Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

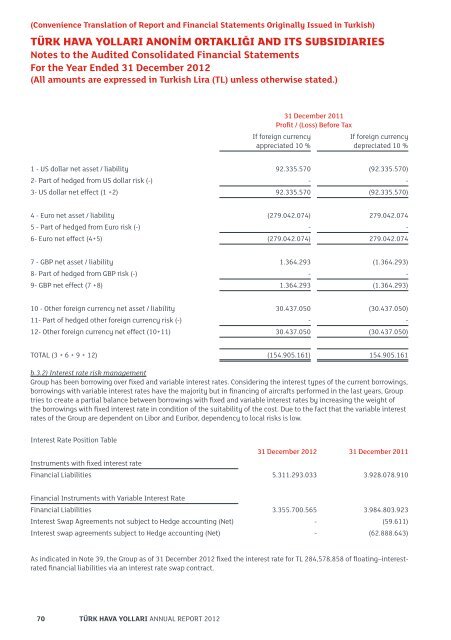

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)31 December 2011Profit / (Loss) Before TaxIf foreign currencyappreciated 10 %If foreign currencydepreciated 10 %1 - US dollar net asset / liability 92.335.570 (92.335.570)2- Part of hedged from US dollar risk (-) - -3- US dollar net effect (1 +2) 92.335.570 (92.335.570)4 - Euro net asset / liability (279.042.074) 279.042.0745 - Part of hedged from Euro risk (-) - -6- Euro net effect (4+5) (279.042.074) 279.042.0747 - GBP net asset / liability 1.364.293 (1.364.293)8- Part of hedged from GBP risk (-) - -9- GBP net effect (7 +8) 1.364.293 (1.364.293)10 - Other foreign currency net asset / liability 30.437.050 (30.437.050)11- Part of hedged other foreign currency risk (-) - -12- Other foreign currency net effect (10+11) 30.437.050 (30.437.050)TOTAL (3 + 6 + 9 + 12) (154.905.161) 154.905.161b.3.2) Interest rate risk managementGroup has been borrowing over fixed and variable interest rates. Considering the interest types of the current borrowings,borrowings with variable interest rates have the majority but in financing of aircrafts performed in the last years, Grouptries to create a partial balance between borrowings with fixed and variable interest rates by increasing the weight ofthe borrowings with fixed interest rate in condition of the suitability of the cost. Due to the fact that the variable interestrates of the Group are dependent on Libor and Euribor, dependency to local risks is low.Interest Rate Position Table31 December 2012 31 December 2011Instruments with fixed interest rate<strong>Financial</strong> Liabilities 5.311.293.033 3.928.078.910<strong>Financial</strong> Instruments with Variable Interest Rate<strong>Financial</strong> Liabilities 3.355.700.565 3.984.803.923Interest Swap Agreements not subject to Hedge accounting (Net) - (59.611)Interest swap agreements subject to Hedge accounting (Net) - (62.888.643)As indicated in Note 39, the Group as of 31 December 2012 fixed the interest rate for TL 284,578,858 of floating–interestratedfinancial liabilities via an interest rate swap contract.70 TÜRK HAVA YOLLARI ANNUAL REPORT 2012