Consolidated statement of cash flowsin EUR 1,000 2010 2009Profit of the year 2,063 4,151Items and leadover to cash flow from operating business activitycontained in annual report without effect on profitDepreciation/appreciation ofproperty, financials and current assets 20,669 29,420Allocation/dissolution of reserves and risks provisions 53,451 54,885Profit from sales of financial and tangible assets -10,351 -20,929Taxes from income and profit 82 2,080Correction of interest profit -124,299 -115,692Other adjustments 533 1,722Changes in assets and liabilities from current operating activitiesfollowing correction of items without effect on overall profitReceivables from financial institutions 18,085 214,161Receivables from customers -229,254 -277,179Positive market values from derivatives 0 149Trading assets, derivatives and financial assets at fair value -399,940 -283,655Other assets -7,892 10,953Payable to financial institutions -111,655 240,985Payable to customers -101,240 437,968Securitised payables and financial payables at fair value -65,016 -786,207Negative market values from derivative hedging instruments 6,895 8,690Derivatives 23,160 -16,235Other liabilities -8,391 -13,783Received interest 385,651 490,271Paid interest -255,873 -376,580Payments on income tax -1,600 -1,600Cash Flow from current operating activities -804,923 -1,272,361Net cash gain from sale/redemption ofFinancial assets - HTM, AFS, L&R and shareholdings 1,104,559 1,577,523Tangible assets, intangible assets, investment properties 20,415 15,923Cash outflow from investment inFinancial assets – HTM, AFS, L&R and shareholdings -302,674 -270,529Tangible assets, intangible assets, investment properties -27,363 -20,841Cash flow from investment activities 794,937 1,302,076Profit – affecting changes in subordinate and non – core capital -18,039 -21,056Dividends payments -4,336 -1,440Issue of participation certificates 3,000 55,800Cash flow from financing activities -19,375 33,304Cash balance at close of pre – fiscal period 123,969 70,953Cash flow from operating activities -804,923 -1,272,361Cash flow from investment activities 794,937 1,302,076Cash flow from financing activities -19,375 33,304Effects of changes in currency exchange rates, valuation, consolidationbasis128 -10,003Cash balance at close of fiscal period 94,736 123,96962

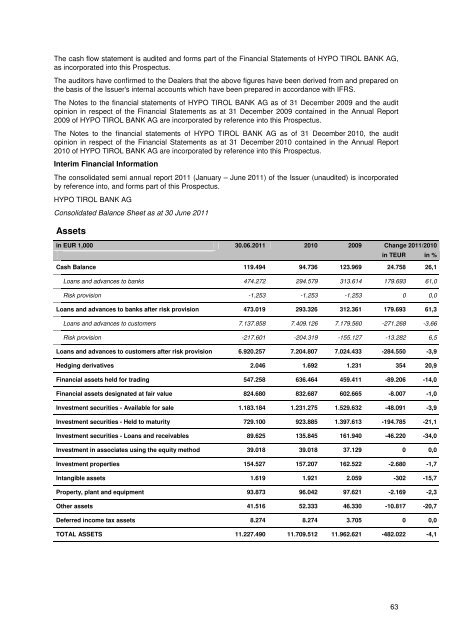

The cash flow statement is audited and forms part of the Financial Statements of <strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong>,as incorporated into this Prospectus.The auditors have confirmed to the Dealers that the above figures have been derived from and prepared onthe basis of the Issuer's internal accounts which have been prepared in accordance with IFRS.The Notes to the financial statements of <strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong> as of 31 December 2009 and the auditopinion in respect of the Financial Statements as at 31 December 2009 contained in the Annual Report2009 of <strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong> are incorporated by reference into this Prospectus.The Notes to the financial statements of <strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong> as of 31 December 2010, the auditopinion in respect of the Financial Statements as at 31 December 2010 contained in the Annual Report2010 of <strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong> are incorporated by reference into this Prospectus.Interim Financial InformationThe consolidated semi annual report 2011 (January – June 2011) of the Issuer (unaudited) is incorporatedby reference into, and forms part of this Prospectus.<strong>HYPO</strong> <strong>TIROL</strong> <strong>BANK</strong> <strong>AG</strong>Consolidated Balance Sheet as at 30 June 2011Assetsin EUR 1,000 30.06.2011 2010 2009 Change 2011/2010in TEUR in %Cash Balance 119.494 94.736 123.969 24.758 26,1Loans and advances to banks 474.272 294.579 313.614 179.693 61,0Risk provision -1.253 -1.253 -1.253 0 0,0Loans and advances to banks after risk provision 473.019 293.326 312.361 179.693 61,3Loans and advances to customers 7.137.858 7.409.126 7.179.560 -271.268 -3,66Risk provision -217.601 -204.319 -155.127 -13.282 6,5Loans and advances to customers after risk provision 6.920.257 7.204.807 7.024.433 -284.550 -3,9Hedging derivatives 2.046 1.692 1.231 354 20,9Financial assets held for trading 547.258 636.464 459.411 -89.206 -14,0Financial assets designated at fair value 824.680 832.687 602.665 -8.007 -1,0Investment securities - Available for sale 1.183.184 1.231.275 1.529.632 -48.091 -3,9Investment securities - Held to maturity 729.100 923.885 1.397.613 -194.785 -21,1Investment securities - Loans and receivables 89.625 135.845 161.940 -46.220 -34,0Investment in associates using the equity method 39.018 39.018 37.129 0 0,0Investment properties 154.527 157.207 162.522 -2.680 -1,7Intangible assets 1.619 1.921 2.059 -302 -15,7Property, plant and equipment 93.873 96.042 97.621 -2.169 -2,3Other assets 41.516 52.333 46.330 -10.817 -20,7Deferred income tax assets 8.274 8.274 3.705 0 0,0TOTAL ASSETS 11.227.490 11.709.512 11.962.621 -482.022 -4,163

- Page 1 and 2:

This document constitutes two base

- Page 4 and 5:

Table of ContentsPageSummary ......

- Page 6 and 7:

SummaryThe following constitutes th

- Page 8 and 9:

NotesInstalment NotesIndex Linked N

- Page 10 and 11:

from payments of principal or inter

- Page 12 and 13: STATUTORY AUDITORSSummary regarding

- Page 14 and 15: In this business year, the interest

- Page 16 and 17: Dr. Toni Ebner, Second Deputy to th

- Page 18 and 19: Members delegated by the StaffCommi

- Page 20 and 21: MATERIAL CONTRACTSThere are no mate

- Page 22 and 23: Note may be negative. The more vola

- Page 24 and 25: German Translation of the SummaryDe

- Page 26 and 27: entspricht, die durch einen Vertrag

- Page 28 and 29: mehrerer solcher Instrumente bezieh

- Page 30 and 31: Verbindlichkeiten der Emittentin, d

- Page 32 and 33: Zusammenfassung in Bezug auf die HY

- Page 34 and 35: im Vorjahr merklich durch die Risik

- Page 36 and 37: Dr. Toni Ebner, 2.Vorsitzender Stel

- Page 38 and 39: 23.11.2007 gemeinsam mit einem weit

- Page 40 and 41: Zusammenfassung der Risikofaktoren

- Page 42 and 43: FinanzmarktkriseSeit Mitte des Jahr

- Page 44 and 45: 44General Description of the Progra

- Page 46 and 47: Risk FactorsRisk Factors regarding

- Page 48 and 49: isk applies to Step-Up Notes and St

- Page 50 and 51: cash as determined in accordance wi

- Page 52 and 53: HYPO TIROL BANK AGSTATUTORY AUDITOR

- Page 54 and 55: In this business year, the interest

- Page 56 and 57: Dr. Toni Ebner, Second Deputy to th

- Page 58 and 59: Members delegated by the StaffCommi

- Page 60 and 61: FINANCIAL INFORMATION RELATING TO T

- Page 64 and 65: Liabilitiesin EUR 1,000 30.06.2011

- Page 66 and 67: ISSUE PROCEDURESfor Notes in Bearer

- Page 68 and 69: Terms and Conditions of the NotesEn

- Page 70 and 71: [In the case the Global Note is a N

- Page 72 and 73: (iv)(v)The set-off of the repayment

- Page 74 and 75: "Interest Determination Date" means

- Page 76 and 77: [In the case of Instalment Notes, s

- Page 78 and 79: Instalment Date(s)Instalment Amount

- Page 80 and 81: (a) For purposes of subparagraph (2

- Page 82 and 83: § 9EVENTS OF DEFAULT(1) Events of

- Page 84 and 85: (3) Change of References. In the ev

- Page 86 and 87: asis of (i) a statement issued by t

- Page 88 and 89: und verwandten Schuldverschreibunge

- Page 90 and 91: applied to the last preceding Inter

- Page 92 and 93: § 4PAYMENTS(1) [(a)] Payment of Pr

- Page 94 and 95: [If the Fiscal Agent is to be appoi

- Page 96 and 97: These Terms and Conditions are writ

- Page 98 and 99: on which the Notes may be redeemed

- Page 100 and 101: B. PFANDBRIEFE IN REGISTERED FORMTh

- Page 102 and 103: appointment or change shall only ta

- Page 104 and 105: 104Teil I - GRUNDBEDINGUNGENA. ANLE

- Page 106 and 107: Schuldverschreibungen zur gleichen

- Page 108 and 109: (ii)(iii)(iv)Zinsen dürfen auf die

- Page 110 and 111: Prozent, wobei 0,000005] aufgerunde

- Page 112 and 113:

[Falls Actual/Actual (ISDA) anwendb

- Page 114 and 115:

(2) Vorzeitige Rückzahlung aus ste

- Page 116 and 117:

[(5)] Vorzeitiger Rückzahlungsbetr

- Page 118 and 119:

118Republik Österreich oder die Eu

- Page 120 and 121:

§ [10]ERSETZUNG(1) Ersetzung. Die

- Page 122 and 123:

Emittentin eine Veröffentlichung n

- Page 124 and 125:

B. ANLEIHEBEDINGUNGENFÜR AUF DEN I

- Page 126 and 127:

Monate][andere festgelegte Zeiträu

- Page 128 and 129:

diesem Zeitpunkt notiert sind und d

- Page 130 and 131:

[im Fall von Raten-Schuldverschreib

- Page 132 and 133:

(3) Beauftragte der Emittentin. Die

- Page 134 and 135:

134TEIL II - ZUSÄTZE ZU DEN GRUNDB

- Page 136 and 137:

[falls der Gläubiger ein Wahlrecht

- Page 138 and 139:

B. NAMENSPFANDBRIEFEDie unten aufge

- Page 140 and 141:

§ 6DIE EMISSIONSSTELLE [,] [UND] D

- Page 142 and 143:

DESCRIPTION OF RULES REGARDING RESO

- Page 144 and 145:

In case of Notes listed on the offi

- Page 146 and 147:

Part I.: Terms and ConditionsTeil I

- Page 148 and 149:

Aggregate Principal Amount [ ]Gesam

- Page 150 and 151:

INTEREST (§ 3)ZINSEN (§ 3) Fixed

- Page 152 and 153:

Maximum Rate of Interest [ ] per ce

- Page 154 and 155:

Minimum Notice to Holders 18 [ ]Min

- Page 156 and 157:

Austria (Amtsblatt zur Wiener Zeitu

- Page 158 and 159:

Securities Identification NumbersWe

- Page 160 and 161:

are most evident 39Umfassende Erlä

- Page 162 and 163:

subscription rights and the treatme

- Page 164 and 165:

Name und Anschrift der Institute, d

- Page 166 and 167:

TaxationThe following is a general

- Page 168 and 169:

Other TaxesNo stamp, issue, registr

- Page 170 and 171:

If interest payments are made by a

- Page 172 and 173:

Under the Luxembourg laws of 21 Jun

- Page 174 and 175:

an application of any third party,

- Page 176 and 177:

Rules") (or, after 18 March 2012, a

- Page 178 and 179:

General InformationCovered Bonds"Co

- Page 180 and 181:

Documents incorporated by Reference

- Page 182 and 183:

ADDRESSESIssuerHYPO TIROL BANK AGMe