Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

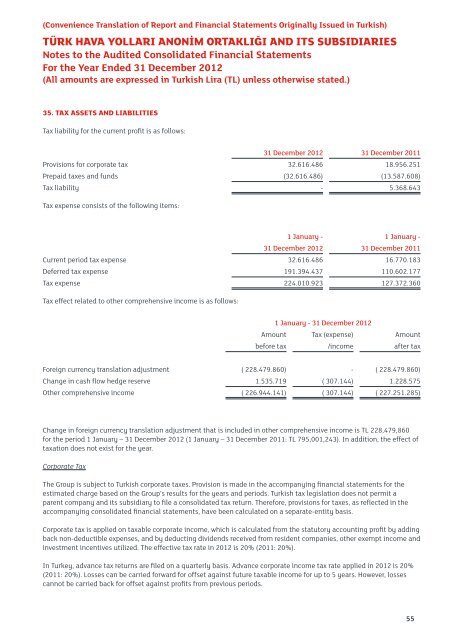

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)35. TAX ASSETS AND LIABILITIESTax liability for the current profit is as follows:31 December 2012 31 December 2011Provisions for corporate tax 32.616.486 18.956.251Prepaid taxes and funds (32.616.486) (13.587.608)Tax liability - 5.368.643Tax expense consists of the following items:1 January - 1 January -31 December 2012 31 December 2011Current period tax expense 32.616.486 16.770.183Deferred tax expense 191.394.437 110.602.177Tax expense 224.010.923 127.372.360Tax effect related to other comprehensive income is as follows:1 January - 31 December 2012Amount Tax (expense) Amountbefore tax /income after taxForeign currency translation adjustment ( 228.479.860) - ( 228.479.860)Change in cash flow hedge reserve 1.535.719 ( 307.144) 1.228.575Other comprehensive income ( 226.944.141) ( 307.144) ( 227.251.285)Change in foreign currency translation adjustment that is included in other comprehensive income is TL 228,479,860for the period 1 January – 31 December 2012 (1 January – 31 December 2011: TL 795,001,243). In addition, the effect oftaxation does not exist for the year.Corporate TaxThe Group is subject to <strong>Turkish</strong> corporate taxes. Provision is made in the accompanying financial statements for theestimated charge based on the Group’s results for the years and periods. <strong>Turkish</strong> tax legislation does not permit aparent company and its subsidiary to file a consolidated tax return. Therefore, provisions for taxes, as reflected in theaccompanying consolidated financial statements, have been calculated on a separate-entity basis.Corporate tax is applied on taxable corporate income, which is calculated from the statutory accounting profit by addingback non-deductible expenses, and by deducting dividends received from resident companies, other exempt income andinvestment incentives utilized. The effective tax rate in 2012 is 20% (2011: 20%).In Turkey, advance tax returns are filed on a quarterly basis. Advance corporate income tax rate applied in 2012 is 20%(2011: 20%). Losses can be carried forward for offset against future taxable income for up to 5 years. However, lossescannot be carried back for offset against profits from previous periods.55