assets - TIAA-CREF

assets - TIAA-CREF

assets - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

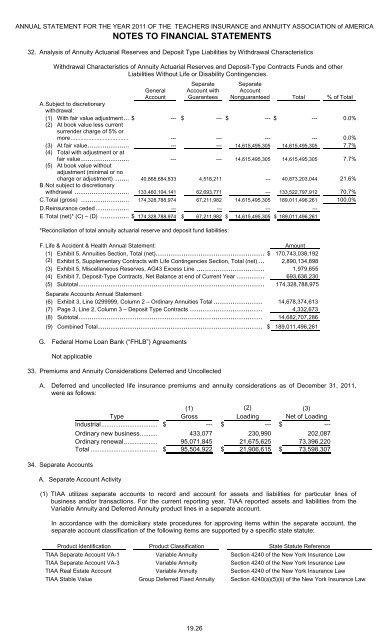

ANNUAL STATEMENT FOR THE YEAR 2011 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICANOTES TO FINANCIAL STATEMENTS32. Analysis of Annuity Actuarial Reserves and Deposit Type Liabilities by Withdrawal CharacteristicsWithdrawal Characteristics of Annuity Actuarial Reserves and Deposit-Type Contracts Funds and otherLiabilities Without Life or Disability Contingencies.A. Subject to discretionarywithdrawal:GeneralAccount(1) With fair value adjustment................................SeparateAccount withGuaranteesSeparateAccountNonguaranteed Total % of Total$ --- $ --- $ --- $ --- 0.0%(2) At book value less currentsurrender charge of 5% ormore................................................................ --- --- --- --- 0.0%(3) At fair value................................ --- --- 14,615,495,305 14,615,495,305 7.7%(4) Total with adjustment or atfair value................................ --- --- 14,615,495,305 14,615,495,305 7.7%(5) At book value withoutadjustment (minimal or nocharge or adjustment) ................................B. Not subject to discretionarywithdrawal ................................C. Total (gross) ................................40,868,684,833 4,518,211 --- 40,873,203,044 21.6%133,460,104,141 62,693,771 --- 133,522,797,912 70.7%174,328,788,974 67,211,982 14,615,495,305 189,011,496,261 100.0%D. Reinsurance ceded ................................ --- --- --- ---E. Total (net)* (C) – (D) ................................$ 174,328,788,974 $ 67,211,982 $ 14,615,495,305 $ 189,011,496,261*Reconciliation of total annuity actuarial reserve and deposit fund liabilities:F. Life & Accident & Health Annual Statement: Amount(1) Exhibit 5, Annuities Section, Total (net)................................................... $ 170,743,038,192(2) Exhibit 5, Supplementary Contracts with Life Contingencies Section, Total (net)... 2,890,134,898(3) Exhibit 5, Miscellaneous Reserves, AG43 Excess Line ................................ 1,979,655(4) Exhibit 7, Deposit-Type Contracts, Net Balance at end of Current Year ............. 693,636,230(5) Subtotal....................................................................................... 174,328,788,975Separate Accounts Annual Statement:(6) Exhibit 3, Line 0299999, Column 2 – Ordinary Annuities Total........................... 14,678,374,613(7) Page 3, Line 2, Column 3 – Deposit Type Contracts ...................................... 4,332,673(8) Subtotal.......................................................................................... 14,682,707,286(9) Combined Total................................................................................. $ 189,011,496,261G. Federal Home Loan Bank (“FHLB”) AgreementsNot applicable33. Premiums and Annuity Considerations Deferred and UncollectedA. Deferred and uncollected life insurance premiums and annuity considerations as of December 31, 2011,were as follows:34. Separate Accounts(1) (2) (3)Type Gross Loading Net of LoadingIndustrial................................ $ --- $ --- $ ---Ordinary new business.......... 433,077 230,990 202,087Ordinary renewal................... 95,071,845 21,675,625 73,396,220Total ...................................... $ 95,504,922 $ 21,906,615 $ 73,598,307A. Separate Account Activity(1) <strong>TIAA</strong> utilizes separate accounts to record and account for <strong>assets</strong> and liabilities for particular lines ofbusiness and/or transactions. For the current reporting year, <strong>TIAA</strong> reported <strong>assets</strong> and liabilities from theVariable Annuity and Deferred Annuity product lines in a separate account.In accordance with the domiciliary state procedures for approving items within the separate account, theseparate account classification of the following items are supported by a specific state statute:Product Identification Product Classification State Statute Reference<strong>TIAA</strong> Separate Account VA-1 Variable Annuity Section 4240 of the New York Insurance Law<strong>TIAA</strong> Separate Account VA-3 Variable Annuity Section 4240 of the New York Insurance Law<strong>TIAA</strong> Real Estate Account Variable Annuity Section 4240 of the New York Insurance Law<strong>TIAA</strong> Stable Value Group Deferred Fixed Annuity Section 4240(a)(5)(ii) of the New York Insurance Law19.26