2003 - 04 Annual Report - Sbs

2003 - 04 Annual Report - Sbs

2003 - 04 Annual Report - Sbs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

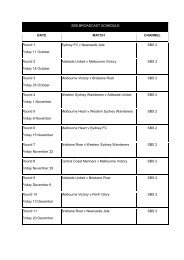

52OVERVIEWSBS embraces good corporate governance andaccountability in the running of the Corporation. Internalmechanisms, including audits and comprehensive riskmanagement procedures, are reinforced by crossdivisionalplanning and strong adherence to humanresources policies and legislation. Externally, SBSprovides considered and strategic contributions togovernment decision-making, industry forums andcommunity events and consultations.FINANCE AND GOVERNANCEFinancial Results <strong>2003</strong>–<strong>04</strong>The Corporation and its controlled entity, MultilingualSubscriber Television Ltd, ended the <strong>2003</strong>-<strong>04</strong> financialyear with a surplus of $2.993 million (1.6% of availableresources). Contributing to the surplus was a higher thanbudgeted result in advertising.The Corporation’s total assets increased during thefinancial year from $196.644 million to $213.527 million.The majority of this increase related to non-financialassets which increased from $118.322 million to $131.687million (mainly due to an upward revaluation of landowned by SBS at 30 June 20<strong>04</strong>).The bulk of the investment recorded at 30 June 20<strong>04</strong>related to funds provided through the part sale of Telstrafor the analogue extension program.The level of Equity Capital has increased from $54.779million to $62.269 million. This increase reflected a $7.490million equity injection received in <strong>2003</strong>-<strong>04</strong>. The bulk ofthis injection was for digital conversion.SBS Accounting ManualSBS’s financial policies and procedures are contained inthe SBS Accounting Manual which is widely distributedthroughout the Corporation, both in written form and on theIntranet. Updates occur frequently throughout the year.External and Internal AuditThe audit of SBS’s financial statements is carried out bythe Australian National Audit Office (ANAO). The ANAOgave an unqualified opinion on the <strong>2003</strong>-<strong>04</strong> financialstatements of the Corporation.During the year, SBS participated in a benchmarkingstudy conducted by Comcover (an agency of theDepartment of Finance and Administration) on RiskManagement Practices and was rated in the top categoryof ‘Advanced Implementation’. In addition, SBS was alsoincluded as a participant in the following ANAO audits:• Protective Security (Business Support Process Audit);• Financial Aspects of the Conversion to DigitalBroadcasting (Performance Audit); and• Investment of Public Monies (Performance Audit).These audits have yet to be finalised.The Internal Audit program was conducted by DeloitteTouche Tohmatsu on a contract basis. The companyperformed audits in accordance with the audit planapproved by the SBS Audit and Finance Committee.In all cases, the results were satisfactory and allapplicable recommendations for improvements to thecontrol environment brought to management’s attention.The audits conducted in <strong>2003</strong>-<strong>04</strong> were: MelbourneOperations; Television Production; Subtitling andCaptioning; Purchasing and Tendering (IT asset focus);Transmission Services; Radio Engineering; AudienceFeedback and Complaints Management; WebsiteManagement; Contract Management; Pay TelevisionContracts; and Superannuation Delegations Review.Operating RevenueExpenditure By Classification50% 100% 50% 100%Employees33%Interest1%Suppliers62%IndependentSourcesGovernmentAppropriation18%78%DepreciationInterest4%1%