assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

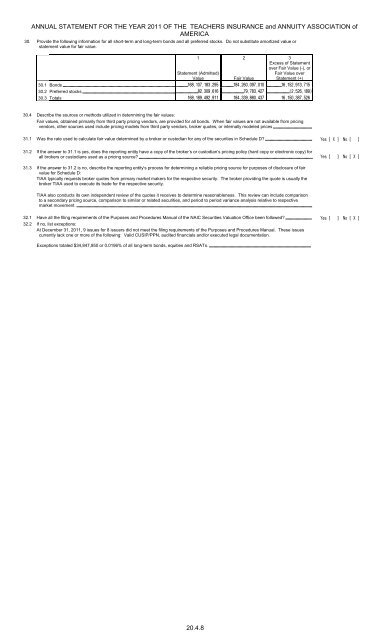

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION ofAMERICA30. Provide the following information for all short-term and long-term bonds and all preferred stocks. Do not substitute amortized value orstatement value for fair value.1Statement (Admitted)Value23Excess of Statementover Fair Value (-), orFair Value overStatement (+)Fair Value30.1 Bonds 30.2 Preferred stocks 30.3 Totals 30.4 Describe the sources or methods utilized in determining the fair values:Fair values, obtained primarily from third party pricing vendors, are provided for all bonds. When fair values are not available from pricingvendors, other sources used include pricing models from third party vendors, broker quotes, or internally modeled prices31.1 Was the rate used to calculate fair value determined by a broker or custodian for any of the securities in Schedule D? 31.2 If the answer to 31.1 is yes, does the reporting entity have a copy of the broker’s or custodian’s pricing policy (hard copy or electronic copy) forall brokers or custodians used as a pricing source?31.3 If the answer to 31.2 is no, describe the reporting entity’s process for determining a reliable pricing source for purposes of disclosure of fairvalue for Schedule D:<strong>TIAA</strong> typically requests broker quotes from primary market makers for the respective security. The broker providing the quote is usually thebroker <strong>TIAA</strong> used to execute its trade for the respective security.<strong>TIAA</strong> also conducts its own independent review of the quotes it receives to determine reasonableness. This review can include comparisonto a secondary pricing source, comparison to similar or related securities, and period to period variance analysis relative to respectivemarket movement.32.1 Have all the filing requirements of the Purposes and Procedures Manual of the NAIC Securities Valuation Office been followed? 32.2 If no, list exceptions:At December 31, 2011, 9 issues for 8 issuers did not meet the filing requirements of the Purposes and Procedures Manual. These issuescurrently lack one or more of the following: Valid CUSIP/PPN, audited financials and/or executed legal documentation.Exceptions totaled $34,847,950 or 0.0196% of all long-term bonds, equities and RSATs.20.4.8