4.15 MB - Food Security Clusters

4.15 MB - Food Security Clusters

4.15 MB - Food Security Clusters

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

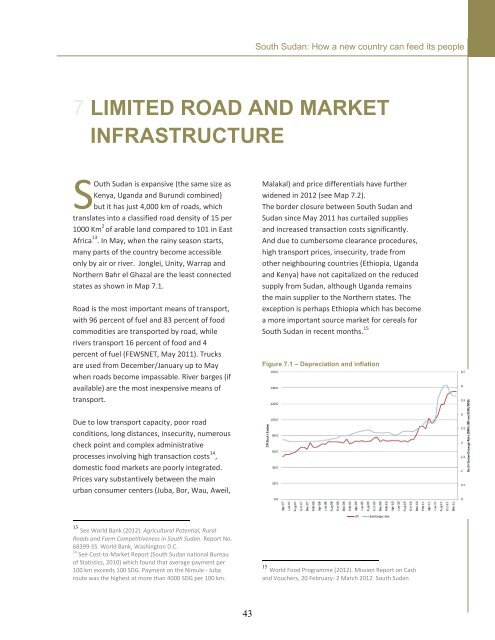

South Sudan: How a new country can feed its peopleLimited road and market infrastructure7 LIMITED ROAD AND MARKETINFRASTRUCTURESOuth Sudan is expansive (the same size asKenya, Uganda and Burundi combined)but it has just 4,000 km of roads, whichtranslates into a classified road density of 15 per1000 Km 2 of arable land compared to 101 in EastAfrica 13 . In May, when the rainy season starts,many parts of the country become accessibleonly by air or river. Jonglei, Unity, Warrap andNorthern Bahr el Ghazal are the least connectedstates as shown in Map 7.1.Road is the most important means of transport,with 96 percent of fuel and 83 percent of foodcommodities are transported by road, whilerivers transport 16 percent of food and 4percent of fuel (FEWSNET, May 2011). Trucksare used from December/January up to Maywhen roads become impassable. River barges (ifavailable) are the most inexpensive means oftransport.Malakal) and price differentials have furtherwidened in 2012 (see Map 7.2).The border closure between South Sudan andSudan since May 2011 has curtailed suppliesand increased transaction costs significantly.And due to cumbersome clearance procedures,high transport prices, insecurity, trade fromother neighbouring countries (Ethiopia, Ugandaand Kenya) have not capitalized on the reducedsupply from Sudan, although Uganda remainsthe main supplier to the Northern states. Theexception is perhaps Ethiopia which has becomea more important source market for cereals forSouth Sudan in recent months. 15Figure 7.1 – Depreciation and inflationDue to low transport capacity, poor roadconditions, long distances, insecurity, numerouscheck point and complex administrativeprocesses involving high transaction costs 14 ,domestic food markets are poorly integrated.Prices vary substantively between the mainurban consumer centers (Juba, Bor, Wau, Aweil,13 See World Bank (2012). Agricultural Potential, RuralRoads and Farm Competitiveness in South Sudan. Report No.68399-SS. World Bank, Washington D.C.14 See Cost-to-Market Report (South Sudan national Bureauof Statistics, 2010) which found that average payment per100 km exceeds 100 SDG. Payment on the Nimule - Jubaroute was the highest at more than 4000 SDG per 100 km.15 World <strong>Food</strong> Programme (2012). Mission Report on Cashand Vouchers, 20 February- 2 March 2012. South Sudan43