the Term Asset-Backed Securities Loan Facility (“TALF”) program. Under the TALF program, the Federal Reserve Bank ofNew York (“FRBNY”) lent up to $200 billion on a non-recourse basis to holders of certain AAA-rated AssetBacked Securities (“ABS”) backed by newly and recently originated consumer and small business loans.The FRBNY lent an amount equal to the market value of the ABS less a haircut and were secured at alltimes by the ABS. Loan proceeds were disbursed to the borrower, contingent on receipt by the FRBNYcustodian bank of the eligible collateral.As of December 31, 2011, <strong>TIAA</strong>’s eligible ABS under the TALF program totaled $887,157,082 which hasbeen pledged as collateral to support an $808,560,881 loan outstanding payable to the FRBNY. The TALFSubscription program officially ended in April 2010.Forward CommitmentsThe Company has the following forward commitments:At December 31, 2011, outstanding forward commitments for future long-term bond investments were$775,926,765. Of this, $590,578,944 is scheduled for disbursement in 2012 and $185,347,821 in later years.The funding of bond commitments is contingent upon the continued favorable financial performance of thepotential borrowers.At December 31, 2011, outstanding forward commitments for future preferred stock investments were$9,314,136. Of this, $1,577,827 is scheduled for disbursement in 2012 and $7,736,309 in later years. Thefunding of preferred stock commitments is contingent upon the continued favorable financial performance.At December 31, 2011, outstanding forward commitments for future mortgage loan investments were$568,258,977. Of this, $465,433,253 is scheduled for disbursement in 2012 and $102,825,724 in lateryears. The funding of mortgage loan commitments is contingent upon the underlying properties meetingspecified requirements, including construction, leasing and occupancy.D. Uncollectible premiums receivableNot applicable.E. Business Interruption Insurance RecoveriesNot applicable.F. State Transferable Tax CreditsNot applicable.G. Subprime Mortgage Related Risk ExposureThe Company’s exposure to subprime lending is limited to investments within its investment portfolio whichare primarily in the form of Residential Mortgage-Backed Securities (“RMBS”) supported by subprimemortgage loans. Additionally, the Company does not underwrite nor does it hold any direct sub-primemortgages. The Company manages its subprime risk exposure by limiting the Company’s holdings in thesetypes of instruments, maintaining high credit quality investments, and performing ongoing analysis of cashflows, prepayment speeds, default rates and other stress variables. Loan-backed and structured securitiesnot in default are held at amortized cost. Securities held for sale, or rated NAIC 6 are held at the lower ofamortized cost or fair value. All securities are subjected to the Company’s process for identifying OTTIs.The impairment identification process utilizes various techniques and processes including a screeningprocess based on declines in fair value and prospects for recovery. The Company writes down securitiesthat it deems to have an OTTI in the period the securities are deemed to be impaired.Furthermore, the Company does not have any underwriting exposure to subprime mortgage risk throughMortgage Guaranty or Financial Guaranty insurance coverage.The following table presents the Company’s exposure to RMBS securities supported by subprime residentialmortgage loans as of December 31, 2011:CreditQualityActual CostBook AdjustedCarrying ValueFair ValueInception toDate OTTINAIC 1..... $ 2,402,001,591 $ 2,389,208,898 $ 2,152,626,557 $ (183,079,555 )NAIC 2..... 205,580,566 205,126,463 167,858,121 (15,967,465 )NAIC 3..... 203,716,746 199,526,691 165,078,632 (28,757,696 )NAIC 4..... 300,505,589 297,039,794 215,223,561 (13,937,357 )NAIC 5..... 68,691,851 64,941,694 44,729,601 (22,012,035 )NAIC 6..... 28,225,945 15,269,972 18,278,178 (55,940,178 )Total ...... $ 3,208,722,288 $ 3,171,113,512 $ 2,763,794,650 $ (319,694,286 )19.22

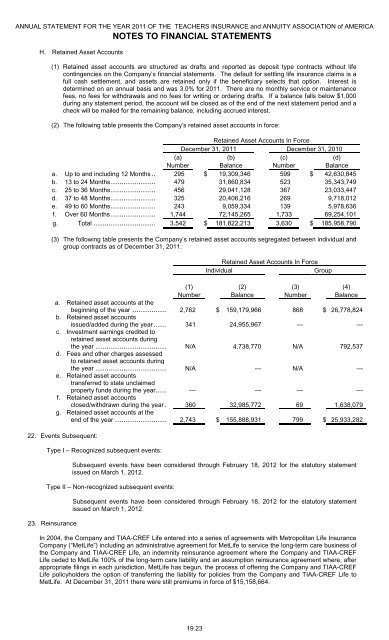

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICAH. Retained Asset AccountsNOTES TO FINANCIAL STATEMENTS(1) Retained asset accounts are structured as drafts and reported as deposit type contracts without lifecontingencies on the Company’s financial statements. The default for settling life insurance claims is afull cash settlement, and <strong>assets</strong> are retained only if the beneficiary selects that option. Interest isdetermined on an annual basis and was 3.0% for 2011. There are no monthly service or maintenancefees, no fees for withdrawals and no fees for writing or ordering drafts. If a balance falls below $1,000during any statement period, the account will be closed as of the end of the next statement period and acheck will be mailed for the remaining balance, including accrued interest.(2) The following table presents the Company’s retained asset accounts in force:Retained Asset Accounts In ForceDecember 31, 2011 December 31, 2010(a) (b) (c) (d)Number Balance Number Balancea. Up to and including 12 Months... 295 $ 19,309,346 599 $ 42,630,845b. 13 to 24 Months...................... 479 31,860,834 523 35,343,749c. 25 to 36 Months...................... 456 29,041,128 367 23,033,447d. 37 to 48 Months...................... 325 20,406,216 269 9,718,012e. 49 to 60 Months...................... 243 9,059,334 139 5,978,636f. Over 60 Months...................... 1,744 72,145,265 1,733 69,254,101g. Total .............................. 3,542 $ 181,822,213 3,630 $ 185,958,790(3) The following table presents the Company’s retained asset accounts segregated between individual andgroup contracts as of December 31, 2011:Retained Asset Accounts In ForceIndividualGroup(1) (2) (3) (4)Number Balance Number Balancea. Retained asset accounts at thebeginning of the year ................ 2,762 $ 159,179,966 868 $ 26,778,824b. Retained asset accountsissued/added during the year...... 341 24,955,967 --- ---c. Investment earnings credited toretained asset accounts duringthe year ................................. N/A 4,738,770 N/A 792,537d. Fees and other charges assessedto retained asset accounts duringthe year ................................. N/A --- N/A ---e. Retained asset accountstransferred to state unclaimedproperty funds during the year..... --- --- --- ---f. Retained asset accountsclosed/withdrawn during the year. 360 32,985,772 69 1,638,079g. Retained asset accounts at theend of the year ........................ 2,743 $ 155,888,931 799 $ 25,933,28222. Events Subsequent:Type I – Recognized subsequent events:Subsequent events have been considered through February 18, 2012 for the statutory statementissued on March 1, 2012.Type II – Non-recognized subsequent events:23. ReinsuranceSubsequent events have been considered through February 18, 2012 for the statutory statementissued on March 1, 2012.In 2004, the Company and <strong>TIAA</strong>-<strong>CREF</strong> Life entered into a series of agreements with Metropolitan Life InsuranceCompany (“MetLife”) including an administrative agreement for MetLife to service the long-term care business ofthe Company and <strong>TIAA</strong>-<strong>CREF</strong> Life, an indemnity reinsurance agreement where the Company and <strong>TIAA</strong>-<strong>CREF</strong>Life ceded to MetLife 100% of the long-term care liability and an assumption reinsurance agreement where, afterappropriate filings in each jurisdiction, MetLife has begun, the process of offering the Company and <strong>TIAA</strong>-<strong>CREF</strong>Life policyholders the option of transferring the liability for policies from the Company and <strong>TIAA</strong>-<strong>CREF</strong> Life toMetLife. At December 31, 2011 there were still premiums in force of $15,158,664.19.23