Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

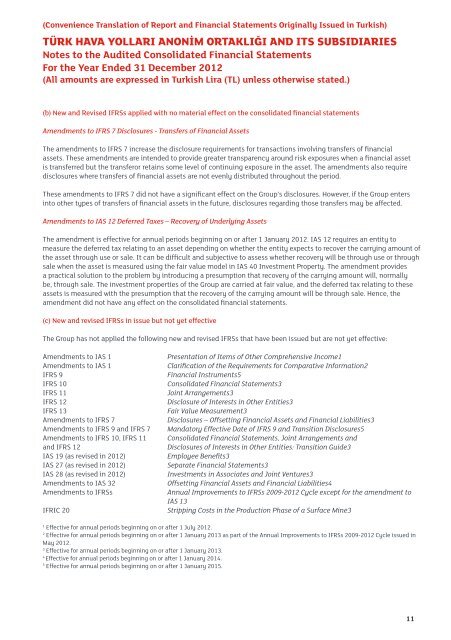

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)(b) New and Revised IFRSs applied with no material effect on the consolidated financial statementsAmendments to IFRS 7 Disclosures - Transfers of <strong>Financial</strong> AssetsThe amendments to IFRS 7 increase the disclosure requirements for transactions involving transfers of financialassets. These amendments are intended to provide greater transparency around risk exposures when a financial assetis transferred but the transferor retains some level of continuing exposure in the asset. The amendments also requiredisclosures where transfers of financial assets are not evenly distributed throughout the period.These amendments to IFRS 7 did not have a significant effect on the Group’s disclosures. However, if the Group entersinto other types of transfers of financial assets in the future, disclosures regarding those transfers may be affected.Amendments to IAS 12 Deferred Taxes – Recovery of Underlying AssetsThe amendment is effective for annual periods beginning on or after 1 January 2012. IAS 12 requires an entity tomeasure the deferred tax relating to an asset depending on whether the entity expects to recover the carrying amount ofthe asset through use or sale. It can be difficult and subjective to assess whether recovery will be through use or throughsale when the asset is measured using the fair value model in IAS 40 Investment Property. The amendment providesa practical solution to the problem by introducing a presumption that recovery of the carrying amount will, normallybe, through sale. The investment properties of the Group are carried at fair value, and the deferred tax relating to theseassets is measured with the presumption that the recovery of the carrying amount will be through sale. Hence, theamendment did not have any effect on the consolidated financial statements.(c) New and revised IFRSs in issue but not yet effectiveThe Group has not applied the following new and revised IFRSs that have been issued but are not yet effective:Amendments to IAS 1Amendments to IAS 1IFRS 9IFRS 10IFRS 11IFRS 12IFRS 13Amendments to IFRS 7Amendments to IFRS 9 and IFRS 7Amendments to IFRS 10, IFRS 11and IFRS 12IAS 19 (as revised in 2012)IAS 27 (as revised in 2012)IAS 28 (as revised in 2012)Amendments to IAS 32Amendments to IFRSsIFRIC 20Presentation of Items of Other Comprehensive Income1Clarification of the Requirements for Comparative Information2<strong>Financial</strong> Instruments5Consolidated <strong>Financial</strong> Statements3Joint Arrangements3Disclosure of Interests in Other Entities3Fair Value Measurement3Disclosures – Offsetting <strong>Financial</strong> Assets and <strong>Financial</strong> Liabilities3Mandatory Effective Date of IFRS 9 and Transition Disclosures5Consolidated <strong>Financial</strong> Statements, Joint Arrangements andDisclosures of Interests in Other Entities: Transition Guide3Employee Benefits3Separate <strong>Financial</strong> Statements3Investments in Associates and Joint Ventures3Offsetting <strong>Financial</strong> Assets and <strong>Financial</strong> Liabilities4Annual Improvements to IFRSs 2009-2012 Cycle except for the amendment toIAS 13Stripping Costs in the Production Phase of a Surface Mine31Effective for annual periods beginning on or after 1 July 2012.2Effective for annual periods beginning on or after 1 January 2013 as part of the Annual Improvements to IFRSs 2009-2012 Cycle issued inMay 2012.3Effective for annual periods beginning on or after 1 January 2013.4Effective for annual periods beginning on or after 1 January 2014.5Effective for annual periods beginning on or after 1 January 2015.11